PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1707473

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1707473

Green Bond Market, By Type, By End Use, By Geography

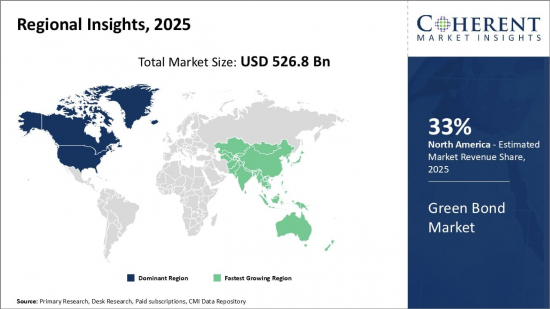

Global Green Bond Market is estimated to be valued at USD 526.8 Bn in 2025 and is expected to reach USD 1,046.35 Bn by 2032, growing at a compound annual growth rate (CAGR) of 10.3% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 526.8 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 10.30% | 2032 Value Projection: | USD 1,046.35 Bn |

Green bond are debt instruments that are issued by sovereign, corporate or local government borrowers to raise funds for investments in projects that have measurable sustainability-based impact. They are typically backed by assets, cash flows or revenue streams, and are often ring fenced to prevent them from being used for other purposes, like general operations of the issuer. Many also carry a designation to indicate compliance with certain environmental standards, such as those of International Capital Market Association (ICMA) Green Bond Principles or Climate Bond Standard (CBS). These designations may be accompanied by third party certifications.

The issuance of green bonds can help issuers attract investors with interest in environmental, social and governance (ESG) based investment destinations and meet disclosure requirements such as those set by the Task Force on Climate-related Financial Disclosures (TCFD). They also support the development and growth of sustainable finance markets, especially where these are underdeveloped.

Market Dynamics

The major driving factor that is responsible for boosting the green bond market growth is a result of the popularity of sustainable investing and the incorporation of environmental, social, and governance (ESG) factors in investment decision-making. With the rise in climatic change and its potential effects, there is increase in demand among people for its urgency and thus, the need of such bonds. Investors prioritize investments that support favorable social and environmental outcomes which would help in increasing the demand for green bonds in the market over the forecast period. Sustainable projects and green projects are being increasingly undertaken by various governments, regulatory authorities, and corporations. This is particularly being implemented to demonstrate strong sustainable commitments and environmental goals, to finance initiatives that correspond with their Corporate social responsibility(CSR) plans. This can help in gaining favor with investors and stakeholders and create a significant impact in the market expansion in the forecasted period.

However, the lack of complete market standardization, verification, and reporting experiments and the scarcity of eligible green projects, may hinder the demand of green bond projects over the forecast period.

Key features of the study:

- This report provides in-depth analysis of the green bond market, and provides market size (US$ Bn) and compound annual growth rate (CAGR %) for the forecast period (2025-2032), considering 2024 as the base year.

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market.

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players.

- It profiles key players in the global green bond market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies.

- Key companies covered as a part of this study include HSBC Holdings plc, Credit Agricole, Deutsche Bank AG, JPMorgan Chase & Co., BofA Securities, Inc., Barclays plc., TD Securities, Morgan Stanley, Citigroup Inc., CFI Education Inc, Climate Bonds, Robeco Institutional Asset Management B.V., Raiffeisen Bank International AG, Green Bond Corporation, and Asian Development Bank.

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics.

- The green bond market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts.

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the green bond market.

Detailed Segmentation:

- By Type:

- Corporate bond

- Project Bond

- Asset-backed Security (ABS)

- Supranational, sub sovereign and agency (SSA) Bond

- Municipal Bond

- Financial Sector Bond

- By End Use Industries:

- Energy / Utility Sector

- Financial Sector and Other Corporates

- Government / Agency / Local

- By Regions:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Company Profiles

- HSBC Holdings plc.

- Credit Agricole

- Deutsche Bank AG

- JPMorgan Chase & Co.

- BofA Securities, Inc.

- Barclays plc.

- TD Securities

- Morgan Stanley

- Citigroup Inc.

- CFI Education Inc.

- Climate Bonds

- Robeco Institutional Asset Management B.V.

- Raiffeisen Bank International AG

- Green Bond Corporation

- Asian Development Bank

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Green Bond Market Snippet, By Type

- Green Bond Market Snippet, By End Use Industries

- Green Bond Market Snippet, By Regions

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Increasing government support and regulations

- Growing demand for sustainable infrastructure projects

- Restraints

- Lack of standardization

- Verification and reporting challenges

- Opportunities

- Development of new green projects

- Diversification of funding sources

- Key Highlights

- Regulatory Scenario

- Product Launches/Approvals

- PEST Analysis

- PORTER's Analysis

- Mergers, Acquisitions, and Collaborations

4. Green Bond Market - Impact of Coronavirus (COVID-19) Pandemic

- COVID-19 Epidemiology

- Supply Side and Demand Side Analysis

- Economic Impact

5. Green Bond Market, By Type, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2020-2032

- Segment Trends

- Corporate bond

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Bn)

- Project Bond

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Bn)

- Asset-backed Security (ABS)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Bn)

- Supranational, sub sovereign and agency (SSA) Bond

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Bn)

- Municipal Bond

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Bn)

- Financial Sector Bond

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Bn)

6. Green Bond Market, By End Use Industries, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 -2032

- Segment Trends

- Energy / Utility Sector

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Bn)

- Financial Sector and Other Corporates

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Bn)

- Government / Agency / Local

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Bn)

7. Green Bond Market, By Region, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, By Sub-region, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, For Sub-region, 2020-2032

- Country Trends

- North America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Type, 2020-2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By End Use Industries, 2020-2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020-2032,(US$ Bn)

- U.S.

- Canada

- Europe

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Type, 2020-2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By End Use Industries, 2020-2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020-2032,(US$ Bn)

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Type, 2020-2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By End Use Industries, 2020-2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020-2032,(US$ Bn)

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Latin America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Type, 2020-2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By End Use Industries, 2020-2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020-2032,(US$ Bn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Type, 2020-2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By End Use Industries, 2020-2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020-2032,(US$ Bn)

- GCC Countries

- Israel

- South Africa

- North Africa

- Central Africa

- Rest of Middle East

8. Competitive Landscape

- Company Profile

- HSBC Holdings plc.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Credit Agricole

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Deutsche Bank AG

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- JPMorgan Chase & Co.

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- BofA Securities, Inc.

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Barclays plc.

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- TD Securities

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Morgan Stanley

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Citigroup Inc.

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- CFI Education Inc.

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Climate Bonds

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Robeco Institutional Asset Management B.V.

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Raiffeisen Bank International AG

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Green Bond Corporation

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Asian Development Bank

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Analyst Views

9. Section

- References

- Research Methodology

- About us