PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1936045

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1936045

Global Defense Aircraft Braking Systems Market 2026-2036

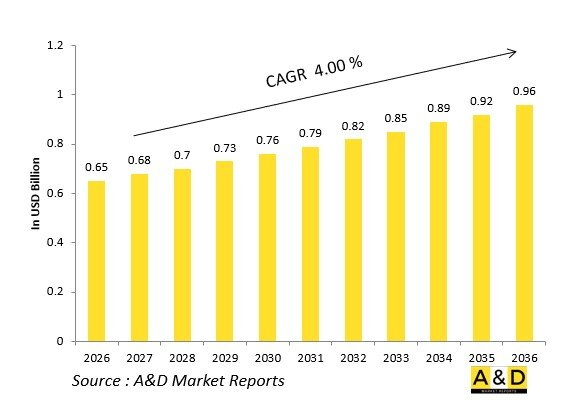

The Global Defense Aircraft Braking Systems Market is estimated at USD 0.65 billion in 2026, projected to grow to USD 0.96billion by 2036 at a Compound Annual Growth Rate (CAGR) of 4.00% over the forecast period 2026-2036.

Introduction

The global Defense Aircraft Braking Systems market underpins tactical aircraft performance, delivering precise control during high-energy landings on carriers, forward strips, and damaged runways. Multi-disc carbon stacks, hydraulic power packs, and anti-skid processors enable aggressive maneuvers while protecting airframes from overload.

Market dynamics reflect fifth-generation fighter sustainment and rotary-wing upgrades, where braking evolves from steel rotors to lightweight composites resisting fade under sustained combat loads. Core technologies include segmented carbon heat sinks, electrically signaled actuation, and prognostic health monitoring integrated with flight controls.

Geopolitical demands for rapid deployment drive procurement, prioritizing systems compatible with STOBAR carriers and desert bases. Modular designs facilitate retrofits across legacy fleets. Supply chains emphasize refractory metals and ceramic coatings. Competition features Honeywell, Safran, and Collins Aerospace pioneering all-electric variants.

This market enables air dominance through ground agility.

Technology Impact in Defense Aircraft Braking Systems

Carbon-carbon composites revolutionize braking with superior heat dissipation, enabling repeated high-energy arrests without fade-critical for carrier traps and weapons deliveries. Segmented rotors allow hot sections to be swapped independently, slashing downtime between missions.

Electro-hydraulic servo valves deliver precise pressure modulation, integrating with fly-by-wire for auto-brake schedules that optimize tire wear across gear trucks. Anti-skid algorithms process wheel speeds against inertial references, preventing lockup on contaminated runways via pulse-code modulation.

Prognostic sensors embedded in stacks monitor carbon oxidation and hydraulic contamination, cueing maintenance before performance degrades. Electric braking actuators eliminate hydraulic lines entirely, reducing vulnerability in stealth designs and enabling variable brake torque for weight-optimized landings.

Integrated brake-by-wire fuses autobrake with thrust reversers and spoilers, compressing landing rolls. Ceramic friction materials withstand directed-energy heat. Digital twins simulate wear profiles for lifetime extension. These advancements boost sortie rates and enable operations from unprepared strips.

Key Drivers in Defense Aircraft Braking Systems

Fifth-generation fighter programs mandate high-cycle braking resilient to stealth coatings and weapons loads. Expeditionary doctrines require short-field capability on semi-prepared surfaces, driving carbon upgrades over steel.

Carrier aviation demands repeated arrested landings, prioritizing fade-resistant stacks. Rotary-wing brownouts necessitate modulated braking to maintain control in zero-visibility dust.

Sustainment economics favor prognostic systems minimizing unscheduled removals. Export offsets spur localized production of hydraulic accumulators. Interoperability standards enable common spares across coalitions.

Directed-energy proliferation requires heat-resistant ceramics. Green procurement pushes recyclable carbon over expendable metals. Supply chain resilience counters raw material constraints.

These imperatives position braking as tactical enablers.

Regional Trends in Defense Aircraft Braking Systems

North America leads with F-35 sustainment driving carbon stack innovations for vertical landings.

Europe upgrades Eurofighter and Rafale with electric actuators for dispersed ops.

Asia-Pacific surges via indigenous fighters-India's Tejas, China's J-35-prioritizing carrier compatibility.

