PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1707406

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1707406

Embedded Lending Market, By Component, By Deployment, By Enterprise Size, By End-use Industry, By Geography

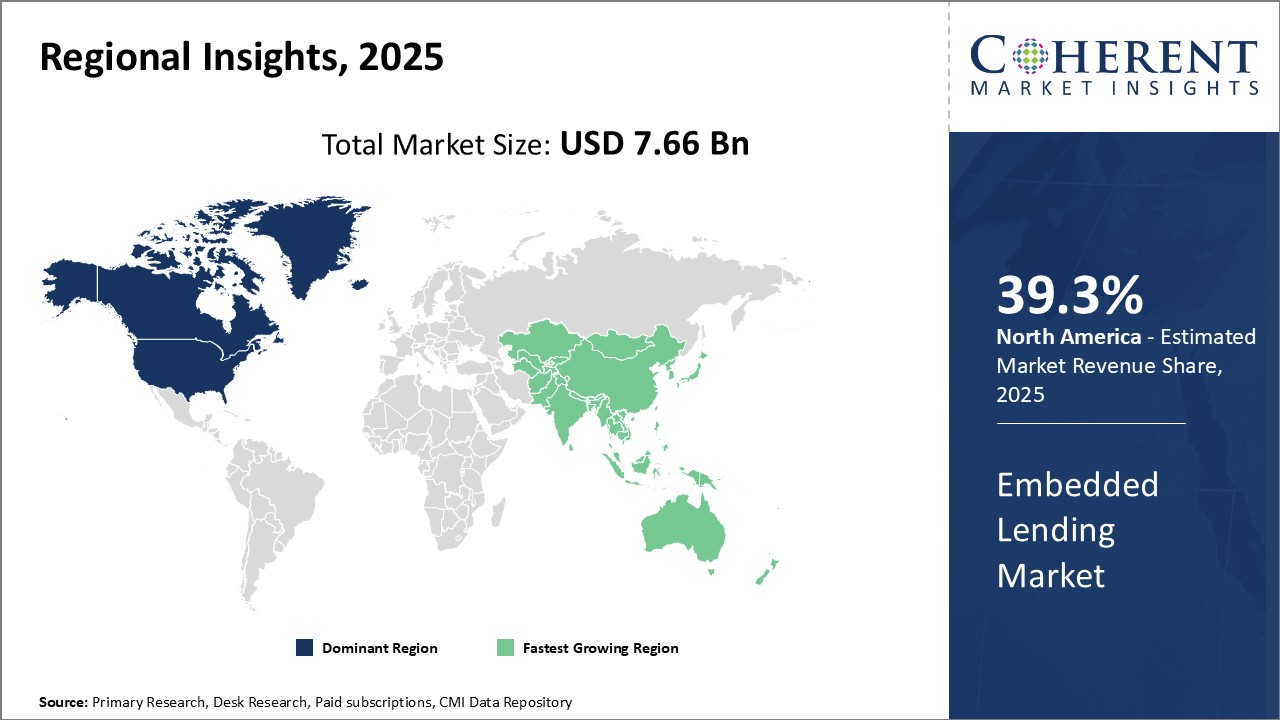

Global Embedded Lending Market is estimated to be valued at USD 7.66 Bn in 2025 and is expected to reach USD 28.43 Bn by 2032, growing at a compound annual growth rate (CAGR) of 20.6% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 7.66 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 20.60% | 2032 Value Projection: | USD 28.43 Bn |

Embedded lending has emerged as a promising growth area in the financial technology sector over the past decade. Embedded lending allows consumers to conveniently access credit directly through the applications and platforms of partner merchants. By embedding financing options directly into the customer checkout experience, embedded lending has the potential to revolutionize how consumers purchase big-ticket items and access credit. Market players are leveraging advanced technologies like artificial intelligence and alternative data to streamline the credit approval process and cater to the growing demand for seamless digital lending experiences.

Market Dynamics:

The embedded lending market is driven by the rising demand for fast, hassle-free digital financing options from tech-savvy consumers. Traditional credit channels can be time-consuming, with lengthy applications and waiting periods. Embedded lending addresses this pain point by offering nearly instant credit decisions and one-click purchases. Furthermore, small business owners and consumers in the developing world with limited access to mainstream credit are availing embedded loans. However, cybersecurity and data privacy concerns pose challenges to the growth of this market. Additionally, regulating embedded lending across different jurisdictions can be complex. On the positive side, opportunities lie in expanding to new merchant categories and partnering with more fintech platforms. Deeper industry collaborations will help unlock the true potential of embedded finance.

Key features of the study:

- This report provides an in-depth analysis of the global embedded lending market, and provides market size (US$ Million) and compound annual growth rate (CAGR %) for the forecast period (2025-2032), considering 2024 as the base year

- It elucidates potential revenue growth opportunities across different segments and explains attractive investment proposition matrices for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players

- It profiles key players in the global embedded lending market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

- Key companies covered as a part of this study include Affirm, Afterpay, Alchemy, Banxware, Biz2X, Finastra, Hokodo, Jaris, Kanmon, Klarna , Lendflow, Liberis, Migo, Sivo, Stripe, Inc., Tapwater, Turnkey Lender, and Zopa Bank Limited

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

- The global embedded lending market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global embedded lending market

Market Segmentation:

- By Component

- Platform

- Services

- By Deployment

- Cloud-Based

- On-Premise

- By Enterprise Size

- Small & Mid-sized Enterprises (SMEs)

- Large Enterprises

- By End-use Industry

- Retail

- Healthcare

- IT and Telecom

- Manufacturing

- Transportation

- Others

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

- Company Profiles

- Affirm

- Afterpay

- Alchemy

- Banxware

- Biz2X

- Finastra

- Hokodo

- Jaris

- Kanmon

- Klarna

- Lendflow

- Liberis

- Migo

- Sivo

- Stripe, Inc.

