PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1708452

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1708452

Zero Emission Vehicles Market, By Vehicle Type, By Propulsion, By Geography .

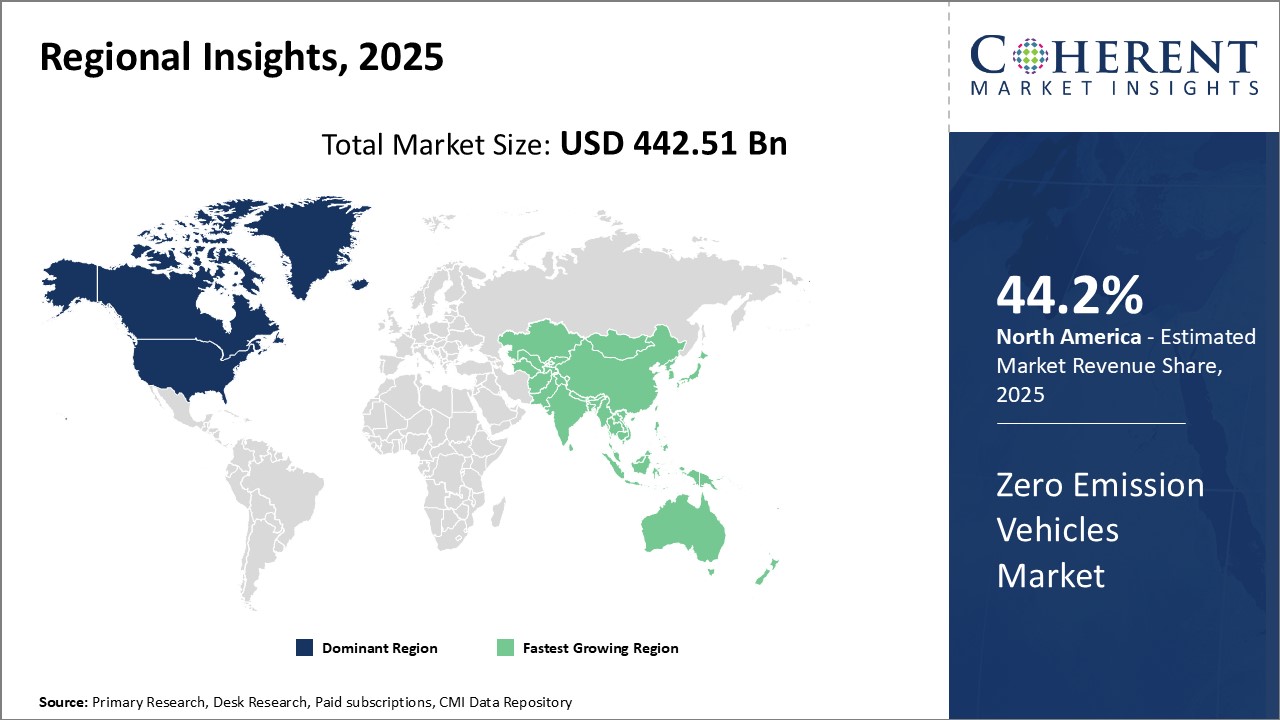

Global Zero Emission Vehicles Market is estimated to be valued at USD 442.51 Bn in 2025 and is expected to reach USD 1,984.56 Bn by 2032, growing at a compound annual growth rate (CAGR) of 23.9% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 442.51 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 23.90% | 2032 Value Projection: | USD 1,984.56 Bn |

Zero emission vehicles (ZEVs) are automobiles that do not produce any emissions from the onboard source of power. With growing concerns over air pollution and climate change, ZEVs are being increasingly recognized as a viable solution for sustainable mobility. Advancements in battery technology and declining battery prices have made electric vehicles (EVs) a commercially attractive alternative to conventional vehicles. Many governments around the world offer purchase incentives and subsidies for EVs to encourage their adoption among consumers and support the growth of the EV industry. With widespread electrification of transport systems, ZEVs have the potential to significantly reduce greenhouse gas emissions and mitigate the impacts of climate change.

Market Dynamics:

Drivers: Stringent emission regulations imposed by regulatory bodies around the world are a key driver fueling the growth of the Zero Emission Vehicle market. Declining battery prices and longer driving ranges are making EVs more affordable and practical. Rising environmental concerns and changing consumer attitudes towards green mobility solutions also boosts the market growth.

Restraints: High cost of EVs compared to gasoline vehicles remains a major barrier. Insufficient public charging infrastructure poses vehicle range issues for customers. Consumers may hesitate investing in new EV technologies with evolving standards. Uncertainties over future government policies for EV subsidies act as a deterrent.

Opportunities: Advancements in batteries with higher energy densities at lower costs present attractive opportunities. Integration of EVs into smart grid systems for Vehicle-to-Grid applications can open new revenue streams. Collaborations across automotive OEMs and tech companies for innovation are expanding opportunities.

Key features of the study:

This report provides an in-depth analysis of the global zero emission vehicles market, and provides market size (US$ Billion) and compound annual growth rate (CAGR %) for the forecast period (2025-2032), considering 2024 as the base year

It elucidates potential revenue growth opportunities across different segments and explains attractive investment proposition matrices for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players

It profiles key players in the global zero emission vehicles market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

Key companies covered as a part of this study include BMW AG, Chevrolet Motor Company, Ford Motor Company, General Motors, Hero Electric, Hyundai Motor Company, Mahindra Electric Mobility Limited, Tata Motors, Tesla Inc., Toyota Motor Corporation, Daimler AG, SEGWAY INC., Motor Development International SA, Volkswagen AG, Honda Motor Co. Ltd., MITSUBISHI MOTORS CORPORATION, Volvo, and GAC Motor

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

The global zero emission vehicles market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global zero emission vehicles market

Market Segmentation

- By Vehicle Type

- Two Wheelers

- Three Wheelers

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- By Propulsion

- Battery-electric vehicles (BEVs)

- Hydrogen fuel cell vehicles (FCVs)

- By Regional

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

- Company Profiles

- BMW AG

- Chevrolet Motor Company

- Ford Motor Company

- General Motors

- Hero Electric

- Hyundai Motor Company

- Mahindra Electric Mobility Limited

- Tata Motors

- Tesla Inc.