Middle East equips high-sortie fleets against desert heat.

Russia adapts MiG-35 braking for rough strips.

South Korea integrates with KF-21 for regional deterrence.

Trends favor all-electric systems; Asia-Pacific gains manufacturing share.

Key Defense Aircraft Braking Systems Programs

F-35 Lightning II integrates carbon stacks with autobrake-by-wire for STOVL operations.

Rafale upgrades deploy segmented ceramics for carrier assaults.

Eurofighter Tranche enhancements fuse braking with flight controls.

India's Tejas Mk2 equips indigenous carbon rotors.

KC-46 Pegasus tanker braking handles heavy loads.

CVN-78 Ford-class catapult integration demands precision modulation.

Black Hawk UH-60M upgrades electric actuators for brownout landings.

V-22 Osprey tiltrotor braking manages proprotor transitions.

Table of Contents

Defense Aircraft Braking Systems Market Market - Table of Contents

Defense Aircraft Braking Systems Market Market Report Definition

Defense Aircraft Braking Systems Market Market Segmentation

By Platform

By Brake Type

By Control System

By Function

Defense Aircraft Braking Systems Market Market Analysis for next 10 Years

The 10-year Defense Aircraft Braking Systems Market market analysis would give a detailed overview of Defense Aircraft Braking Systems Market market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense Aircraft Braking Systems Market Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense Aircraft Braking Systems Market Market Forecast

The 10-year Defense Aircraft Braking Systems Market market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense Aircraft Braking Systems Market Market Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense Aircraft Braking Systems Market Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense Aircraft Braking Systems Market Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense Aircraft Braking Systems Market Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2026-2036

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2026-2036

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2026-2036

- Table 19: Scenario Analysis, Scenario 1, By Brake Type , 2026-2036

- Table 20: Scenario Analysis, Scenario 2, By Region, 2026-2036

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2026-2036

- Table 22: Scenario Analysis, Scenario 2, By Brake Type , 2026-2036

List of Figures

- Figure 1: Global Aircraft Braking Systems Market Forecast, 2026-2036

- Figure 2: Global Aircraft Braking Systems Market Forecast, By Region, 2026-2036

- Figure 3: Global Aircraft Braking Systems Market Forecast, By Platform, 2026-2036

- Figure 4: Global Aircraft Braking Systems Market Forecast, By Brake Type , 2026-2036

- Figure 5: North America, Aircraft Braking Systems Market, Forecast, 2026-2036

- Figure 6: Europe, Aircraft Braking Systems Market, Forecast, 2026-2036

- Figure 7: Middle East, Aircraft Braking Systems Market, Forecast, 2026-2036

- Figure 8: APAC, Aircraft Braking Systems Market, Forecast, 2026-2036

- Figure 9: South America, Aircraft Braking Systems Market, Forecast, 2026-2036

- Figure 10: United States, Aircraft Braking Systems Market, Technology Maturation, 2026-2036

- Figure 11: United States, Aircraft Braking Systems Market, Forecast, 2026-2036

- Figure 12: Canada, Aircraft Braking Systems Market, Technology Maturation, 2026-2036

- Figure 13: Canada, Aircraft Braking Systems Market, Forecast, 2026-2036

- Figure 14: Italy, Aircraft Braking Systems Market, Technology Maturation, 2026-2036

- Figure 15: Italy, Aircraft Braking Systems Market, Market Forecast, 2026-2036

- Figure 16: France, Aircraft Braking Systems Market, Technology Maturation, 2026-2036

- Figure 17: France, Aircraft Braking Systems Market, Market Forecast, 2026-2036

- Figure 18: Germany, Aircraft Braking Systems Market, Technology Maturation, 2026-2036

- Figure 19: Germany, Aircraft Braking Systems Market, Market Forecast, 2026-2036

- Figure 20: Netherlands, Aircraft Braking Systems Market, Technology Maturation, 2026-2036

- Figure 21: Netherlands, Aircraft Braking Systems Market, Market Forecast, 2026-2036

- Figure 22: Belgium, Aircraft Braking Systems Market, Technology Maturation, 2026-2036

- Figure 23: Belgium, Aircraft Braking Systems Market, Market Forecast, 2026-2036

