PUBLISHER: China Research and Intelligence | PRODUCT CODE: 1280691

PUBLISHER: China Research and Intelligence | PRODUCT CODE: 1280691

Indonesia Automotive Tire Industry Research Report 2023-2032

Motor vehicles are a form of transportation that is inseparable from people's activities, especially in Indonesia, which has a population of 258.7 million. According to CRI's analysis, the number of motor vehicles in Indonesia reached 153 million. Among them, 126.99 million, or 83.27%, are motorcycles and 19.31 million are passenger cars. The rising level of purchasing power of Indonesian nationals has led to an increasing number of motor vehicles in the Indonesian market, which in turn has prompted motor vehicle manufacturers to compete to meet the growing demand for motor vehicles in Indonesia.

SAMPLE VIEW

Over the past decade, Indonesia has become one of the largest producers and consumers of tires in Southeast Asia. The country is home to some of the leading brands in the global tire industry, and the installed capacity and production of the Indonesian tire market grew significantly in the first five years of the past decade, while the second five years were relatively quiet.

Indonesian tire producers have a huge advantage in terms of raw material supply. The country is the second largest producer of natural rubber, producing 3.12 million tons of natural rubber in 2021, according to CRI's analysis. The tire industry consumes more than 250,000 tons of natural rubber annually, accounting for nearly 40% of domestic natural rubber consumption. The availability and pricing of natural rubber is one of the major advantages of Indonesia's tire manufacturing industry.

According to CRI's analysis, Indonesia's domestic tire production grows 38% to 193 million tires in 2021. Of these, approximately 79.5 million are automotive tires. Of the units produced, 30% of the total production is absorbed by the domestic market and the remaining 70% is exported to foreign markets. The market for passenger car and truck tires in Indonesia grows from 24.1 million tires in 2020 to 28.9 million tires in 2021, an increase of 19.9%. The OEM (original equipment manufacturer) assembly and replacement markets grew by 47.1% and 8%, respectively.

In addition to the domestic market, Indonesian tire producers have a major share of many export markets. The country's low production costs have given domestic tire manufacturers a significant competitive advantage in the export market. In addition, Indonesian tires for export have reached world class quality standards in the Middle East, America and even Europe. This is because the type of Indonesian natural rubber used in tire production is SIR 20 TSR (technically graded rubber) rubber, which is made by extracting the sap from Brazilian rubber trees, then solidifying, refining and heating the sap, SIR 20 TSR rubber is used as a raw material for making tires and engine hoses without any chemical additives. Meanwhile, the types of rubber produced in other countries, namely Thailand and Vietnam, must first undergo a blending process with a variety of chemicals to achieve the quality of Indonesian natural rubber.

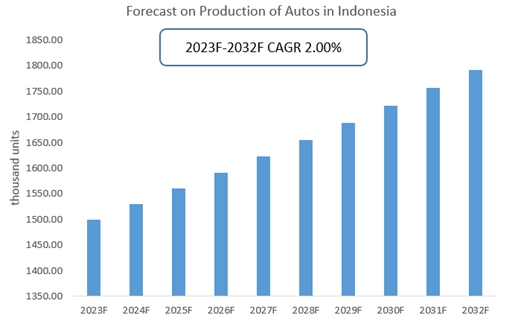

The impact of COVID-19 has led to a significant contraction in Indonesia's auto production in 2020, with only 691,000 units in 2020, down 46.28% y-o-y, according to CRI's analysis.Vietnam's auto production will grow at a CAGR of 2.27% from 2018 to 2022.In 2021 and 2022, as the impact of COVID-19 gradually dissipates, the economic recovery in domestic and global markets, Indonesia's automotive production also rises significantly, with annual production of about 1.47 million units in 2022, up 31.03% YoY. The rising car production in Indonesia has driven up the demand for car tires.

According to CRI, the market size of automotive industry will reach US$ 1.79 million in 2032 and the CAGR in 2023 to 2032 is 2%.

Source:China Association of Automobile Manufacturers, CRI

Topics covered:

- Indonesia Automotive Tire Industry Overview

- Economic Environment and Policy Environment of the Automotive Tire Industry in Indonesia

- What is the impact of COVID-19 on the Indonesian automotive tire industry?

- Indonesia Automotive Tire Industry Market Size 2018-2022

- Analysis of major Indonesian auto tire industry manufacturers

- Key Drivers and Market Opportunities in Indonesia's Automotive Tire Industry

- What are the key drivers, challenges and opportunities for Indonesia's automotive tire industry during the forecast period of 2023-2032?

- Which companies are the key players in the Indonesian Automotive Tire Industry market and what are their competitive advantages?

- What is the expected revenue of Indonesia Automotive Tire Industry market during the forecast period 2023-2032?

- What are the strategies adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Indonesia Automotive Tire Industry market is expected to dominate the market by 2032?

- What are the main negative factors facing the automotive tire industry in Indonesia?

