PUBLISHER: China Research and Intelligence | PRODUCT CODE: 1462394

PUBLISHER: China Research and Intelligence | PRODUCT CODE: 1462394

Indonesia Fertilizer Industry Research Report 2024-2033

Indonesia is the fourth most populous country in the world and an important agricultural country. The overall demand for fertilizers in Indonesia is showing an increasing trend. In 2021, Indonesia's agricultural land reached 64.6 million hectares, and the cultivated land area reached 26.3 million hectares. The cultivated land area accounted for 13.9% of the country's land area. According to statistics, 45% of Indonesia's population lives in rural areas, and more than 90% of those engaged in agriculture are small farmers.

SAMPLE VIEW

According to CRI analysis, farms account for 32% of Indonesia's total land area, and agricultural production accounts for 14% of the gross domestic product (GDP). Indonesia is also the world's third largest exporter of cocoa and rubber, and increased export-oriented crop cultivation has led to rising demand for fertilizers in Indonesia. In 2023, Indonesia's fertilizer imports reached US$ 2.03 billion, and Indonesia is one of the world's largest fertilizer importers.

In 2020-2022, the COVID -19 pandemic had an adverse impact on the Indonesian fertilizer industry. Fertilizer production in Indonesia fell by 20-30% due to supply constraints. In addition, due to the turmoil in the international situation, which has had a huge impact on the supply side of the fertilizer market, especially the potash fertilizer market, Indonesian fertilizer market prices have also increased.

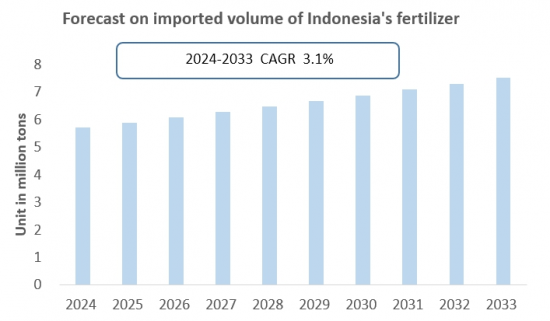

CRI predicts that with the development of Indonesia's agriculture and planting industry, Indonesia's demand for fertilizers will continue to rise from 2024 to 2033.

Due to Indonesia's limited domestic fertilizer production capacity, annual fertilizer imports will continue to rise. CRI predicts that Indonesia's fertilizer imports will reach 7.54 million tons in 2033, with a compound annual growth rate of 3.1 % from 2024 to 2033.

Topics covered:

Indonesia Fertilizer Industry Overview

Economic environment and policy environment of fertilizers in Indonesia

Indonesian fertilizer market size from 2019 to 2023

Analysis of major Indonesian fertilizer manufacturers

Key Drivers and Market Opportunities of Indonesia's Fertilizer Industry

What are the key drivers, challenges and opportunities for the Indonesian fertilizer industry during the forecast period 2024-2033?

What is the expected revenue of the Indonesia Fertilizer market during the forecast period 2024-2033?

What strategies are adopted by the key players in the market to increase their market share in the industry?

Which segment of the Indonesian Fertilizer Market is expected to dominate the market in 2033?

Indonesia Fertilizer Market Forecast from 2024 to 2033

What are the main headwinds facing Indonesia's fertilizer industry?

