PUBLISHER: China Research and Intelligence | PRODUCT CODE: 1259918

PUBLISHER: China Research and Intelligence | PRODUCT CODE: 1259918

Research Report on Southeast Asia Cassava Industry 2023-2032

Cassava is one of the world's three major potatoes, widely cultivated in tropical and subtropical regions, with characteristics of rough and easy to plant, fast growth, high yield, strong adaptability and wide range of uses, known as the "king of starch" and "underground breadbasket". According to CRI analysis, cassava is also an excellent industrial raw material, which can be processed and produced into five series of more than 2,000 varieties of products, such as starch sugar, starch, alcohol, organic chemicals and fine chemicals, which are used in food, medicine, alcohol, textile, paper, sugar and paint.

SAMPLE VIEW

Most Southeast Asian countries are traditional agricultural countries and are important producers and suppliers of crops globally. According to CRI's analysis, with the economic growth in Southeast Asia and the development of downstream applications in the cassava industry, the market demand for cassava has gradually expanded and the production of cassava in Southeast Asia has increased. In addition to meeting domestic demand, Southeast Asia also exports a large amount of cassava to other overseas regions.

There are disparities in the degree of development of the cassava industry in Southeast Asia in different countries. According to CRI's analysis, the cassava industry in Thailand, Cambodia, Laos and Vietnam is large in scale. For example, Thailand is the world's leading cassava producer and exporter, with a cassava plantation area of more than 8 million Thai acres and an annual output of more than 30 million tons, and the export volume of Thai cassava and its products reached 11.18 million tons in 2022. Cambodia is also one of the top ten cassava exporters in the world. After the rice industry, cassava industry has become the second pillar industry of Cambodian agriculture. Cambodia has also promulgated the National Cassava Policy 2020-2025, which plans to promote the transformation and upgrading of its cassava industry to produce more high value-added cassava products for a larger global cassava market share.

Southeast Asia in this report includes 10 countries: Singapore, Thailand, Philippines, Malaysia, Indonesia, Vietnam, Myanmar, Brunei, Laos and Cambodia. With a total population of nearly 700 million by the end of 2022, Southeast Asia has an overall economic growth rate higher than the global average and is one of the key drivers of future global economic growth.

According to CRI's analysis, the economic levels of the 10 Southeast Asian countries vary greatly, with Singapore being the only developed country with a per capita GDP of about US$79,000 in 2022. While Myanmar and Cambodia will have a GDP per capita of less than US$2,000 in 2022. The population and minimum wage levels of each country also vary greatly. Brunei, which has the smallest population, will have a total population of less than 500,000 people in 2022, while Indonesia, which has the largest population, will have a population of about 280 million people in 2022.

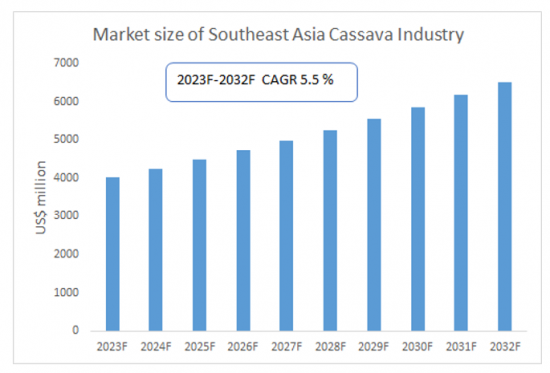

CRI expects the Southeast Asian cassava industry to continue to grow from 2023-2032.

Topics covered:

- Southeast Asia Cassava Industry Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on Southeast Asia Cassava Industry?

- Which Companies are the Major Players in Southeast Asia Cassava Industry Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in Southeast Asia Cassava Industry

- What are the Key Drivers, Challenges, and Opportunities for Southeast Asia Cassava Industry during 2023-2032?

- What is the Expected Revenue of Southeast Asia Cassava Industry during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in Southeast Asia Cassava Industry Market?

- Which Segment of Southeast Asia Cassava Industry is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing Southeast Asia Cassava Industry?

