PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1936043

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1936043

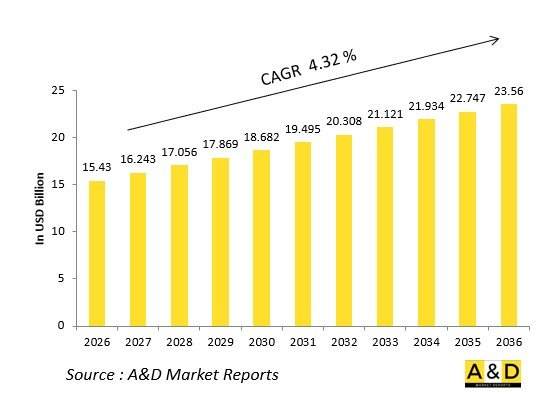

Global Airborne Countermeasures System Market 2026-2036

The Global Airborne Countermeasures System Market is estimated at USD 15.43 billion in 2026, projected to grow to USD 23.56 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 4.32% over the forecast period 2026-2036.

Introduction

The global Airborne Countermeasures System market safeguards fixed-wing and rotary aircraft against evolving missile threats, integrating radar warning receivers, missile approach warners, and countermeasure dispensers into seamless self-protection suites. These systems detect, identify, and neutralize infrared, radar, and laser-guided munitions via chaff, flares, and electronic jamming.

Market growth mirrors rising air defense densities, with suites evolving from reactive dispensers to AI-driven directional effectors. Core components include podded jammers, towed decoys, and programmable dispensers compatible across platforms from stealth fighters to VIP transports. Emphasis on low-collateral urban ops drives modulated infrared countermeasures.

Geopolitical flashpoints accelerate retrofits, prioritizing interoperability for coalition missions. Open architectures enable rapid threat library updates. Supply chains focus on resilient electronics amid directed-energy proliferation. Competition features primes like BAE and Saab pioneering fiber-optic towed arrays.

This market underscores aircraft survivability as mission enabler.

Technology Impact in Airborne Countermeasures System

Technological fusion transforms Airborne Countermeasures Systems into proactive shields. Multi-spectral missile approach warners-UV, IR, and laser-based-detect launches from all quadrants, cueing effectors in microseconds via AI threat classifiers trained on global engagement data.

Directional Infrared Countermeasures (DIRCM) lasers dazzle seeker heads with modulated beams, defeating advanced imaging missiles without expendables. Fiber-optic towed decoys extend jamming envelopes, mimicking aircraft signatures while surviving supersonic ejections. Smart dispensers sequence chaff and flares optimally, minimizing signatures via spectral analysis.

Networked architectures share threat data across formations, enabling formation-wide defenses. GaN amplifiers power compact jammers resisting barrage jamming. Quantum cascade lasers target hyperspectral seekers. Digital radio frequency memory (DRFM) creates false targets indistinguishable from real emitters.

Integration with AESA radars provides fused situational awareness. Expendable decoys deploy micro-jammers mid-flight. These innovations slash break-lock probabilities, extend no-escape zones, and enable deep-strike penetrations against integrated air defenses.

Key Drivers in Airborne Countermeasures System

Proliferating man-portable air defense systems expose high-value aircraft to top-attack profiles, mandating layered countermeasures. Advanced imaging missiles counter legacy flares, driving DIRCM adoption across air forces.

Fleet sustainment programs prioritize survivability upgrades for legacy transports and tankers operating in contested zones. Export markets demand turnkey suites compatible with diverse threat libraries.

Coalition interoperability standards accelerate common architectures. Urban close air support doctrines require precision effectors minimizing collateral. Directed-energy weapon proliferation necessitates laser warning receivers.

Budget imperatives favor podded solutions over airframe redesigns. Training revolutions leverage virtual threat injectors. Supply chain resilience counters sanctions via diversified electronics.

Sustainability via reusable lasers reduces expendable logistics. These dynamics position countermeasures as airpower prerequisites.

Regional Trends in Airborne Countermeasures System

North America pioneers DIRCM suites for strategic airlift and fifth-generation fighters, emphasizing towed decoys.

Europe standardizes via NATO frameworks, equipping multirole fleets with fiber-optic jammers for eastern corridors.

Asia-Pacific surges with indigenous development-India's digital RWR, China's modular pods-for maritime patrols.

