PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1936051

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1936051

Global Defense Engine Fuel Pumps Market 2026-2036

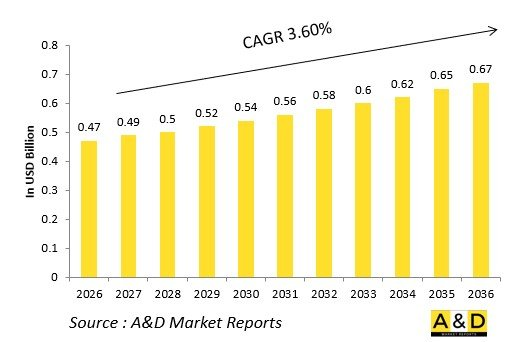

The Global Defense Engine Fuel Pumps Market is estimated at USD 0.47 billion in 2026, projected to grow to USD 0.67 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 3.60% over the forecast period 2026-2036.

Introduction

The global Defense Engine Fuel Pumps market delivers precise kerosene flow to combustors under extreme dynamics, from idle to full afterburner via gear-driven positive displacement and centrifugal boosters. Main pumps meter fuel through engine-mounted filters, while emergency systems ensure restart capability post-flameout.

Market evolution tracks adaptive cycle engines requiring variable delivery across bypass ratios. Core technologies include dual-shear gears, electro-hydraulic servos, and vapor-separating inlets preventing cavitation at altitude. Emphasis on fault-tolerant designs supports unmanned deep-strike missions.

Geopolitical air superiority competitions drive development, prioritizing pumps compatible with synthetic fuels and directed-energy power extraction. Modular cartridges enable field replacement without engine teardown. Supply chains focus on contamination-resistant coatings and high-pressure seals. Competition features Parker, Eaton, and Woodward pioneering electric main pumps.

Technology Impact in Defense Engine Fuel Pumps

Electric fuel pumps decouple delivery from engine speed, enabling precise metering via brushless DC motors independent of accessory gearbox failures. Variable speed controllers adjust flow preemptively during transients, preventing rich/lean excursions.

Integrated health monitoring embeds pressure transducers and flow sensors feeding FADEC prognostics, detecting gear wear via debris analysis. Carbon composite impellers resist foreign object damage while slashing inertial loads. Electrostatic precipitators capture submicron contaminants before pump faces.

Adaptive control laws compensate for fuel thermal expansion across climates, maintaining spray quality. Dual-channel redundancy cross-checks delivery against combustor demands. Vapor tolerant inlets with porous metal screens separate gas during climbs.

Cascaded architectures layer boost then main stages, each optimized for pressure rise. 3D-printed helical gears enable custom tooth profiles minimizing shear heating. Digital twins validate pump signatures against battle-damaged engines. These innovations ensure combustion stability under 9g maneuvers.

Key Drivers in Defense Engine Fuel Pumps

Adaptive cycle engines demand variable flow independent of spool speeds, driving electric pump adoption over gearbox slaves. Sixth-generation unmanned platforms require restart capability without starter cart dependency.

Sustainment economics favor cartridge designs eliminating scheduled removals. Export markets need synthetic fuel compatibility across coalitions. Supercruise transitions mandate instantaneous delivery without surge.

Budget pressures prioritize commercial derivatives with military hardening. Supply chain resilience counters rare-earth magnet shortages. Interoperability standards enable common manifolds across engine families.

Directed-energy weapons extraction requires high-pressure boost stages. These imperatives position pumps as combustion enablers.

Regional Trends in Defense Engine Fuel Pumps

North America leads with F-35 sustainment driving electric main pumps for STOVL profiles.

Europe upgrades Rafale/Typhoon with variable speed controllers for dispersed basing.

Asia-Pacific accelerates indigenous development-India's Kaveri, China's WS-15-for high-altitude startups.

Middle East pursues sand-tolerant designs with advanced filtration.

Russia advances high-g tolerant pumps for Su-57 agility.

South Korea integrates with KF-21 export packages.

Trends favor brushless electric; Asia-Pacific gains manufacturing share.

Key Defense Engine Fuel Pumps Programs

F135 fuel system meters STOVL lift fan transitions and afterburner surges via electric boost.

NGAD adaptive pumps schedule delivery with third-stream modulation.