Table of Contents

1 Overview of Indonesia

- 1.1 Geographical conditions

- 1.2 Indonesia's demographic structure

- 1.3 Indonesia's economy

- 1.4 Indonesian minimum wage from 2014 to 2024

- 1.5 Impact of COVID -19 on Indonesia's Fertilizer Industry

2 Development environment of Indonesia's fertilizer industry

- 2.1 Economic environment

- 2.1.1 Development status of agriculture and plantation industry in Indonesia

- 2.1.2 Analysis of fertilizer usage in the Indonesian market

- 2.2 Technical environment

- 2.2.1 Main types of chemical fertilizers used in Indonesia

- 2.2.2 Technical level of Indonesia's fertilizer manufacturing industry

- 2.3 Policy environment for Indonesia's fertilizer industry

- 2.3.1 Main government policies for Indonesia's fertilizer industry

- 2.3.2 Foreign investment policies in Indonesia's fertilizer industry

- 2.4 Analysis of operating costs of Indonesia's fertilizer industry

- 2.4.1 Human resource costs

- 2.4.2 Electricity price

- 2.4.3 Factory rent

- 2.4.4 Other costs

3 Supply and demand status of Indonesia's fertilizer industry

- 3.1 Supply status of Indonesia's fertilizer industry

- 3.1.1 Indonesia's total fertilizer production

- 3.1.2 Production of different types of fertilizers

- 3.2 Demand status of Indonesia's fertilizer industry

- 3.2.1 Analysis of fertilizer consumption in Indonesia

- 3.2.2 Analysis of Indonesian market demand for different types of fertilizers

- 3.2.3 Comprehensive forecast of Indonesia's fertilizer market

- 3.3 Indonesia Fertilizer Market Price Analysis

4 Import and export status of Indonesia's fertilizer industry from 2019 to 2023

- 4.1 Import status of Indonesia's fertilizer industry

- 4.1.1 Indonesia's fertilizer import volume and import value

- 4.1.2 Main import sources of chemical fertilizers in Indonesia

- 4.2 Export status of Indonesia's fertilizer industry

- 4.2.1 Indonesia's fertilizer export volume and export value

- 4.2.2 Main export destinations of fertilizers in Indonesia

5 Market Competition Analysis of Indonesia's Fertilizer Industry

- 5.1 Barriers to entry in Indonesia's fertilizer industry

- 5.1.1 Brand barriers

- 5.1.2 Quality barriers

- 5.1.3 Capital barriers

- 5.2 Competitive Structure of Indonesia's Fertilizer Industry

- 5.2.1 Bargaining power of fertilizer suppliers

- 5.2.2 Consumer bargaining power

- 5.2.3 Competition in Indonesia's Fertilizer Industry

- 5.2.4 Potential Entrants to the Fertilizer Industry

- 5.2.5 Alternatives to chemical fertilizers

6 Analysis of major fertilizer brands in Indonesia

- 6.1 PT. Pupuk Sriwidjaya Palembang

- 6.1.1 The development history of PT. Pupuk Sriwidjaya Palembang

- 6.1.2 Main products of PT. Pupuk Sriwidjaya Palembang

- 6.1.3 PT. Pupuk Sriwidjaya Palembang's operating model

- 6.2 PT Petrokimia Gresik

- 6.2.1 Development History of PT Petrokimia Gresik

- 6.2.2 Main Products of PT Petrokimia Gresik

- 6.2.3 PT Petrokimia Gresik's operating model

- 6.3 PT Pupuk Kujang

- 6.3.1 The development history of PT Pupuk Kujang

- 6.3.2 Main products of PT Pupuk Kujang

- 6.3.3 PT Pupuk Kujang's operating model

- 6.4 PT. Pupuk Kalimantan Timur

- 6.4.1 The development history of PT. Pupuk Kalimantan Timur

- 6.4.2 Main Products of PT. Pupuk Kalimantan Timur

- 6.4.3 Operation model of PT. Pupuk Kalimantan Timur

- 6.5 PT Pupuk Iskandar Muda

- 6.5.1 The development history of PT Pupuk Iskandar Muda

- 6.5.2 Main products of PT Pupuk Iskandar Muda

- 6.5.3 Operation model of PT Pupuk Iskandar Muda

- 6. 6 PT Jadi Mas

- 6. 6 .1 The development history of PT Jadi Mas

- 6. 6 .2 Main products of PT Jadi Mas

- 6. 6 .3 Operation model of PT Jadi Mas

- 6. 7 Wilmar International Limited

- 6. 7 .1 The development history of Wilmar International Limited

- 6. 7 .2 Main products of Wilmar International Limited

- 6.7.3 Wilmar International Limited 's operating model

- 6. 8 Kuok Group ( Agrifert )

- 6.8.1 Development History of Kuok Group ( Agrifert )

- 6.8.2 Main products of Kuok Group ( Agrifert )

- 6.8.3 Kuok Group ( Agrifert ) operating model

- 6. 9 PT. Dupan Anugerah Lestari

- 6. 9 .1 PT. Dupan The development history of Anugerah Lestari

- 6. 9 .2 PT. Dupan Anugerah Lestari's main products

- 6. 9 .3 PT. Dupan Anugerah Lestari's operating model

7 Indonesia's Fertilizer Industry Outlook 2024-2033

- 7.1 Analysis of development factors of Indonesia's fertilizer industry

- 7.1.1 Driving forces and development opportunities of Indonesia's fertilizer industry

- 7.1.2 Threats and challenges faced by Indonesia's fertilizer industry

- 7.2 Supply Forecast of Indonesia's Fertilizer Industry

- 7.3 Indonesia Fertilizer Market Demand Forecast

- 7.4 Indonesia's Fertilizer Import and Export Forecast

Disclaimer

Service Guarantees

LIST OF CHARTS

- Chart Indonesia's total population from 2013 to 2023

- Chart Indonesia's GDP per capita from 2013 to 2023

Char Policies related to the fertilizer industry issued by the Indonesian government from 2018 to 2024

- Chart Foreign investment policy in Indonesia's fertilizer industry

- Chart 2014-2024 Indonesian minimum wage

- Chart 2019-2023 Indonesia's total fertilizer production

- Chart 2019-2023 Indonesia's nitrogen, phosphorus and potassium fertilizer production

- Chart 2019-2023 Indonesia's domestic consumption of chemical fertilizers

- Chart 2019-2023 Indonesian fertilizer imports

- Chart 2019-2023 Indonesian fertilizer import amount

- Chart 2019-2023 Indonesia's fertilizer importing countries and import amounts

- Chart 2019-2023 Indonesian fertilizer export volume

- Chart 2019-2023 Indonesian fertilizer export value

- Chart 2019-2023 Indonesia's main export destinations of fertilizers

- Chart 2024-2033 Indonesia's fertilizer production forecast

- Chart 2024-2033 Indonesian domestic fertilizer market size forecast

- Chart 2024-2033 Indonesia's fertilizer import forecast

- Chart 2024-2033 Indonesia's fertilizer export forecast