PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1936049

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1936049

Global Defense Full Authority Digital Engine Control (FADEC) Market 2026-2036

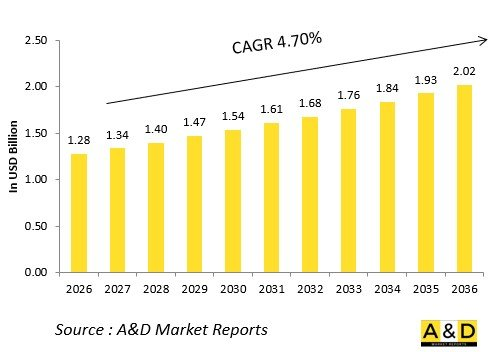

The Global Defense Full Authority Digital Engine Control (FADEC) Market is estimated at USD 1.28 billion in 2026, projected to grow to USD 2.02 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 4.70% over the forecast period 2026-2036.

Introduction

The global Defense FADEC market governs military turbofan and turboshaft performance through electronic engine controllers processing throttle inputs alongside pressures, temperatures, and Mach data. Dual-channel architectures command fuel metering, stator vanes, bleed valves, and afterburner sequencing without mechanical backups, placing full authority in software.

Market evolution tracks sixth-generation demands, where FADEC fuses with flight controls for optimized thrust under extreme transients. Core capabilities include surge prevention, overtemperature protection, and automatic relights, all while maximizing efficiency across flight envelopes. Health monitoring streams diagnostics to ground stations.

Geopolitical air superiority races drive development, prioritizing cyber-hardened controllers for networked warfare. Modular software enables rapid threat response updates. Supply chains focus on radiation-tolerant processors. Competition features BAE Systems, Honeywell, and Safran pioneering model-based controls.

Technology Impact in Defense FADEC

AI-driven model predictive control anticipates compressor stalls before degradation, adjusting vanes proactively during aggressive maneuvers. Dual-channel voting compares sensor suites continuously, isolating faults within microseconds via hardware separation and diverse software paths.

Cyber-hardened partitions segregate critical thrust commands from prognostic data links. Open-system architectures enable third-party apps for mission-specific scheduling-supercruise versus loiter. Integrated vehicle management fuses FADEC outputs with flight laws for canardless stability.

Quantum-resistant encryption secures parameter tables against nation-state threats. Digital twins validate control laws pre-flight against engine variants. Fault-tolerant designs degrade gracefully, reverting to single-channel limp-home modes.

High-temperature silicon carbide processors survive uncontained failures. Blockchain logs immutable health data for post-mission audits. Adaptive fuel schedules counter degraded components automatically. These innovations slash pilot workload while expanding operational envelopes safely.

Key Drivers in Defense FADEC

Sixth-generation integration mandates FADEC fusion with mission systems for autonomous teaming. Super cruise optimization requires real-time variable geometry beyond human response times.

Sustainment economics favor prognostics eliminating scheduled removals. Export markets demand configurable software for diverse engines. Cyber warfare escalation drives air-gapped controllers.

Budget pressures prioritize commercial derivatives with military hardening. Supply chain resilience counters processor shortages via domestic fabs. Interoperability standards enable coalition data sharing.

Unmanned loyal wingmen need lightweight controllers without cockpit interfaces. These imperatives embed FADEC as propulsion intelligence.

Regional Trends in Defense FADEC

North America pioneers AI-augmented controls for NGAD adaptive engines.

Europe standardizes via FCAS frameworks, harmonizing dual-channel architectures.

Asia-Pacific accelerates indigenous development-India's Kaveri FADEC, China's WS-15-for high-altitude intercepts.

Middle East pursues hardened controllers for desert over temps.

Russia advances fault-tolerant designs for Su-57 agility.

South Korea integrates with KF-21 export packages.

Trends favor model-based controls; Asia-Pacific gains software talent.

Key Defense FADEC Programs

F135 FADEC governs STOVL lift fan transitions and afterburner sequencing across variants.

NGAD digital engine control fuses with AI wingmen for formation thrust.

EJ200 upgrades enable dry super cruise via predictive scheduling.

India's GTRE FADEC powers Kaveri derivatives with stall protection.

WS-15 controller manages high-temperature materials autonomously.

Rafale M88 FADEC integrates carrier catapult profiles.

Su-57 AL-41F1S FADEC enables 3D thrust vectoring safely.

T-50 FADEC handles super maneuverability envelope protection.

