PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1729703

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1729703

Art Funds Market, By Fund Type (Public and Private), By Application (Financial Investment and Art Development), By Geography (North America, Latin America, Asia Pacific, Europe, Middle East, and Africa)

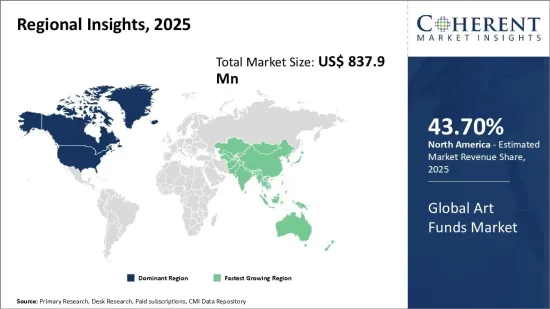

Global Art Funds Market is estimated to be valued at USD 837.9 Mn in 2025 and is expected to reach USD 1,243.3 Mn by 2032, growing at a compound annual growth rate (CAGR) of 5.8% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 837.9 Mn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 5.80% | 2032 Value Projection: | USD 1,243.3 Mn |

The global art funds market has seen significant growth over the past few years driven by increasing participation of high-net-worth individuals and growth in private investments in art. Art funds allow individual and institutional investors to build diversified portfolios of famous artworks and investing in them through a fund structure. These funds purchase artworks from established and emerging artists and manage and resell them to generate returns for investors. They aim to bring transparency and liquidity to the largely illiquid fine arts industry. As wealth around the world increases and more individuals seek alternative investments, the art funds market is expected to continue its upward trajectory in the coming years.

Market Dynamics:

The global art funds market has been witnessing considerable growth driven by the growing affluence of high-net-worth individuals and increasing private capital investments in fine arts. Additionally, changing consumer patterns and growing acceptance of artwork as an investment asset class have augmented the demand for art funds. However, high operating costs associated with managing artwork portfolios and the lack of standardized valuation methods pose challenges to the market's continuity. Furthermore, the predominance of uncertainty associated with the performance and returns of individual artworks restrains the industry growth. On the positive side, expanding millennials' population base interested in art collection and rising art endowments by wealthy families are likely to present significant opportunities for market players over the next few years.

Key Features of the Study:

This report provides in-depth analysis of the global art funds market, and provides market size (US$ Million) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players

It profiles key players in the global art funds market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

Key companies covered as a part of this study include Anthea - Contemporary Art Investment Fund SICAV FIS, The Fine Art Group, Artemundi Global Fund, Liquid Rarity Exchange, Saatchi Art, Dejia Art Fund, Arthena, Masterworks, The Arts Fund, Castlestone Management, Deloitte Art & Finance, Art Fund Group, Ascribe Capital, Arte Collectum, and RIT Capital Partners

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

The global art funds market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global art funds market

Market Segmentation

- Fund Type Insights (Revenue, US$ Mn, 2020 - 2032)

- Public

- Private

- Application Insights (Revenue, US$ Mn, 2020 - 2032)

- Financial Investment

- Art Development

- Regional Insights (Revenue, US$ Mn, 2020 - 2032)

- North America

- U.S.

- Canada

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

- Company Profiles:

- Anthea - Contemporary Art Investment Fund SICAV FIS

- The Fine Art Group

- Artemundi Global Fund

- Liquid Rarity Exchange

- Saatchi Art

- Dejia Art Fund

- Arthena

- Masterworks

- The Arts Fund

- Castlestone Management

- Deloitte Art & Finance

- Art Fund Group

- Ascribe Capital

- Arte Collectum

- RIT Capital Partners

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Global Art Funds Market, By Fund Type

- Global Art Funds Market, By Application

- Global Art Funds Market, By Region

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Product Launches/Approvals

- PEST Analysis

- PORTER's Analysis

- Market Opportunities

- Regulatory Scenario

- Key Developments

- Industry Trends

4. Global Art Funds Market, By Fund Type, 2020-2032, (US$ Mn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Public

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

- Private

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

5. Global Art Funds Market, By Application, 2020-2032, (US$ Mn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Financial Investment

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

- Art Development

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

6. Global Art Funds Market, By Region, 2020 - 2032, Value (US$ Mn)

- Introduction

- Market Share (%) Analysis, 2025, 2028 & 2032, Value (US$ Mn)

- Market Y-o-Y Growth Analysis (%), 2021 - 2032, Value (US$ Mn)

- Regional Trends

- North America

- Introduction

- Market Size and Forecast, By Fund Type, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (US$ Mn)

- U.S.

- Canada

- Latin America

- Introduction

- Market Size and Forecast, By Fund Type, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (US$ Mn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Introduction

- Market Size and Forecast, By Fund Type, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (US$ Mn)

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, By Fund Type, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (US$ Mn)

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- Introduction

- Market Size and Forecast, By Fund Type, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (US$ Mn)

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- Introduction

- Market Size and Forecast, By Fund Type, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Country/Region, 2020 - 2032, Value (US$ Mn)

- South Africa

- North Africa

- Central Africa

7. Competitive Landscape

- Anthea - Contemporary Art Investment Fund SICAV FIS

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- The Fine Art Group

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Artemundi Global Fund

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Liquid Rarity Exchange

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Saatchi Art

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Dejia Art Fund

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Arthena

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Masterworks

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- The Arts Fund

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Castlestone Management

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Deloitte Art & Finance

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Art Fund Group

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Ascribe Capital

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Arte Collectum

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- RIT Capital Partners

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

8. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

9. References and Research Methodology

- References

- Research Methodology

- About us