Table of Contents

1 Overview of the Indonesian automotive tire industry

- 1.1 Definition and Classification

- 1.2 Automotive Tire Industry in the Indonesian Economy 2021-2023

- 1.2.1 Auto tire industry share of GDP

- 1.2.2 Auto tire industry accounted for the proportion of the automotive industry

2 2021-2023 Indonesia Automotive Tire Industry Development Environment

- 2.1 Economic environment and development of the automotive industry

- 2.1.1 Indonesian Economy

- 2.1.2 Indonesia Automotive Industry Overview

- 2.1.3 Analysis of Car Ownership in Indonesia

- 2.2 Policy Environment

- 2.2.1 Policy Overview

- 2.2.2 Key Policy Analysis

- 2.2.3 Policy Trends

3 2021-2023 Indonesia Automotive Tire Industry Operation

- 3.1 Industry Scale

- 3.1.1 Number of enterprises

- 3.1.2 Status of foreign investment in Indonesia's auto tire industry

- 3.2 Indonesia Automotive Tire Industry Supply Analysis

- 3.2.1 Production capacity

- 3.2.2 Production

- 3.3 Overall requirements

- 3.3.1 Consumption

- 3.3.2 Market Size

- 3.4 Indonesia Automotive Tire Market Segment Analysis

- 3.4.1 Analysis of the demand for automotive tires in the vehicle manufacturing industry

- 3.4.2 Auto aftermarket demand analysis for auto tires

4 Indonesia Automotive Tire Industry Market Competition Scenario, 2021-2023

- 4.1 Barriers to entry

- 4.1.1 Policy Barriers

- 4.1.2 Financial barriers

- 4.1.3 Technical barriers

- 4.1.4 Customer Barrier

- 4.2 Industry Competition Structure

- 4.2.1 Upstream suppliers

- 4.2.2 Downstream users

- 4.2.3 Competition among existing companies in the industry

- 4.2.4 New entrants

- 4.2.5 Alternatives

5 2021-2023 Indonesia Automotive Tire Industry Import and Export Analysis

- 5.1 Import

- 5.1.1 Import Overview

- 5.1.2 Main import sources

- 5.1.3 Import trends

- 5.2 Export

- 5.2.1 Export Overview

- 5.2.2 Main export destinations

- 5.2.3 Export Trends

6 Indonesia automotive tire industry chain, 2021-2023

- 6.1 Introduction to the industry chain

- 6.2 Upstream of the industry chain

- 6.2.1 Steel industry

- 6.2.2 Rubber Industry

- 6.2.3 Non-ferrous raw materials

- 6.2.4 The impact of upstream industry on the automotive tire industry

- 6.3 Downstream industries

- 6.3.1 Automotive industry

- 6.3.2 Automotive after-sales service industry

- 6.3.3 Impact of downstream industries on the automotive tire industry

7 2021-2023 Indonesia Automotive Tire Industry Key Companies Analysis

- 7.1 PT Gajah Tunggal Tbk.

- 7.1.1 PT Gajah Tunggal Tbk Corporate Profile

- 7.1.2 PT Gajah Tunggal Tbk Auto Tire Production and Sales

- 7.2 PT Bridgestone Indonesia

- 7.2.1 PT Bridgestone Indonesia Corporate Profile

- 7.2.2 PT Bridgestone Indonesia Automotive Tire Production and Sales

- 7.3 PT Michelin Indonesia

- 7.3.1 PT Michelin Indonesia Corporate Profile

- 7.3.2 PT Michelin Indonesia Automobile tire production and sales

- 7.4 PT Multistrada Arah Sarana Tbk

- 7.4.1 PT Multistrada Arah Sarana Tbk Corporate Profile

- 7.4.2 PT Multistrada Arah Sarana Tbk Auto Tire Production and Sales

- 7.5 PT Hankook Tire Indonesia

- 7.5.1 PT Hankook Tire Indonesia Corporate Profile

- 7.5.2 PT Hankook Tire Indonesia Auto Tire Production and Sales

- 7.6 PT Goodyear Indonesia Tbk

- 7.6.1 PT Goodyear Indonesia Tbk Corporate Profile

- 7.6.2 PT Goodyear Indonesia Tbk Automotive Tire Production and Sales

- 7.7 PT Sumi Rubber Indonesia

- 7.7.1 PT Sumi Rubber Indonesia Corporate Profile

- 7.7.2 PT Sumi Rubber Indonesia Auto Tire Production and Sales

- 7.8 PT Elang Perdana

- 7.8.1 PT Elang Perdana Corporate Profile

- 7.8.2 PT Elang Perdana Auto Tire Production and Sales

8 Indonesia Automotive Tire Industry Outlook 2023-2032

- 8.1 Development Influencing Factors

- 8.1.1 Driving forces and market opportunities

- 8.1.2 Threats and Challenges

- 8.2 Supply Forecast

- 8.2.1 Production capacity forecast

- 8.2.2 Production Forecast

- 8.3 Demand forecasting

- 8.3.1 Overall market size forecast

- 8.3.2 Analysis of the demand for automotive tires in Indonesia's vehicle manufacturing industry

- 8.3.3 Indonesia Automotive Aftermarket Demand Analysis for Automotive Tires

- 8.4 Development and Investment Recommendations

- 8.4.1 Exploring Investment Opportunities

- 8.4.2 Development suggestions

Disclaimer

Service Guarantees