- Toyota Motor Corporation

- Daimler AG

- SEGWAY INC.

- Motor Development International SA

- Volkswagen AG

- Honda Motor Co. Ltd.

- MITSUBISHI MOTORS CORPORATION

- Volvo

- GAC Motor

Table of Content

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

2. Market Overview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snapshot, By Vehicle Type

- Market Snapshot, By Propulsion

- Market Snapshot, By Region

- Market Scenario - Conservative, Likely, Opportunistic

- Market Opportunity Map

3. Market Dynamics and Trend Analysis

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Impact Analysis

- Pest Analysis

- Porters Analysis

- COVID-19 Impact Analysis

- New Product Approvals

- Promotion and Marketing Initiatives

- Market Attractiveness, By Country

- Market Attractiveness, By Market Segment

- Key Developments & Deals

- Trend Analysis - Historic and Future Trend Assessment

- Key Developments

4. Global Zero Emission Vehicles Market, By Vehicle Type, 2020 - 2032 (US$ Billion)

- Introduction

- Market Share (%) Analysis, 2025 and 2032

- Market Y-o-Y Growth Comparison (%), 2021 - 2032

- Segment Trends

- Two Wheelers, 2020 - 2032(US$ Billion)

- Introduction

- Market Size and Forecast, 2020 - 2032, (US$ Billion)

- Three Wheelers, 2020 - 2032(US$ Billion)

- Introduction

- Market Size and Forecast, 2020 - 2032, (US$ Billion)

- Passenger Vehicle, 2020 - 2032(US$ Billion)

- Introduction

- Market Size and Forecast, 2020 - 2032, (US$ Billion)

- Light Commercial Vehicle, 2020 - 2032(US$ Billion)

- Introduction

- Market Size and Forecast, 2020 - 2032, (US$ Billion)

- Heavy Commercial Vehicle, 2020 - 2032(US$ Billion)

- Introduction

- Market Size and Forecast, 2020 - 2032, (US$ Billion)

5. Global Zero Emission Vehicles Market, By Propulsion, 2020 - 2032 (US$ Billion)

- Introduction

- Market Share (%) Analysis, 2025 and 2032

- Market Y-o-Y Growth Comparison (%), 2021 - 2032

- Segment Trends

- Battery-electric vehicles (BEVs), 2020 - 2032(US$ Billion)

- Introduction

- Market Size and Forecast, 2020 - 2032, (US$ Billion)

- Hydrogen fuel cell vehicles (FCVs), 2020 - 2032(US$ Billion)

- Introduction

- Market Size and Forecast, 2020 - 2032, (US$ Billion)

6. Global Zero Emission Vehicles Market, By Region, 2020 - 2032 (US$ Billion)

- Introduction

- Market Share (%) Analysis, 2025 and 2032, (US$ Billion)

- Market Y-o-Y Growth Comparison (%), 2025 - 2032, (US$ Billion)

- Regional Trends

- North America

- Introduction

- Market Size and Forecast, By Vehicle Type, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By Propulsion, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By Country, 2020 - 2032, (US$ Billion)

- U.S.

- Canada

- Europe

- Introduction

- Market Size and Forecast, By Vehicle Type, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By Propulsion, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By Country, 2020 - 2032, (US$ Billion)

- U.K.

- Germany

- Italy

- France

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, By Vehicle Type, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By Propulsion, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By Country, 2020 - 2032, (US$ Billion)

- China

- India

- Japan

- Australia

- South Korea

- Asean

- Rest Of Asia Pacific

- Middle East & Africa

- Introduction

- Market Size and Forecast, By Vehicle Type, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By Propulsion, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By Country/Sub-region, 2020 - 2032, (US$ Billion)

- GCC

- Israel

- Rest Of Middle East

- Latin America

- Introduction

- Market Size and Forecast, By Vehicle Type, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By Propulsion, 2020 - 2032, (US$ Billion)

- Market Size and Forecast, By Country, 2020 - 2032, (US$ Billion)

- Brazil

- Mexico

- Argentina

- Rest of Latin America

7. Competitive Landscape

- Competitive Snapshot

- What Market Participants are Saying?

- Competitive Dashboard

- Company Market Share Analysis, 2025 - Global

8. Company Profiles - Global Zero Emission Vehicles Market

- BMW AG*

- Company Overview

- Product/Service Portfolio

- Financial Performance

- Recent Developments/Updates

- Strategic Overview

- Chevrolet Motor Company

- Ford Motor Company

- General Motors

- Hero Electric

- Hyundai Motor Company

- Mahindra Electric Mobility Limited

- Tata Motors

- Tesla Inc.

- Toyota Motor Corporation

- Daimler AG

- SEGWAY INC.

- Motor Development International SA

- Volkswagen AG

- Honda Motor Co. Ltd.

- MITSUBISHI MOTORS CORPORATION

- Volvo

- GAC Motor

9. Wheel of Fortune

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

10. References and Research Methodology

- References

- Research Methodology

- About us and Sales Contact