PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1708457

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1708457

U.S. Ethanol Market, By Feedstock Type, By End Use, By Technology, By Application

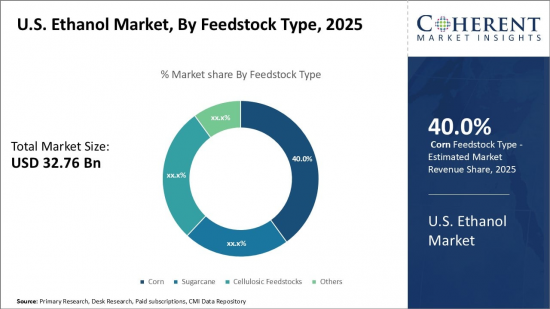

The U.S. Ethanol Market size is estimated at USD 32.76 billion in 2025, and is expected to reach USD 60.66 billion by 2032, growing at a CAGR of 9.20% during the forecast period (2025-2032).

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 32.76 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 9.20% | 2032 Value Projection: | USD 60.66 Bn |

Ethanol is a renewable fuel that has gained significant attention in recent years due to its potential to reduce greenhouse gas emissions and dependence on fossil fuels. Derived primarily from corn and other biomass, ethanol is widely used as a cleaner alternative to gasoline in the transportation sector.

The U.S ethanol market has witnessed substantial growth over the years, driven by increasing government regulations and incentives promoting the use of biofuels. The U.S., in particular, is a key player in the ethanol market, with a significant share of production and consumption. The U.S. ethanol market has experienced steady growth and is expected to continue to expand in the coming years.

Market Dynamics:

The U.S. ethanol market is influenced by various market dynamics, including drivers, restraints, and opportunities. One of the major drivers propelling market growth is growing environmental concerns and the need to reduce greenhouse gas emissions. Ethanol offers a lower carbon footprint compared to gasoline, making it an attractive alternative for meeting sustainability targets.

Government support and regulations aimed at promoting the use of biofuels also contribute to the growth of the ethanol market. Policies such as the Renewable Fuel Standard (RFS) mandate a certain volume of renewable fuels, including ethanol, to be blended into transportation fuel. This creates a favorable market environment for ethanol producers.

However, there are certain challenges and restraints that impact the market. Fluctuations in feedstock prices, particularly corn prices, can affect the profitability of ethanol production. Additionally, the competition from other renewable fuels and limited infrastructure for distribution and storage pose challenges to market growth.

Despite these challenges, the U.S. ethanol market holds promising opportunities. The increasing demand for biofuels, advancements in technology for ethanol production, and the potential to expand into other sectors such as aviation fuel present growth prospects for market players. Moreover, the development of cellulosic ethanol, which utilizes non-food feedstocks such as agricultural residues and dedicated energy crops, further expands the scope of the market.

Key Features of the Study:

The study on the U.S. ethanol market provides valuable insights and analysis for stakeholders in the industry. Key features of the study include:

- Market Size and Growth: The report offers an in-depth analysis of the market size in terms of US$ Bn and the compound annual growth rate (CAGR%) for the forecast period. It considers the base year as 2024

- Revenue Opportunities and Investment Proposition: The study elucidates potential revenue opportunities across different market segments and provides attractive investment proposition matrices for the U.S ethanol market

- Market Dynamics and Trends: The report provides key insights into market drivers, restraints, opportunities, market trends, and regional outlook. It also highlights new product launches, approvals, and the competitive strategies adopted by key players.

- Company Profiles: The study profiles key players in the U.S ethanol market, including company highlights, product portfolios, key financial performance, and strategies. The list of companies covered includes Archer Daniels Midland, Valero Energy Corp., Green Plains Inc., Flint Hills Resources.

- Decision-Making Support: The insights from this report enable marketers and management authorities to make informed decisions regarding future product launches, market expansion, upgradation, and marketing tactics

- Stakeholder Analysis: The report caters to various stakeholders in the ethanol industry, including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

- Strategy Matrices: Stakeholders can benefit from various strategy matrices utilized to analyze the U.S ethanol market, facilitating ease in decision-making

U.S. Ethanol Market Segmentation:

- By Feedstock Type:

- Corn

- Sugarcane

- Cellulosic Feedstocks

- Others (wheat, milo, barley, cassava)

- By End Use

- Fuel

- Industrial Solvents

- Beverages

- Cosmetics

- Pharmaceuticals

- Others (vinegar, paints)

- By Technology

- Wet Milling

- Dry Milling

- Cellulosic Ethanol

- By Application

- Transportation

- Power Generation

- Lab Use

- Alcoholic Beverages

- Others (cleaning, personal care)

- Company Profiles

- Archer Daniels Midland

- Valero Energy Corp.

- Green Plains Inc.

- Flint Hills Resources

- Pacific Ethanol Inc.

- The Andersons Inc.

- White Energy

- CHS Inc.

- Aemetis Inc.

- Alto Ingredients Inc.

- Red Trail Energy, LLC

- Siouxland Ethanol LLC

- Little Sioux Corn Processors

- Southwest Iowa Renewable Energy

- Homeland Energy Solutions

- Bushmills Ethanol Inc.

- Blue Flint Ethanol LLC

- Corn LP

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market U.S. Ethanol, By Feedstock Type

- Market U.S. Ethanol, By End Use

- Market U.S. Ethanol, By Technology

- Market U.S. Ethanol, By Application

- Market U.S. Ethanol, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Supportive government policies and regulations

- Restraints

- Declining gasoline demand and fuel efficiency improvements

- Opportunities

- Rising Adoption of High Ethanol Blend Fuels

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Product launch/Approvals

- PEST Analysis

- PORTER's Analysis

- Merger and Acquisition Scenario

4. U.S. Ethanol Market - Impact of Coronavirus (COVID-19) Pandemic

- COVID-19 Epidemiology

- Supply Side and Demand Side Analysis

- Economic Impact

5. U.S. Ethanol Market , By Feedstock Type, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Corn

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Bn)

- Sugarcane

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Bn)

- Cellulosic Feedstocks

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Bn)

- Others (wheat, milo, barley, cassava)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Bn)

6. U.S. Ethanol Market , By End Use, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2020- 2032

- Segment Trends

- Fuel

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Billion)

- Industrial Solvents

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Billion)

- Beverages

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Billion)

- Cosmetics

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Billion)

- Pharmaceuticals

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Billion)

- Others (vinegar, paints)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Billion)

7. U.S. Ethanol Market , By Technology, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2020- 2032

- Segment Trends

- Wet Milling

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Billion)

- Dry Milling

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Billion)

- Cellulosic Ethanol

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Billion)

8. U.S. Ethanol Market , By Application, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2020- 2032

- Segment Trends

- Transportation

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Billion)

- Power Generation

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Billion)

- Lab Use

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Billion)

- Alcoholic Beverages

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Billion)

- Others (cleaning, personal care)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Billion)

9. Competitive Landscape

- Archer Daniels Midland

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Valero Energy Corp.

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Green Plains Inc.

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Flint Hills Resources

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Pacific Ethanol Inc.

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- The Andersons Inc.

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- White Energy

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- CHS Inc.

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Aemetis Inc.

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Alto Ingredients Inc.

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Red Trail Energy, LLC

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Siouxland Ethanol LLC

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Little Sioux Corn Processors

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Southwest Iowa Renewable Energy

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Homeland Energy Solutions

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Bushmills Ethanol Inc.

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Blue Flint Ethanol LLC

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Corn LP

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Analyst Views

10. Section

- Research Methodology

- About us