Table of Contents

Defense Full Authority Digital Engine Control (FADEC) Market- Table of Contents

Defense Full Authority Digital Engine Control (FADEC) Market Report Definition

Defense Full Authority Digital Engine Control (FADEC) Market Segmentation

By Platform

By Region

By Engine Type

Defense Full Authority Digital Engine Control (FADEC) Market Analysis for next 10 Years

The 10-year Defense Full Authority Digital Engine Control (FADEC) Market analysis would give a detailed overview of Defense Full Authority Digital Engine Control (FADEC) Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense Aircraft Braking Systems Market Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense Full Authority Digital Engine Control (FADEC) Market Forecast

The 10-year Defense Full Authority Digital Engine Control (FADEC) Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense Full Authority Digital Engine Control (FADEC) Market Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense Aircraft Braking Systems Market Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense Aircraft Braking Systems Market Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense Full Authority Digital Engine Control (FADEC) Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2026-2036

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2026-2036

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2026-2036

- Table 19: Scenario Analysis, Scenario 1, By Engine Type, 2026-2036

- Table 20: Scenario Analysis, Scenario 2, By Region, 2026-2036

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2026-2036

- Table 22: Scenario Analysis, Scenario 2, By Engine Type, 2026-2036

List of Figures

- Figure 1: Global Full Authority Digital Engine Control (FADEC) Market Forecast, 2026-2036

- Figure 2: Global Full Authority Digital Engine Control (FADEC) Market Forecast, By Region, 2026-2036

- Figure 3: Global Full Authority Digital Engine Control (FADEC) Market Forecast, By Platform, 2026-2036

- Figure 4: Global Full Authority Digital Engine Control (FADEC) Market Forecast, By Engine Type, 2026-2036

- Figure 5: North America, Full Authority Digital Engine Control (FADEC) Market , Forecast, 2026-2036

- Figure 6: Europe, Full Authority Digital Engine Control (FADEC) Market , Forecast, 2026-2036

- Figure 7: Middle East, Full Authority Digital Engine Control (FADEC) Market , Forecast, 2026-2036

- Figure 8: APAC, Full Authority Digital Engine Control (FADEC) Market , Forecast, 2026-2036

- Figure 9: South America, Full Authority Digital Engine Control (FADEC) Market , Forecast, 2026-2036

- Figure 10: United States, Full Authority Digital Engine Control (FADEC) Market , Technology Maturation, 2026-2036

- Figure 11: United States, Full Authority Digital Engine Control (FADEC) Market , Forecast, 2026-2036

- Figure 12: Canada, Full Authority Digital Engine Control (FADEC) Market , Technology Maturation, 2026-2036

- Figure 13: Canada, Full Authority Digital Engine Control (FADEC) Market , Forecast, 2026-2036

- Figure 14: Italy, Full Authority Digital Engine Control (FADEC) Market , Technology Maturation, 2026-2036

- Figure 15: Italy, Full Authority Digital Engine Control (FADEC) Market , Market Forecast, 2026-2036

- Figure 16: France, Full Authority Digital Engine Control (FADEC) Market , Technology Maturation, 2026-2036

- Figure 17: France, Full Authority Digital Engine Control (FADEC) Market , Market Forecast, 2026-2036

- Figure 18: Germany, Full Authority Digital Engine Control (FADEC) Market , Technology Maturation, 2026-2036

- Figure 19: Germany, Full Authority Digital Engine Control (FADEC) Market , Market Forecast, 2026-2036

- Figure 20: Netherlands, Full Authority Digital Engine Control (FADEC) Market , Technology Maturation, 2026-2036

- Figure 21: Netherlands, Full Authority Digital Engine Control (FADEC) Market , Market Forecast, 2026-2036

- Figure 22: Belgium, Full Authority Digital Engine Control (FADEC) Market , Technology Maturation, 2026-2036

- Figure 23: Belgium, Full Authority Digital Engine Control (FADEC) Market , Market Forecast, 2026-2036

- Figure 24: Spain, Full Authority Digital Engine Control (FADEC) Market , Technology Maturation, 2026-2036

- Figure 25: Spain, Full Authority Digital Engine Control (FADEC) Market , Market Forecast, 2026-2036

- Figure 26: Sweden, Full Authority Digital Engine Control (FADEC) Market , Technology Maturation, 2026-2036

- Figure 27: Sweden, Full Authority Digital Engine Control (FADEC) Market , Market Forecast, 2026-2036

- Figure 28: Brazil, Full Authority Digital Engine Control (FADEC) Market , Technology Maturation, 2026-2036

