PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1729693

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1729693

Short Term Insurance Market, By Product Category, By Application, By Geography

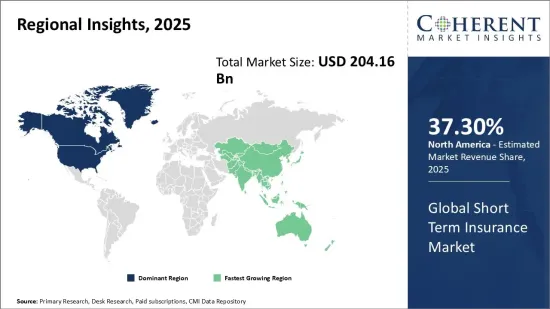

Global Short Term Insurance Market is estimated to be valued at US$ 204.16 Bn in 2025 and is expected to reach US$ 317.01 Bn by 2032, growing at a compound annual growth rate (CAGR) of 6.5% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 204.16 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 6.50% | 2032 Value Projection: | USD 317.01 Bn |

The market has witnessed steady growth due to the increasing demand for flexible and cost-effective insurance policies across various industries, including healthcare, automotive, travel, and property. With rising consumer awareness and digitalization in the insurance sector, short-term policies have gained traction as they offer tailored coverage with lower commitment periods. Additionally, the expansion of online insurance platforms and the introduction of AI-driven underwriting processes are further supporting market growth. However, challenges, such as regulatory complexities and fraudulent claims, pose significant concerns for market players.

Market Dynamics:

The global short term insurance market is driven by growing consumer preference for on-demand, customizable insurance solutions. The rising adoption of usage-based insurance (UBI), especially in the automotive and travel segments, has significantly contributed to market expansion. Additionally, increasing penetration of digital insurance platforms and InsurTech innovations have simplified policy issuance, claim processing, and risk assessment. However, the market faces challenges due to stringent regulatory frameworks, pricing pressures, and fraudulent claims, which impact profitability. Compliance with varying regulations across regions remains a key concern for insurers. Meanwhile, opportunities lie in the expansion of microinsurance, catering to underserved populations, and leveraging Blockchain technology to enhance transparency and security in policy management. As digital transformation continues to reshape the industry, market players are expected to focus on strategic partnerships, AI-driven risk assessment, and product innovation to maintain a competitive edge.

Key Features of the Study:

This report provides in-depth analysis of the global short term insurance market, and provides market size (US$ Billion) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players

It profiles key players in the global short term insurance market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

Key companies covered as a part of this study include Allianz, Cigna TTK, Zurich, BUPA, UnitedHealth Group, Anthem, CVS Health, Humana, Centene, WellCare Health Plans, State Farm, Liberty Mutual, Chubb, SBI Holdings, and Santam

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

The global short term insurance market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

Market Segmentation

- Product Category Insights (Revenue, USD Bn, 2020 - 2032)

- Homeowner Insurance

- Household Insurance

- Vehicle Insurance

- Personal Liability Insurance

- Others

- Application Insights (Revenue, USD Bn, 2020 - 2032)

- Individual

- Group

- Regional Insights (Revenue, USD Bn, 2020 - 2032)

- North America

- U.S.

- Canada

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

- Company Profiles:

- Allianz

- Cigna TTK

- Zurich

- BUPA

- UnitedHealth Group

- Anthem

- CVS Health

- Humana

- Centene

- WellCare Health Plans

- State Farm

- Liberty Mutual

- Chubb

- SBI Holdings

- Santam

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Global Short Term Insurance Market, By Product Category

- Global Short Term Insurance Market, By Application

- Global Short Term Insurance Market, By Region

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Product Launches/Approvals

- PEST Analysis

- PORTER's Analysis

- Market Opportunities

- Regulatory Scenario

- Key Developments

- Industry Trends

4. Global Short Term Insurance Market, By Product Category, 2020-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Homeowner Insurance

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Household Insurance

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Vehicle Insurance

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Personal Liability Insurance

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

5. Global Short Term Insurance Market, By Application, 2020-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Individual

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Group

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

6. Global Short Term Insurance Market, By Region, 2020 - 2032, Value (USD Bn)

- Introduction

- Market Share (%) Analysis, 2025, 2028 & 2032, Value (USD Bn)

- Market Y-o-Y Growth Analysis (%), 2021 - 2032, Value (USD Bn)

- Regional Trends

- North America

- Introduction

- Market Size and Forecast, By Product Category, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- U.S.

- Canada

- Latin America

- Introduction

- Market Size and Forecast, By Product Category, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Introduction

- Market Size and Forecast, By Product Category, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, By Product Category, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- Introduction

- Market Size and Forecast, By Product Category, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- Introduction

- Market Size and Forecast, By Product Category, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country/Region, 2020 - 2032, Value (USD Bn)

- South Africa

- North Africa

- Central Africa

7. Competitive Landscape

- Allianz

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Cigna TTK

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Zurich

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- BUPA

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- UnitedHealth Group

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Anthem

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- CVS Health

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Humana

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Centene

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- WellCare Health Plans

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- State Farm

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Liberty Mutual

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Chubb

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- SBI Holdings

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Santam

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

8. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

9. References and Research Methodology

- References

- Research Methodology

- About us