PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1936054

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1936054

Global Defense Thrust Reverser Systems Market 2026-2036

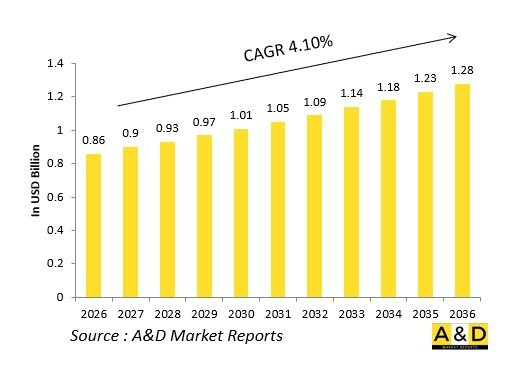

The Global Defense Thrust Reverser Systems Market is estimated at USD 0.86 billion in 2026, projected to grow to USD 1.28 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 4.10% over the forecast period 2026-2036.

Introduction

The global Defense Thrust Reverser Systems market equips tactical transports, tankers, and STOVL platforms with cascade, clamshell, and target mechanisms redirecting fan bypass flow forward post-touchdown. Translating sleeves expose turning vanes while blocker doors seal nacelles, generating braking force without wheel brake overload.

Market evolution reflects expeditionary requirements for short-field performance on damaged runways. Core technologies include electro-hydraulic sleeves, pneumatic accumulators, and FADEC-interlocked sequencing preventing in-flight deployment. Modular cascades enable rapid field swaps during forward operations.

Geopolitical demands for surge deployments drive development, prioritizing reversers compatible with high-bypass cores and synthetic fuels. Open architectures support retrofits across engine families. Supply chains focus on titanium extrusions and wear-resistant coatings. Competition features Collins Aerospace, Safran, and Spirit AeroSystems pioneering electromechanical drives.

Technology Impact in Defense Thrust Reverser Systems

Electromechanical actuators replace hydraulics, eliminating leak-prone lines while enabling precise sleeve positioning across temperatures. Shape memory alloy locks secure stowed positions without mechanical pins, auto-releasing on weight-on-wheels.

Variable area cascades adjust vane geometry mid-deployment, optimizing reverse thrust versus FOD ingestion. Embedded load cells monitor blocker door seals, preventing hot gas reingestion via FADEC aborts. Carbon composite translating sleeves slash weight while resisting bird strikes.

Smart sequencing fuses reverser deployment with autobrake and spoilers, maximizing deceleration envelopes. Digital twins validate cascade aerodynamics under crosswinds. Plasma surface treatments reduce nacelle icing adhesion.

Pneumatic over hydraulic actuation accelerates deployment for rejected takeoffs. Self-diagnostic strain gauges detect sleeve binding before failure. Target-style reversers for low-bypass engines pivot clamshells with electric rams. These innovations shrink landing rolls on unprepared surfaces.

Key Drivers in Defense Engine Thrust Reverser Systems

Expeditionary airlift demands short-field capability on semi-prepared strips, driving cascade adoption over legacy brakes. STOVL transitions require rapid deceleration post-vertical landings.

Sustainment economics favor modular sleeve assemblies minimizing engine removals. Export programs need synthetic fuel compatibility across kerosene blends. Surge operations mandate sub-second deployment.

Budget pressures prioritize commercial derivatives with mil-spec hardening. Supply resilience counters titanium sheet constraints. Interoperability enables common cascades across multinational fleets.

Carrier recoveries stress reversers beyond civil limits. These position thrust reversers as tactical enablers.

Regional Trends in Defense Thrust Reverser Systems

North America dominates C-17/A400M sustainment, pioneering electromechanical cascades for austere strips.

Europe upgrades A400M reversers for NATO forward basing.

Asia-Pacific surges with indigenous transports-India's MTA, China's Y-20-prioritizing carrier compatibility.

Middle East adapts coatings for desert FOD ingestion.

Russia hardens reversers for Il-76 arctic deployments.

South Korea integrates KF-21 ground test platforms.

Trends favor electromechanical; Asia-Pacific captures growth.

Key Defense Thrust Reverser Systems Programs

C-17 Globemaster cascades deploy pneumatically for short-field assaults.