- Figure 24: Spain, Aircraft Braking Systems Market, Technology Maturation, 2026-2036

- Figure 25: Spain, Aircraft Braking Systems Market, Market Forecast, 2026-2036

- Figure 26: Sweden, Aircraft Braking Systems Market, Technology Maturation, 2026-2036

- Figure 27: Sweden, Aircraft Braking Systems Market, Market Forecast, 2026-2036

- Figure 28: Brazil, Aircraft Braking Systems Market, Technology Maturation, 2026-2036

- Figure 29: Brazil, Aircraft Braking Systems Market, Market Forecast, 2026-2036

- Figure 30: Australia, Aircraft Braking Systems Market, Technology Maturation, 2026-2036

- Figure 31: Australia, Aircraft Braking Systems Market, Market Forecast, 2026-2036

- Figure 32: India, Aircraft Braking Systems Market, Technology Maturation, 2026-2036

- Figure 33: India, Aircraft Braking Systems Market, Market Forecast, 2026-2036

- Figure 34: China, Aircraft Braking Systems Market, Technology Maturation, 2026-2036

- Figure 35: China, Aircraft Braking Systems Market, Market Forecast, 2026-2036

- Figure 36: Saudi Arabia, Aircraft Braking Systems Market, Technology Maturation, 2026-2036

- Figure 37: Saudi Arabia, Aircraft Braking Systems Market, Market Forecast, 2026-2036

- Figure 38: South Korea, Aircraft Braking Systems Market, Technology Maturation, 2026-2036

- Figure 39: South Korea, Aircraft Braking Systems Market, Market Forecast, 2026-2036

- Figure 40: Japan, Aircraft Braking Systems Market, Technology Maturation, 2026-2036

- Figure 41: Japan, Aircraft Braking Systems Market, Market Forecast, 2026-2036

- Figure 42: Malaysia, Aircraft Braking Systems Market, Technology Maturation, 2026-2036

- Figure 43: Malaysia, Aircraft Braking Systems Market, Market Forecast, 2026-2036

- Figure 44: Singapore, Aircraft Braking Systems Market, Technology Maturation, 2026-2036

- Figure 45: Singapore, Aircraft Braking Systems Market, Market Forecast, 2026-2036

- Figure 46: United Kingdom, Aircraft Braking Systems Market, Technology Maturation, 2026-2036

- Figure 47: United Kingdom, Aircraft Braking Systems Market, Market Forecast, 2026-2036

- Figure 48: Opportunity Analysis, Aircraft Braking Systems Market, By Region (Cumulative Market), 2026-2036

- Figure 49: Opportunity Analysis, Aircraft Braking Systems Market, By Region (CAGR), 2026-2036

- Figure 50: Opportunity Analysis, Aircraft Braking Systems Market, By (Cumulative Market), 2026-2036

- Figure 51: Opportunity Analysis, Aircraft Braking Systems Market, By Platform(CAGR), 2026-2036

- Figure 52: Opportunity Analysis, Aircraft Braking Systems Market, By Brake Type (Cumulative Market), 2026-2036

- Figure 53: Opportunity Analysis, Aircraft Braking Systems Market, By Brake Type (CAGR), 2026-2036

- Figure 54: Scenario Analysis, Aircraft Braking Systems Market, Cumulative Market, 2026-2036

- Figure 55: Scenario Analysis, Aircraft Braking Systems Market, Global Market, 2026-2036

- Figure 56: Scenario 1, Aircraft Braking Systems Market, Total Market, 2026-2036

- Figure 57: Scenario 1, Aircraft Braking Systems Market, By Region, 2026-2036

- Figure 58: Scenario 1, Aircraft Braking Systems Market, By Platform, 2026-2036

- Figure 59: Scenario 1, Aircraft Braking Systems Market, By Brake Type , 2026-2036

- Figure 60: Scenario 2, Aircraft Braking Systems Market, Total Market, 2026-2036

- Figure 61: Scenario 2, Aircraft Braking Systems Market, By Region, 2026-2036

- Figure 62: Scenario 2, Aircraft Braking Systems Market, By Platform, 2026-2036

- Figure 63: Scenario 2, Aircraft Braking Systems Market, By Brake Type , 2026-2036

- Figure 64: Company Benchmark, Aircraft Braking Systems Market, 2026-2036