EJ200 upgrades deliver supercruise flow through dual positive displacement.

India's Kaveri equips dry/wet variants with indigenous gear pumps.

F119 pumps sustain stealth missions with low-vapor inlets.

Rafale M88 integrates emergency electric restart capability.

Su-57 AL-41F1 pumps handle 3D thrust vectoring transients.

T-50 FADEC-driven metering prevents compressor stalls.

Table of Contents

Defense Engine Fuel Pumps Market - Table of Contents

Defense Engine Fuel Pumps Market Report Definition

Defense Engine Fuel Pumps Market Segmentation

By Platform

By Pump Type

By Drive Method

By Fuel Type

Defense Engine Fuel Pumps Market Analysis for next 10 Years

The 10-year Defense Engine Fuel Pumps market analysis would give a detailed overview of Defense Engine Fuel Pumps market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense Engine Fuel Pumps Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense Engine Fuel Pumps Market Forecast

The 10-year Defense Engine Fuel Pumps market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense Engine Fuel Pumps Market Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense Engine Fuel Pumps Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense Engine Fuel Pumps Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense Engine Fuel Pumps Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2026-2036

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Pump Type, 2026-2036

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2026-2036

- Table 19: Scenario Analysis, Scenario 1, By Fuel Type, 2026-2036

- Table 20: Scenario Analysis, Scenario 2, By Pump Type, 2026-2036

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2026-2036

- Table 22: Scenario Analysis, Scenario 2, By Fuel Type, 2026-2036

List of Figures

- Figure 1: Global Defense Engine Fuel Pumps Market Forecast, 2026-2036

- Figure 2: Global Defense Engine Fuel Pumps Market Forecast, By Pump Type, 2026-2036

- Figure 3: Global Defense Engine Fuel Pumps Market Forecast, By Platform, 2026-2036

- Figure 4: Global Defense Engine Fuel Pumps Market Forecast, By Fuel Type, 2026-2036

- Figure 5: North America, Defense Engine Fuel Pumps Market, Forecast, 2026-2036

- Figure 6: Europe, Defense Engine Fuel Pumps Market, Forecast, 2026-2036

- Figure 7: Middle East, Defense Engine Fuel Pumps Market, Forecast, 2026-2036

- Figure 8: APAC, Defense Engine Fuel Pumps Market, Forecast, 2026-2036

- Figure 9: South America, Defense Engine Fuel Pumps Market, Forecast, 2026-2036

- Figure 10: United States, Defense Engine Fuel Pumps Market, Technology Maturation, 2026-2036

- Figure 11: United States, Defense Engine Fuel Pumps Market, Forecast, 2026-2036

- Figure 12: Canada, Defense Engine Fuel Pumps Market, Technology Maturation, 2026-2036

- Figure 13: Canada, Defense Engine Fuel Pumps Market, Forecast, 2026-2036

- Figure 14: Italy, Defense Engine Fuel Pumps Market, Technology Maturation, 2026-2036

- Figure 15: Italy, Defense Engine Fuel Pumps Market, Market Forecast, 2026-2036

- Figure 16: France, Defense Engine Fuel Pumps Market, Technology Maturation, 2026-2036

- Figure 17: France, Defense Engine Fuel Pumps Market, Market Forecast, 2026-2036

- Figure 18: Germany, Defense Engine Fuel Pumps Market, Technology Maturation, 2026-2036

- Figure 19: Germany, Defense Engine Fuel Pumps Market, Market Forecast, 2026-2036

- Figure 20: Netherlands, Defense Engine Fuel Pumps Market, Technology Maturation, 2026-2036

- Figure 21: Netherlands, Defense Engine Fuel Pumps Market, Market Forecast, 2026-2036

- Figure 22: Belgium, Defense Engine Fuel Pumps Market, Technology Maturation, 2026-2036

- Figure 23: Belgium, Defense Engine Fuel Pumps Market, Market Forecast, 2026-2036

- Figure 24: Spain, Defense Engine Fuel Pumps Market, Technology Maturation, 2026-2036

- Figure 25: Spain, Defense Engine Fuel Pumps Market, Market Forecast, 2026-2036

- Figure 26: Sweden, Defense Engine Fuel Pumps Market, Technology Maturation, 2026-2036

- Figure 27: Sweden, Defense Engine Fuel Pumps Market, Market Forecast, 2026-2036