A400M electromechanical reversers enable unprepared strip landings.

C-130J target reversers sustain legacy turboprops in counterinsurgency.

KC-46 Pegasus integrates with 767 nacelles for tanker recoveries.

V-22 Osprey proprotor reversers manage tiltrotor transitions.

C-2 Greyhound upgrades clamshell doors for carrier ops.

Il-76MD-90 cascades handle heavy-lift ground rolls.

Y-20 strategic reversers support Chinese airlift expansion.

Table of Contents

Defense thrust reverser systems Market - Table of Contents

Defense thrust reverser systems Market Report Definition

Defense thrust reverser systems Market Segmentation

By Platform

By Reverser Type

By Actuation

Defense thrust reverser systems Market Analysis for next 10 Years

The 10-year Defense thrust reverser systems market analysis would give a detailed overview of Defense thrust reverser systems market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense thrust reverser systems Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense thrust reverser systems Market Forecast

The 10-year Defense thrust reverser systems market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense thrust reverser systems Market Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense thrust reverser systems Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense thrust reverser systems Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense thrust reverser systems Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2026-2036

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Reverser Type, 2026-2036

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2026-2036

- Table 19: Scenario Analysis, Scenario 1, By Region, 2026-2036

- Table 20: Scenario Analysis, Scenario 2, By Reverser Type, 2026-2036

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2026-2036

- Table 22: Scenario Analysis, Scenario 2, By Region, 2026-2036

List of Figures

- Figure 1: Global Defense Thrust Reverser Systems Market Forecast, 2026-2036

- Figure 2: Global Defense Thrust Reverser Systems Market Forecast, By Reverser Type, 2026-2036

- Figure 3: Global Defense Thrust Reverser Systems Market Forecast, By Platform, 2026-2036

- Figure 4: Global Defense Thrust Reverser Systems Market Forecast, By Region, 2026-2036

- Figure 5: North America, Defense Thrust Reverser Systems Market , Forecast, 2026-2036

- Figure 6: Europe, Defense Thrust Reverser Systems Market , Forecast, 2026-2036

- Figure 7: Middle East, Defense Thrust Reverser Systems Market , Forecast, 2026-2036

- Figure 8: APAC, Defense Thrust Reverser Systems Market , Forecast, 2026-2036

- Figure 9: South America, Defense Thrust Reverser Systems Market , Forecast, 2026-2036

- Figure 10: United States, Defense Thrust Reverser Systems Market , Technology Maturation, 2026-2036

- Figure 11: United States, Defense Thrust Reverser Systems Market , Forecast, 2026-2036

- Figure 12: Canada, Defense Thrust Reverser Systems Market , Technology Maturation, 2026-2036

- Figure 13: Canada, Defense Thrust Reverser Systems Market , Forecast, 2026-2036

- Figure 14: Italy, Defense Thrust Reverser Systems Market , Technology Maturation, 2026-2036

- Figure 15: Italy, Defense Thrust Reverser Systems Market , Market Forecast, 2026-2036

- Figure 16: France, Defense Thrust Reverser Systems Market , Technology Maturation, 2026-2036

- Figure 17: France, Defense Thrust Reverser Systems Market , Market Forecast, 2026-2036

- Figure 18: Germany, Defense Thrust Reverser Systems Market , Technology Maturation, 2026-2036

- Figure 19: Germany, Defense Thrust Reverser Systems Market , Market Forecast, 2026-2036

- Figure 20: Netherlands, Defense Thrust Reverser Systems Market , Technology Maturation, 2026-2036

- Figure 21: Netherlands, Defense Thrust Reverser Systems Market , Market Forecast, 2026-2036

- Figure 22: Belgium, Defense Thrust Reverser Systems Market , Technology Maturation, 2026-2036

- Figure 23: Belgium, Defense Thrust Reverser Systems Market , Market Forecast, 2026-2036

- Figure 24: Spain, Defense Thrust Reverser Systems Market , Technology Maturation, 2026-2036

- Figure 25: Spain, Defense Thrust Reverser Systems Market , Market Forecast, 2026-2036

- Figure 26: Sweden, Defense Thrust Reverser Systems Market , Technology Maturation, 2026-2036

- Figure 27: Sweden, Defense Thrust Reverser Systems Market , Market Forecast, 2026-2036