- Tapwater

- Turnkey Lender

- Zopa Bank Limited

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

2. Market Overview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snapshot, By Component

- Market Snapshot, By Deployment

- Market Snapshot, By Enterprise Size

- Market Snapshot, By End-use Industry

- Market Snapshot, By Region

- Market Scenario - Conservative, Likely, Opportunistic

- Market Opportunity Map

3. Market Dynamics and Trend Analysis

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Impact Analysis

- Pest Analysis

- Porters Analysis

- Regulatory Scenario

- COVID-19 Impact Analysis

- Market Attractiveness, By Country

- Market Attractiveness, By Market Segment

- Key Developments & Deals

- Trend Analysis - Historic and Future Trend Assessment

4. Global Embedded Lending Market, By Component, 2020 - 2032 (US$ Billion)

- Introduction

- Market Share (%) Analysis, 2025, 2028 & 2032

- Market Y-o-Y Growth Comparison (%), 2020 - 2032

- Segment Trends

- Platform, 2020 - 2032(US$ Billion)

- Introduction

- Market Size and Forecast, 2020 - 2032, (US$ Billion)

- Services, 2020 - 2032(US$ Billion)

- Introduction

- Market Size and Forecast, 2020 - 2032, (US$ Billion)

5. Global Embedded Lending Market, By Deployment, 2020 - 2032 (US$ Billion)

- Introduction

- Market Share (%) Analysis, 2025, 2028 & 2032

- Market Y-o-Y Growth Comparison (%), 2020 - 2032

- Segment Trends

- Cloud-Based, 2020 - 2032(US$ Billion)

- Introduction

- Market Size and Forecast, 2020 - 2032, (US$ Billion)

- On-Premise, 2020 - 2032(US$ Billion)

- Introduction

- Market Size and Forecast, 2020 - 2032, (US$ Billion)

6. Global Embedded Lending Market, By Enterprise Size, 2020 - 2032 (US$ Billion)

- Introduction

- Market Share (%) Analysis, 2025, 2028 & 2032

- Market Y-o-Y Growth Comparison (%), 2020 - 2032

- Segment Trends

- Small & Mid-sized Enterprises (SMEs), 2020 - 2032(US$ Billion)

- Introduction

- Market Size and Forecast, 2020 - 2032, (US$ Billion)

- Large Enterprises, 2020 - 2032(US$ Billion)

- Introduction

- Market Size and Forecast, 2020 - 2032, (US$ Billion)

7. Global Embedded Lending Market, By End-use Industry, 2020 - 2032 (US$ Billion)

- Introduction

- Market Share (%) Analysis, 2025, 2028 & 2032

- Market Y-o-Y Growth Comparison (%), 2020 - 2032

- Segment Trends

- Retail, 2020 - 2032(US$ Billion)

- Introduction

- Market Size and Forecast, 2020 - 2032, (US$ Billion)

- Healthcare, 2020 - 2032(US$ Billion)

- Introduction

- Market Size and Forecast, 2020 - 2032, (US$ Billion)

- IT and Telecom, 2020 - 2032(US$ Billion)

- Introduction

- Market Size and Forecast, 2020 - 2032, (US$ Billion)

- Manufacturing, 2020 - 2032(US$ Billion)

- Introduction

- Market Size and Forecast, 2020 - 2032, (US$ Billion)

- Transportation, 2020 - 2032(US$ Billion)

- Introduction

- Market Size and Forecast, 2020 - 2032, (US$ Billion)

- Others , 2020 - 2032(US$ Billion)

- Introduction

- Market Size and Forecast, 2020 - 2032, (US$ Billion)

8. Global Embedded Lending Market, By Region, 2020 - 2032 (US$ Billion)

- Introduction

- Market Share (%) Analysis, 2025, 2028 & 2032, (US$ Billion)

- Market Y-o-Y Growth Comparison (%), 2025 - 2032, (US$ Billion)

- Regional Trends

- North America

- Introduction

- Market Size and Forecast, By Component, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By Deployment, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By Enterprise Size, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By End-use Industry, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By Country, 2020 - 2032, (US$ Billion)

- U.S.

- Canada

- Europe

- Introduction

- Market Size and Forecast, By Component, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By Deployment, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By Enterprise Size, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By End-use Industry, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By Country, 2020 - 2032, (US$ Billion)

- U.K.

- Germany

- Italy

- France

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, By Component, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By Deployment, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By Enterprise Size, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By End-use Industry, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By Country, 2020 - 2032, (US$ Billion)

- China

- India

- Japan

- Australia

- South Korea

- Asean

- Rest Of Asia Pacific

- Middle East & Africa

- Introduction

- Market Size and Forecast, By Component, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By Deployment, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By Enterprise Size, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By End-use Industry, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By Country, 2020 - 2032, (US$ Billion)

- GCC

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Introduction

- Market Size and Forecast, By Component, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By Deployment, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By Enterprise Size, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By End-use Industry, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By Country, 2020 - 2032, (US$ Billion)

- Brazil

- Mexico

- Argentina

- Rest of Latin America

9. Company Profiles - Global Embedded Lending Market

- Affirm

- Company Overview

- Product/Service Portfolio

- Financial Performance

- Recent Developments/Updates

- Strategic Overview

- Afterpay

- Alchemy

- Banxware

- Biz2X

- Finastra

- Hokodo

- Jaris

- Kanmon

- Klarna

- Lendflow

- Liberis

- Migo

- Sivo

- Stripe, Inc.

- Tapwater

- Turnkey Lender

- Zopa Bank Limited

10. References and Research Methodology

- References

- Research Methodology

- About us and Sales Contact