- Figure 29: Brazil, Full Authority Digital Engine Control (FADEC) Market , Market Forecast, 2026-2036

- Figure 30: Australia, Full Authority Digital Engine Control (FADEC) Market , Technology Maturation, 2026-2036

- Figure 31: Australia, Full Authority Digital Engine Control (FADEC) Market , Market Forecast, 2026-2036

- Figure 32: India, Full Authority Digital Engine Control (FADEC) Market , Technology Maturation, 2026-2036

- Figure 33: India, Full Authority Digital Engine Control (FADEC) Market , Market Forecast, 2026-2036

- Figure 34: China, Full Authority Digital Engine Control (FADEC) Market , Technology Maturation, 2026-2036

- Figure 35: China, Full Authority Digital Engine Control (FADEC) Market , Market Forecast, 2026-2036

- Figure 36: Saudi Arabia, Full Authority Digital Engine Control (FADEC) Market , Technology Maturation, 2026-2036

- Figure 37: Saudi Arabia, Full Authority Digital Engine Control (FADEC) Market , Market Forecast, 2026-2036

- Figure 38: South Korea, Full Authority Digital Engine Control (FADEC) Market , Technology Maturation, 2026-2036

- Figure 39: South Korea, Full Authority Digital Engine Control (FADEC) Market , Market Forecast, 2026-2036

- Figure 40: Japan, Full Authority Digital Engine Control (FADEC) Market , Technology Maturation, 2026-2036

- Figure 41: Japan, Full Authority Digital Engine Control (FADEC) Market , Market Forecast, 2026-2036

- Figure 42: Malaysia, Full Authority Digital Engine Control (FADEC) Market , Technology Maturation, 2026-2036

- Figure 43: Malaysia, Full Authority Digital Engine Control (FADEC) Market , Market Forecast, 2026-2036

- Figure 44: Singapore, Full Authority Digital Engine Control (FADEC) Market , Technology Maturation, 2026-2036

- Figure 45: Singapore, Full Authority Digital Engine Control (FADEC) Market , Market Forecast, 2026-2036

- Figure 46: United Kingdom, Full Authority Digital Engine Control (FADEC) Market , Technology Maturation, 2026-2036

- Figure 47: United Kingdom, Full Authority Digital Engine Control (FADEC) Market , Market Forecast, 2026-2036

- Figure 48: Opportunity Analysis, Full Authority Digital Engine Control (FADEC) Market , By Region (Cumulative Market), 2026-2036

- Figure 49: Opportunity Analysis, Full Authority Digital Engine Control (FADEC) Market , By Region (CAGR), 2026-2036

- Figure 50: Opportunity Analysis, Full Authority Digital Engine Control (FADEC) Market , By (Cumulative Market), 2026-2036

- Figure 51: Opportunity Analysis, Full Authority Digital Engine Control (FADEC) Market , By Platform(CAGR), 2026-2036

- Figure 52: Opportunity Analysis, Full Authority Digital Engine Control (FADEC) Market , By Engine Type (Cumulative Market), 2026-2036

- Figure 53: Opportunity Analysis, Full Authority Digital Engine Control (FADEC) Market , By Engine Type (CAGR), 2026-2036

- Figure 54: Scenario Analysis, Full Authority Digital Engine Control (FADEC) Market , Cumulative Market, 2026-2036

- Figure 55: Scenario Analysis, Full Authority Digital Engine Control (FADEC) Market , Global Market, 2026-2036

- Figure 56: Scenario 1, Full Authority Digital Engine Control (FADEC) Market , Total Market, 2026-2036

- Figure 57: Scenario 1, Full Authority Digital Engine Control (FADEC) Market , By Region, 2026-2036

- Figure 58: Scenario 1, Full Authority Digital Engine Control (FADEC) Market , By Platform, 2026-2036

- Figure 59: Scenario 1, Full Authority Digital Engine Control (FADEC) Market , By Engine Type, 2026-2036

- Figure 60: Scenario 2, Full Authority Digital Engine Control (FADEC) Market , Total Market, 2026-2036

- Figure 61: Scenario 2, Full Authority Digital Engine Control (FADEC) Market , By Region, 2026-2036

- Figure 62: Scenario 2, Full Authority Digital Engine Control (FADEC) Market , By Platform, 2026-2036

- Figure 63: Scenario 2, Full Authority Digital Engine Control (FADEC) Market , By Engine Type, 2026-2036

- Figure 64: Company Benchmark, Full Authority Digital Engine Control (FADEC) Market , 2026-2036