- Figure 28: Brazil, Defense Thrust Reverser Systems Market , Technology Maturation, 2026-2036

- Figure 29: Brazil, Defense Thrust Reverser Systems Market , Market Forecast, 2026-2036

- Figure 30: Australia, Defense Thrust Reverser Systems Market , Technology Maturation, 2026-2036

- Figure 31: Australia, Defense Thrust Reverser Systems Market , Market Forecast, 2026-2036

- Figure 32: India, Defense Thrust Reverser Systems Market , Technology Maturation, 2026-2036

- Figure 33: India, Defense Thrust Reverser Systems Market , Market Forecast, 2026-2036

- Figure 34: China, Defense Thrust Reverser Systems Market , Technology Maturation, 2026-2036

- Figure 35: China, Defense Thrust Reverser Systems Market , Market Forecast, 2026-2036

- Figure 36: Saudi Arabia, Defense Thrust Reverser Systems Market , Technology Maturation, 2026-2036

- Figure 37: Saudi Arabia, Defense Thrust Reverser Systems Market , Market Forecast, 2026-2036

- Figure 38: South Korea, Defense Thrust Reverser Systems Market , Technology Maturation, 2026-2036

- Figure 39: South Korea, Defense Thrust Reverser Systems Market , Market Forecast, 2026-2036

- Figure 40: Japan, Defense Thrust Reverser Systems Market , Technology Maturation, 2026-2036

- Figure 41: Japan, Defense Thrust Reverser Systems Market , Market Forecast, 2026-2036

- Figure 42: Malaysia, Defense Thrust Reverser Systems Market , Technology Maturation, 2026-2036

- Figure 43: Malaysia, Defense Thrust Reverser Systems Market , Market Forecast, 2026-2036

- Figure 44: Singapore, Defense Thrust Reverser Systems Market , Technology Maturation, 2026-2036

- Figure 45: Singapore, Defense Thrust Reverser Systems Market , Market Forecast, 2026-2036

- Figure 46: United Kingdom, Defense Thrust Reverser Systems Market , Technology Maturation, 2026-2036

- Figure 47: United Kingdom, Defense Thrust Reverser Systems Market , Market Forecast, 2026-2036

- Figure 48: Opportunity Analysis, Defense Thrust Reverser Systems Market , By Reverser Type (Cumulative Market), 2026-2036

- Figure 49: Opportunity Analysis, Defense Thrust Reverser Systems Market , By Reverser Type (CAGR), 2026-2036

- Figure 50: Opportunity Analysis, Defense Thrust Reverser Systems Market , By (Cumulative Market), 2026-2036

- Figure 51: Opportunity Analysis, Defense Thrust Reverser Systems Market , By Platform(CAGR), 2026-2036

- Figure 52: Opportunity Analysis, Defense Thrust Reverser Systems Market , By Region (Cumulative Market), 2026-2036

- Figure 53: Opportunity Analysis, Defense Thrust Reverser Systems Market , By Region (CAGR), 2026-2036

- Figure 54: Scenario Analysis, Defense Thrust Reverser Systems Market , Cumulative Market, 2026-2036

- Figure 55: Scenario Analysis, Defense Thrust Reverser Systems Market , Global Market, 2026-2036

- Figure 56: Scenario 1, Defense Thrust Reverser Systems Market , Total Market, 2026-2036

- Figure 57: Scenario 1, Defense Thrust Reverser Systems Market , By Reverser Type, 2026-2036

- Figure 58: Scenario 1, Defense Thrust Reverser Systems Market , By Platform, 2026-2036

- Figure 59: Scenario 1, Defense Thrust Reverser Systems Market , By Region, 2026-2036

- Figure 60: Scenario 2, Defense Thrust Reverser Systems Market , Total Market, 2026-2036

- Figure 61: Scenario 2, Defense Thrust Reverser Systems Market , By Reverser Type, 2026-2036

- Figure 62: Scenario 2, Defense Thrust Reverser Systems Market , By Platform, 2026-2036

- Figure 63: Scenario 2, Defense Thrust Reverser Systems Market , By Region, 2026-2036

- Figure 64: Company Benchmark, Defense Thrust Reverser Systems Market , 2026-2036