PUBLISHER: China Research and Intelligence | PRODUCT CODE: 1280688

PUBLISHER: China Research and Intelligence | PRODUCT CODE: 1280688

Vietnam Shipbuilding Industry Research Report 2023-2032

Vietnam's shipbuilding industry is developing rapidly and has taken shape. Overall, the market size of Vietnam's shipbuilding industry has shown an upward trend in recent years, with sustained economic growth, industrial and supporting industry chain development promoting the development of its shipbuilding industry.

SAMPLE VIEW

Benefiting from a long coastline bordering the Gulf of Thailand, the South China Sea and Tokyo Bay, Vietnam has the second highest number of international ports in ASEAN, after the Philippines. There are three major port cities along the Vietnamese coastline - Haiphong in the north, Ho Chi Minh City in the south and Da Nang in the central region. They are all leading container ports in Asia in terms of cargo capacity, with Ho Chi Minh City port cargo throughput accounting for the largest share of the Vietnamese market.

Meanwhile, the northern port of Hai Phong is a major port for international container traffic. Hai Phong International Container Terminal (HICT) can call large container ships, reducing the time and cost of shipping containers to northern Vietnam. With its strategic location, Da Nang manages cargo from the central region, linking Vietnam with Myanmar, Thailand and Laos.

While the rate of cargo movement through the country's seaports typically increases by an average of 10-15% per year, more investment is needed to develop the country's shipping fleet and ports due to rising freight rates and supply chain issues.

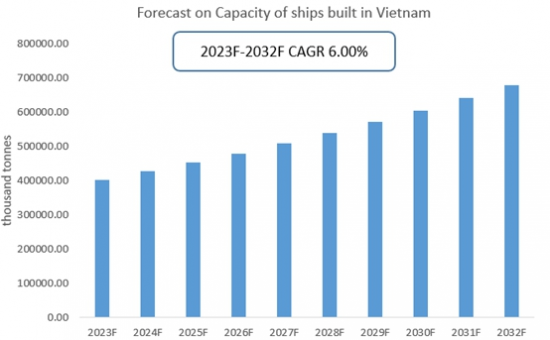

According to CRI, the capacity of ships built will reach US$ 680 million in 2032 and the CAGR in 2023 to 2032 is 6.0%

Source: CRI

In terms of international trade activities, Vietnam ports ship components, machinery and raw materials to support its shipbuilding activities. Major import sources include South Korea, Japan, China and countries in the European region, among others. Vietnam's shipbuilding industry also exports ships to international markets, including merchant ships, offshore support vessels and fishing vessels; major export destinations include Europe, Asia and the Middle East.

Due to the growth in global trade, offshore energy project development and increasing demand for specialized vessels, CRI Consulting expects a positive outlook for the Vietnamese shipbuilding industry from 2023 to 2027, with a growing Vietnamese shipbuilding market full of opportunities for growth. The adoption of advanced technology, emphasis on environmental protection and training of skilled labor are critical to remain competitive.

Topics covered:

- Overview of Vietnam's shipbuilding industry

- The economic and policy environment of Vietnam's shipbuilding industry

- What is the impact of COVID-19 on the Vietnamese shipbuilding industry?

- Vietnam Shipbuilding Industry Market Size 2023-2032

- Analysis of the main Vietnamese shipbuilding industry producers

- Key drivers and market opportunities for Vietnam's shipbuilding industry

- What are the key drivers, challenges and opportunities for Vietnam's shipbuilding industry during the forecast period of 2023-2032?

- Which companies are the key players in the Vietnamese shipbuilding industry market and what are their competitive advantages?

- What is the expected revenue of the Vietnam Shipbuilding Industry market during the forecast period of 2023-2032?

- What are the strategies adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Vietnam shipbuilding industry market is expected to dominate the market in 2032?

- What are the main unfavorable factors facing the Vietnamese shipbuilding industry?