Middle East fortifies VIP transports against shoulder-fired threats.

Russia advances plasma-based decoys resilient to multimode seekers.

South Korea integrates with K9 howitzers' air cover.

Latin America protects counter-narcotics helos.

Trends favor AI-driven autonomy, Asia-Pacific gaining manufacturing share.

Key Airborne Countermeasures System Programs

AN/ALE-47 dispensers equip coalition fighters with adaptive sequencing against IR/RF threats.

Saab's CMDS integrates with Gripen for sequenced expendables.

BAE's DIRCM suites dazzle advanced seekers on C-130J.

AN/ALQ-214 podded jammers defend legacy platforms.

Next-gen fiber decoys tow behind F-35s.

European MBDA Talios fuses RWR with laser warning.

India's digital integrated RF suite upgrades Su-30MKI.

VIP aircraft receive commercial DIRCM variants.

Export packages bundle with missile warners.

Table of Contents

Airborne Countermeasures System Market - Table of Contents

Airborne Countermeasures System Market Report Definition

Airborne Countermeasures System Market Segmentation

By Application

By Region

By Type

Airborne Countermeasures System Market Analysis for next 10 Years

The 10-year Airborne Countermeasures System Market analysis would give a detailed overview of Airborne Countermeasures System Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Airborne Countermeasures System Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Airborne Countermeasures System Market Forecast

The 10-year Airborne Countermeasures System Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Airborne Countermeasures System Market Trends & Forecast

The regional Airborne Countermeasures System Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Airborne Countermeasures System Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Airborne Countermeasures System Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Airborne Countermeasures System Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2026-2036

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2026-2036

- Table 18: Scenario Analysis, Scenario 1, By Application , 2026-2036

- Table 19: Scenario Analysis, Scenario 1, By Type , 2026-2036

- Table 20: Scenario Analysis, Scenario 2, By Region, 2026-2036

- Table 21: Scenario Analysis, Scenario 2, By Application , 2026-2036

- Table 22: Scenario Analysis, Scenario 2, By Type , 2026-2036

List of Figures

- Figure 1: Global Airborne Countermeasures System Market Forecast, 2026-2036

- Figure 2: Global Airborne Countermeasures System Market Forecast, By Region, 2026-2036

- Figure 3: Global Airborne Countermeasures System Market Forecast, By Application , 2026-2036

- Figure 4: Global Airborne Countermeasures System Market Forecast, By Type , 2026-2036

- Figure 5: North America, Airborne Countermeasures System Market, Forecast, 2026-2036

- Figure 6: Europe, Airborne Countermeasures System Market, Forecast, 2026-2036

- Figure 7: Middle East, Airborne Countermeasures System Market, Forecast, 2026-2036

- Figure 8: APAC, Airborne Countermeasures System Market, Forecast, 2026-2036

- Figure 9: South America, Airborne Countermeasures System Market, Forecast, 2026-2036

- Figure 10: United States, Airborne Countermeasures System Market, Technology Maturation, 2026-2036

- Figure 11: United States, Airborne Countermeasures System Market, Forecast, 2026-2036

- Figure 12: Canada, Airborne Countermeasures System Market, Technology Maturation, 2026-2036

- Figure 13: Canada, Airborne Countermeasures System Market, Forecast, 2026-2036

- Figure 14: Italy, Airborne Countermeasures System Market, Technology Maturation, 2026-2036

- Figure 15: Italy, Airborne Countermeasures System Market, Market Forecast, 2026-2036

- Figure 16: France, Airborne Countermeasures System Market, Technology Maturation, 2026-2036

- Figure 17: France, Airborne Countermeasures System Market, Market Forecast, 2026-2036

- Figure 18: Germany, Airborne Countermeasures System Market, Technology Maturation, 2026-2036

- Figure 19: Germany, Airborne Countermeasures System Market, Market Forecast, 2026-2036

- Figure 20: Netherlands, Airborne Countermeasures System Market, Technology Maturation, 2026-2036

- Figure 21: Netherlands, Airborne Countermeasures System Market, Market Forecast, 2026-2036

- Figure 22: Belgium, Airborne Countermeasures System Market, Technology Maturation, 2026-2036

- Figure 23: Belgium, Airborne Countermeasures System Market, Market Forecast, 2026-2036

