PUBLISHER: CSIL Centre for Industrial Studies | PRODUCT CODE: 1775079

PUBLISHER: CSIL Centre for Industrial Studies | PRODUCT CODE: 1775079

The Office Furniture Market in North America. The United States, Canada, and Mexico

The CSIL report "The office furniture market in North America: the United States, Canada and Mexico" offers an extensive analysis, through historical trends, future developments, tracking the North American office furniture industry's strategic turning points.

The study examines how the office furniture market in North America has evolved in recent years through:

- Basic data (production, consumption, imports and exports) for the time series 2019 to 2024, for the area and by country

- Office furniture market forecasts up to 2026, for the area and by country

- Competitive landscape analysis: information and performance of major players

- An analysis of the distribution system by country

- Product trends: from hybrid workspaces and rising demand for height-adjustable desks to the growing role of acoustic solutions and phone booths.

SCOPE AND STRUCTURE OF THE REPORT

An Executive Summary offering a first, extensive picture of the sector opens the report. The content is then structured into seven comprehensive chapters, combining quantitative analysis, maps, tables and graphs with CSIL's assessment:

1. Scenario: Structure, Evolution, and Office Furniture Market Forecasts in North America

An overview of the office furniture sector in North America, including production, consumption, and international trade data. The section features five-year trends (2019-2024) and two-year market forecasts (2025-2026), introducing the leading office furniture companies in North America and their market shares.

2. Business Performance by Country: the US, Canada, and Mexico

Each country is analysed in depth with:

- Office furniture market performance

- Key economic and demographic indicators

- Non-residential construction trends and outlook

3. International Trade: Imports and Exports of Office Furniture in North America

This chapter explores import and export flows of office furniture, by product segment and destination/origin country. Trade balances are provided for each market and the major categories.

4. Product Segmentation

A detailed breakdown of office furniture in North America by type:

- Office seating (task chairs, executive, soft, stackable)

- Operative and executive desks

- Height-adjustable tables (HAT)

- Cabinets and filing systems

- Partitions, acoustic solutions, and phone booths

- Furniture for communal and meeting areas

5. Distribution Channels

Office furniture distribution system in Canada, Mexico, and the U.S., including performance by channel type (independent or exclusive dealers, national office products chains, direct sales -including the Government/GSA-, wholesale, e-commerce / online business), and state-level office furniture consumption in the United States.

6. Competition: Company Market Shares by Product

This section includes information and sales estimates of selected top office furniture manufacturers by segment: seating, desking, executive furniture, partitions, acoustic pods, and booths. It also presents foreign companies operating or exporting to the region.

7. Competition: Company Market Shares by Country

A country-specific view of leading players, highlighting their market presence, estimated turnover, and competitive position in Canada, Mexico, and the U.S.

Overall, 75 North American companies and 50 international companies operating in the region are considered in the report.

This research answers insightful questions on the North American Office furniture Sector:

- What is the current size and value of the office furniture market in North America?

- How are countries and office furniture segments performing?

- Who are the leading manufacturers, and what is their market share?

- How are product trends, distribution models, and workspace evolving?

- Where are the export/import flows moving?

- What impact does workplace transformation have on demand?

Selected companies:

Among the office furniture manufacturers mentioned in the report: 9 to 5 Seating, Allseating Corporation, Arcadia+Encore, Artopex, Bernhardt, Bestar Inc, Creaciones Industriales, Fellowes, Gebesa, Global Furniture Group, Groupe Lacasse, Hat Collective, Haworth, HNI Corporation, Humanscale, Indiana Furniture, Jasper Group JSI, Keilhauer, KI, MillerKnoll, Office Master, OFS-Room, Productos Metalicos Steele, SitOnIt Seating, SnapCab, Steelcase, Teknion Group, Vari, Watson

Highlights:

The North American office furniture market is the largest in the world, and amounts to around USD 17 billion, according to the latest CSIL data. The rapid transformation recorded by the sector has brought numerous changes both in terms of products and the competitive landscape. Hybrid working and office vacancy rate continued to rise across North America, impacting market dynamics.

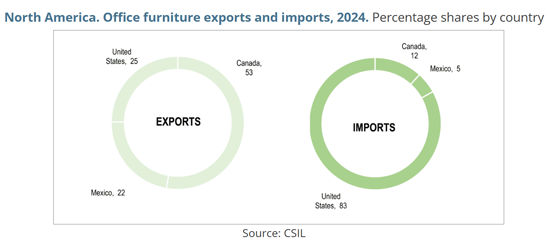

The United States maintained its position as the leading office furniture importer worldwide. Canada and Mexico, on the other hand, are net exporters with a positive trade balance, progressively improving over the last years. Canada, in particular, is the world's second-largest office furniture exporter after China and covers over half of the total export values of North America.

TABLE OF CONTENTS

METHODOLOGY

EXECUTIVE SUMMARY:

- A comprehensive outlook on the office furniture industry in North America

1. SCENARIO

- 1.1. Market evolution and figures by country

- Office furniture consumption in North America and prices

- Production, consumption, international trade and openness of the office furniture market

- 1.2. Leading companies in North America and their market shares

- Market concentration

- Market share estimates of the top 30 companies

- 1.3. Manufacturing presence

- Employment in the Office Industry

- 1.4. Forecasts for 2025 and 2026

2. BUSINESS PERFORMANCE

- For the US, Canada and Mexico:

- Office furniture sector performance: basic data 2019-2024

- Economic indicators and Macroeconomic trends

- Employment and occupation

- Population

- Construction

3. INTERNATIONAL TRADE

- For the US, Canada, and Mexico:

- Trade balance, 2019-2024

- Exports

- Exports of office furniture, 2019-2024

- Exports of office furniture by destination and by segment

- Exports of office seating by country and by geographical area

- Exports of office furniture (excluding seating) by country and by geographical area

- Imports

- Imports of office furniture, 2019-2024

- Imports of office furniture by area of origin and by segment

- Imports of office seating by country and by geographical area

- Imports of office furniture (excluding seating) by country and by geographical area

4. PRODUCTS

- 4.1. Product segments

- Market breakdown by segment, 2019-2024

- Office seating: Breakdown by kind and by coverings

- Office desking & Height-Adjustable Tables (HAT). Incidence of HAT and mechanism

- 4.2. Partitions, acoustic products, and Phone Booths/Pods

5. DISTRIBUTION

- Distribution channels in the US, Canada, and Mexico

- Sales of office furniture by state (US)

6. COMPANY MARKET SHARES BY PRODUCT

- 6.1. Total sales of Office furniture by major manufacturers

- Estimated sales of office seating by major manufacturers in

- Seating

- Office desking

- Executive furniture

- Office filing and storage

- Furniture for communal areas

- Partitions, acoustic and other products

- Phone Booths/Pods

- Foreign companies active in North America

- Estimated sales of office seating by major manufacturers in

7. COMPANY MARKET SHARES BY COUNTRY

- Total sales by major manufacturers in the United States, Canada and Mexico

APPENDIX 1:

- TRADE FAIRS, MAGAZINES AND ASSOCIATIONS

APPENDIX 2:

- LIST OF MENTIONED COMPANIES