Table of Contents

1 Singapore Cassava Industry Analysis

- 1.1 Singapore's Cassava Industry Development Environment

- 1.1.1 Geography

- 1.1.2 Population

- 1.1.3 Economy

- 1.1.4 Minimum Wage in Singapore

- 1.2 Singapore Cassava Industry Operation 2023-2032

- 1.2.1 Supply

- 1.2.2 Demand

- 1.2.3 Imports and Exports

- 1.3 Analysis of Major Cassava Producers and Traders in Singapore

2 Analysis of Thailand's Cassava Industry

- 2.1 Thailand Cassava Industry Development Environment

- 2.1.1 Geography

- 2.1.2 Population

- 2.1.3 Economy

- 2.1.4 Thailand Minimum Wage

- 2.2 Thailand Cassava Industry Operation 2023-2032

- 2.2.1 Supply

- 2.2.2 Demand

- 2.2.3 Import and Export

- 2.3 Analysis of Major Cassava Producers and Traders in Thailand

3 Analysis of Cassava Industry in the Philippines

- 3.1 Philippine Cassava Industry Development Environment

- 3.1.1 Geography

- 3.1.2 Population

- 3.1.3 Economy

- 3.1.4 Minimum Wage in the Philippines

- 3.2 Philippine Cassava Industry Operation 2023-2032

- 3.2.1 Supply

- 3.2.2 Demand

- 3.2.3 Imports and Exports

- 3.3 Analysis of Major Cassava Producers and Traders in the Philippines

4 Analysis of Malaysia's Cassava Industry

- 4.1 Malaysia's Cassava Industry Development Environment

- 4.1.1 Geography

- 4.1.2 Population

- 4.1.3 Economy

- 4.1.4 Minimum Wage in Malaysia

- 4.2 Malaysia Cassava Industry Operation 2023-2032

- 4.2.1 Supply

- 4.2.2 Demand

- 4.2.3 Import and Export

- 4.3 Analysis of Major Cassava Producers and Traders in Malaysia

5 Indonesia Cassava Industry Analysis

- 5.1 Indonesia Cassava Industry Development Environment

- 5.1.1 Geography

- 5.1.2 Population

- 5.1.3 Economy

- 5.1.4 Minimum Wage in Indonesia

- 5.2 Indonesia Cassava Industry Operation 2023-2032

- 5.2.1 Supply

- 5.2.2 Demand

- 5.2.3 Import and Export

- 5.3 Analysis of Major Cassava Producers and Traders in Indonesia

6 Analysis of Vietnam's Cassava Industry

- 6.1 Vietnam Cassava Industry Development Environment

- 6.1.1 Geography

- 6.1.2 Population

- 6.1.3 Economy

- 6.1.4 Minimum Wage in Vietnam

- 6.2 Vietnam Cassava Industry Operation 2023-2032

- 6.2.1 Supply

- 6.2.2 Demand

- 6.2.3 Import and Export

- 6.3 Analysis of Major Cassava Producers and Traders in Vietnam

7 Analysis of Myanmar's Cassava Industry

- 7.1 Myanmar Cassava Industry Development Environment

- 7.1.1 Geography

- 7.1.2 Population

- 7.1.3 Economy

- 7.1.4 Myanmar Minimum Wage

- 7.2 Myanmar Cassava Industry Operation 2023-2032

- 7.2.1 Supply

- 7.2.2 Demand

- 7.2.3 Import and Export

- 7.3 Analysis of Major Cassava Producers and Traders in Myanmar

8 Analysis of Brunei Cassava Industry

- 8.1 Brunei Cassava Industry Development Environment

- 8.1.1 Geography

- 8.1.2 Population

- 8.1.3 Economy

- 8.1.4 Brunei Minimum Wage

- 8.2 Brunei Cassava Industry Operation 2023-2032

- 8.2.1 Supply

- 8.2.2 Demand

- 8.2.3 Import and Export

- 8.3 Brunei Major Cassava Producers and Traders Analysis

9 Analysis of the Lao Cassava Industry

- 9.1 Lao Cassava Industry Development Environment

- 9.1.1 Geography

- 9.1.2 Population

- 9.1.3 Economy

- 9.1.4 Minimum Wage in Laos

- 9.2 Lao Cassava Industry Operation 2023-2032

- 9.2.1 Supply

- 9.2.2 Demand

- 9.2.3 Import and Export

- 9.3 Analysis of Major Cassava Producers and Traders in Laos

10 Analysis of Cambodia's Cassava Industry

- 10.1 Cambodia Cassava Industry Development Environment

- 10.1.1 Geography

- 10.1.2 Population

- 10.1.3 Economy

- 10.1.4 Minimum Wage in Cambodia

- 10.2 Cambodia Cassava Industry Operation in 2023-2032

- 10.2.1 Supply

- 10.2.2 Demand

- 10.2.3 Import and Export

- 10.3 Analysis of Major Cassava Producers and Traders in Cambodia

11 Southeast Asia Cassava Industry Outlook 2023-2032

- 11.1 Southeast Asia Cassava Industry Development Influencing Factors Analysis

- 11.1.1 Favorable Factors

- 11.1.2 Unfavorable Factors

- 11.2 Southeast Asia Cassava Industry Supply Analysis, 2023-2032

- 11.3 Southeast Asia Cassava Industry Demand Analysis 2023-2032

- 11.4 Impact of COVID -19 Epidemic on Cassava Industry