- Figure 24: Spain, Airborne Countermeasures System Market, Technology Maturation, 2026-2036

- Figure 25: Spain, Airborne Countermeasures System Market, Market Forecast, 2026-2036

- Figure 26: Sweden, Airborne Countermeasures System Market, Technology Maturation, 2026-2036

- Figure 27: Sweden, Airborne Countermeasures System Market, Market Forecast, 2026-2036

- Figure 28: Brazil, Airborne Countermeasures System Market, Technology Maturation, 2026-2036

- Figure 29: Brazil, Airborne Countermeasures System Market, Market Forecast, 2026-2036

- Figure 30: Australia, Airborne Countermeasures System Market, Technology Maturation, 2026-2036

- Figure 31: Australia, Airborne Countermeasures System Market, Market Forecast, 2026-2036

- Figure 32: India, Airborne Countermeasures System Market, Technology Maturation, 2026-2036

- Figure 33: India, Airborne Countermeasures System Market, Market Forecast, 2026-2036

- Figure 34: China, Airborne Countermeasures System Market, Technology Maturation, 2026-2036

- Figure 35: China, Airborne Countermeasures System Market, Market Forecast, 2026-2036

- Figure 36: Saudi Arabia, Airborne Countermeasures System Market, Technology Maturation, 2026-2036

- Figure 37: Saudi Arabia, Airborne Countermeasures System Market, Market Forecast, 2026-2036

- Figure 38: South Korea, Airborne Countermeasures System Market, Technology Maturation, 2026-2036

- Figure 39: South Korea, Airborne Countermeasures System Market, Market Forecast, 2026-2036

- Figure 40: Japan, Airborne Countermeasures System Market, Technology Maturation, 2026-2036

- Figure 41: Japan, Airborne Countermeasures System Market, Market Forecast, 2026-2036

- Figure 42: Malaysia, Airborne Countermeasures System Market, Technology Maturation, 2026-2036

- Figure 43: Malaysia, Airborne Countermeasures System Market, Market Forecast, 2026-2036

- Figure 44: Singapore, Airborne Countermeasures System Market, Technology Maturation, 2026-2036

- Figure 45: Singapore, Airborne Countermeasures System Market, Market Forecast, 2026-2036

- Figure 46: United Kingdom, Airborne Countermeasures System Market, Technology Maturation, 2026-2036

- Figure 47: United Kingdom, Airborne Countermeasures System Market, Market Forecast, 2026-2036

- Figure 48: Opportunity Analysis, Airborne Countermeasures System Market, By Region (Cumulative Market), 2026-2036

- Figure 49: Opportunity Analysis, Airborne Countermeasures System Market, By Region (CAGR), 2026-2036

- Figure 50: Opportunity Analysis, Airborne Countermeasures System Market, By (Cumulative Market), 2026-2036

- Figure 51: Opportunity Analysis, Airborne Countermeasures System Market, By Application (CAGR), 2026-2036

- Figure 52: Opportunity Analysis, Airborne Countermeasures System Market, By Type (Cumulative Market), 2026-2036

- Figure 53: Opportunity Analysis, Airborne Countermeasures System Market, By Type (CAGR), 2026-2036

- Figure 54: Scenario Analysis, Airborne Countermeasures System Market, Cumulative Market, 2026-2036

- Figure 55: Scenario Analysis, Airborne Countermeasures System Market, Global Market, 2026-2036

- Figure 56: Scenario 1, Airborne Countermeasures System Market, Total Market, 2026-2036

- Figure 57: Scenario 1, Airborne Countermeasures System Market, By Region, 2026-2036

- Figure 58: Scenario 1, Airborne Countermeasures System Market, By Application , 2026-2036

- Figure 59: Scenario 1, Airborne Countermeasures System Market, By Type , 2026-2036

- Figure 60: Scenario 2, Airborne Countermeasures System Market, Total Market, 2026-2036

- Figure 61: Scenario 2, Airborne Countermeasures System Market, By Region, 2026-2036

- Figure 62: Scenario 2, Airborne Countermeasures System Market, By Application , 2026-2036

- Figure 63: Scenario 2, Airborne Countermeasures System Market, By Type , 2026-2036

- Figure 64: Company Benchmark, Airborne Countermeasures System Market, 2026-2036