- Figure 28: Brazil, Defense Engine Fuel Pumps Market, Technology Maturation, 2026-2036

- Figure 29: Brazil, Defense Engine Fuel Pumps Market, Market Forecast, 2026-2036

- Figure 30: Australia, Defense Engine Fuel Pumps Market, Technology Maturation, 2026-2036

- Figure 31: Australia, Defense Engine Fuel Pumps Market, Market Forecast, 2026-2036

- Figure 32: India, Defense Engine Fuel Pumps Market, Technology Maturation, 2026-2036

- Figure 33: India, Defense Engine Fuel Pumps Market, Market Forecast, 2026-2036

- Figure 34: China, Defense Engine Fuel Pumps Market, Technology Maturation, 2026-2036

- Figure 35: China, Defense Engine Fuel Pumps Market, Market Forecast, 2026-2036

- Figure 36: Saudi Arabia, Defense Engine Fuel Pumps Market, Technology Maturation, 2026-2036

- Figure 37: Saudi Arabia, Defense Engine Fuel Pumps Market, Market Forecast, 2026-2036

- Figure 38: South Korea, Defense Engine Fuel Pumps Market, Technology Maturation, 2026-2036

- Figure 39: South Korea, Defense Engine Fuel Pumps Market, Market Forecast, 2026-2036

- Figure 40: Japan, Defense Engine Fuel Pumps Market, Technology Maturation, 2026-2036

- Figure 41: Japan, Defense Engine Fuel Pumps Market, Market Forecast, 2026-2036

- Figure 42: Malaysia, Defense Engine Fuel Pumps Market, Technology Maturation, 2026-2036

- Figure 43: Malaysia, Defense Engine Fuel Pumps Market, Market Forecast, 2026-2036

- Figure 44: Singapore, Defense Engine Fuel Pumps Market, Technology Maturation, 2026-2036

- Figure 45: Singapore, Defense Engine Fuel Pumps Market, Market Forecast, 2026-2036

- Figure 46: United Kingdom, Defense Engine Fuel Pumps Market, Technology Maturation, 2026-2036

- Figure 47: United Kingdom, Defense Engine Fuel Pumps Market, Market Forecast, 2026-2036

- Figure 48: Opportunity Analysis, Defense Engine Fuel Pumps Market, By Pump Type (Cumulative Market), 2026-2036

- Figure 49: Opportunity Analysis, Defense Engine Fuel Pumps Market, By Pump Type (CAGR), 2026-2036

- Figure 50: Opportunity Analysis, Defense Engine Fuel Pumps Market, By (Cumulative Market), 2026-2036

- Figure 51: Opportunity Analysis, Defense Engine Fuel Pumps Market, By Platform(CAGR), 2026-2036

- Figure 52: Opportunity Analysis, Defense Engine Fuel Pumps Market, By Fuel Type (Cumulative Market), 2026-2036

- Figure 53: Opportunity Analysis, Defense Engine Fuel Pumps Market, By Fuel Type (CAGR), 2026-2036

- Figure 54: Scenario Analysis, Defense Engine Fuel Pumps Market, Cumulative Market, 2026-2036

- Figure 55: Scenario Analysis, Defense Engine Fuel Pumps Market, Global Market, 2026-2036

- Figure 56: Scenario 1, Defense Engine Fuel Pumps Market, Total Market, 2026-2036

- Figure 57: Scenario 1, Defense Engine Fuel Pumps Market, By Pump Type, 2026-2036

- Figure 58: Scenario 1, Defense Engine Fuel Pumps Market, By Platform, 2026-2036

- Figure 59: Scenario 1, Defense Engine Fuel Pumps Market, By Fuel Type, 2026-2036

- Figure 60: Scenario 2, Defense Engine Fuel Pumps Market, Total Market, 2026-2036

- Figure 61: Scenario 2, Defense Engine Fuel Pumps Market, By Pump Type, 2026-2036

- Figure 62: Scenario 2, Defense Engine Fuel Pumps Market, By Platform, 2026-2036

- Figure 63: Scenario 2, Defense Engine Fuel Pumps Market, By Fuel Type, 2026-2036

- Figure 64: Company Benchmark, Defense Engine Fuel Pumps Market, 2026-2036