Table of Contents

1 Overview of Vietnam

- 1.1 Geographical situation

- 1.2 Demographic structure of Vietnam

- 1.3 The economic situation in Vietnam

- 1.4 Minimum Wage in Vietnam 2013-2022

- 1.5 Impact of COVID-19 on the electric vehicle industry in Vietnam

2 Overview of Vietnam's shipbuilding industry

- 2.1 History of Vietnam's shipbuilding industry

- 2.2 FDI in Vietnam's shipbuilding industry

- 2.3 Policy environment of Vietnam's shipbuilding industry

3 Vietnam shipbuilding industry supply and demand situation

- 3.1 Vietnam shipbuilding industry supply situation

- 3.2 Vietnam shipbuilding industry demand situation

4 Vietnam shipbuilding industry import and export situation

- 4.1.1 Vietnam shipbuilding industry import volume and import value

- 4.1.2 Main import sources of Vietnam's shipbuilding industry

- 4.2 Vietnam's shipbuilding industry export situation

- 4.2.1 Vietnam shipbuilding industry export volume and export value

- 4.2.2 Main export destinations of Vietnam's shipbuilding industry

5 Cost analysis of Vietnam's shipbuilding industry

6 Vietnam shipbuilding industry market competition

- 6.1 Barriers to entry in Vietnam's shipbuilding industry

- 6.1.1 Brand barriers

- 6.1.2 Quality Barriers

- 6.1.3 Capital Barriers

- 6.2 Competitive structure of Vietnam's shipbuilding industry

- 6.2.1 Bargaining power of suppliers in shipbuilding industry

- 6.2.2 Consumer bargaining power

- 6.2.3 Competition in Vietnam's shipbuilding industry

- 6.2.4 Potential entrants in shipbuilding industry

- 6.2.5 Shipbuilding industry alternatives

7 Analysis of major shipbuilding and trading companies in Vietnam

- 7.1 Damen Shipyards Group.

- 7.1.1 Damen Shipyards Group Corporate Profile

- 7.1.2 Damen Shipyards Group's ship orders in hand

- 7.2 Hyundai Heavy Industries

- 7.2.1 Hyundai Heavy Industries Corporate Profile

- 7.2.2 Hyundai Heavy Industries' ship orders in hand

- 7.3 Samsung Heavy Industries

- 7.3.1 Samsung Heavy Industries Corporate Profile

- 7.3.2 Samsung Heavy Industries' ship orders in hand

- 7.4 Mitsui Engineering & Shipbuilding

- 7.4.1 Mitsui Engineering & Shipbuilding Corporate Profile

- 7.4.2 Mitsui Engineering & Shipbuilding's ship orders in hand

- 7.5 Vinashin (Vietnam Shipbuilding Industry Group)

- 7.5.1 Vinashin (Vietnam Shipbuilding Industry Group) Corporate Profile

- 7.5.2 Vinashin (Vietnam Shipbuilding Industry Group) Ship Orders in Hand

- 7.6 Vinalines (Vietnam National Shipping Lines)

- 7.6.1 Corporate Profile of Vinalines (Vietnam National Shipping Lines)

- 7.6.2 Vinalines (Vietnam National Shipping Lines) ship orders on hand

- 7.7 Nam Trieu Shipbuilding Industry Corporation

- 7.7.1 Nam Trieu Shipbuilding Industry Corporation Corporate Profile

- 7.7.2 Nam Trieu Shipbuilding Industry Corporation Ship Orders in Hand

- 7.8 Pha Rung Shipyard

- 7.8.1 Pha Rung Shipyard Corporate Profile

- 7.8.2 Pha Rung Shipyard's ship orders in hand

8 Vietnam Shipbuilding Industry Outlook 2023-2032

- 8.1 Analysis of development factors of Vietnam's shipbuilding industry

- 8.1.1 Drivers and Development Opportunities for Vietnam's Shipbuilding Industry

- 8.1.2 Threats and challenges to Vietnam's shipbuilding industry

- 8.2 Vietnam shipbuilding industry supply forecast

- 8.3 Vietnam Shipbuilding Industry Market Demand Forecast

- 8.4 Vietnam shipbuilding industry import and export forecast

Disclaimer

Service Guarantees