PUBLISHER: CSIL Centre for Industrial Studies | PRODUCT CODE: 1745946

PUBLISHER: CSIL Centre for Industrial Studies | PRODUCT CODE: 1745946

The European Market for Lighting Fixtures

The CSIL Market Research Report "The European market for lighting fixtures" offers a detailed analysis of the lighting fixtures industry across 30 European countries, providing insights, statistics, and the main indicators to go in-depth into this sector, and is structured as follows:

1. SCENARIO: OVERVIEW OF THE LIGHTING FIXTURES IN EUROPE

The European lighting fixtures sector is analysed through tables and graphs showing production, consumption, and international trade at both European and Country level, highlighting the two main market segments in Europe:

- Residential lighting

- Professional lighting (commercial, industrial, outdoor lighting)

The chapter also provides a panorama of the leading European groups with their market shares.

Forecasts on lighting fixtures consumption for 2025, 2026, and 2027 conclude the chapter.

2. THE EUROPEAN LIGHTING FIXTURES BUSINESS PERFORMANCE

This section offers statistics on lighting fixtures (Production, consumption, international trade) and comparison with selected country key macroeconomic indicators to assess sector performance for the time series 2019-2024, with forecasts for 2025-2027.

Data are provided at the European and Country level, by area:

- Northern Europe (Denmark, Finland, Norway, Sweden)

- Western Europe (Belgium, France, Ireland, Netherlands, United Kingdom)

- Central Europe (DACH: Austria, Germany, Switzerland)

- Southern Europe (Greece, Italy, Portugal, Spain)

- Central Eastern Europe (Bulgaria, Croatia, Cyprus, Czech Republic, Estonia, Hungary, Lithuania, Latvia, Malta, Poland, Romania, Slovenia, Slovakia)

3. THE DYNAMICS OF LIGHTING FIXTURES' TRADE

A comprehensive overview of international trade in lighting fixtures, focusing on exports and imports for the 30 European countries over the past six years (2019-2024).

4. MARKET STRUCTURE: APPLICATIONS, PRODUCTS, AND TECHNOLOGIES IN THE LIGHTING INDUSTRY

Analysis of the structure of the European lighting fixtures market, breaking down data by segment:

- Residential lighting: Breakdown of Lighting Fixtures market by style and by products.

- Professional lighting: breakdown by products and by destination for Commercial and Industrial lighting.

- Outdoor lighting: breakdown by products and by destination.

A selection of the main companies operating in each segment and forecasts by segment and destination are also provided.

Special focus is given to the main sector trends, including the growth of LED and smart / connected lighting technologies; sustainability; human-centric lighting (HCL); miniaturization trends; evolution of USB / portable lamps.

The study also examines intellectual property developments and patent activity within the European lighting industry.

5. LIGHTING FIXTURES DISTRIBUTION IN EUROPE

An overview of the European lighting fixtures distribution through tables showing the breakdown of lighting fixtures sales by distribution channel (Direct sales / Contract / Projects; Lighting specialists; Furniture chains / furniture stores / department stores; Wholesalers; E-commerce) for residential and professional lighting, and for most of the leading companies and the largest markets.

6. THE COMPETITIVE SYSTEM: THE LARGEST MANUFACTURERS OF LIGHTING FIXTURES IN EUROPE

Insights into the leading local and foreign players in each application segment and each European Country, providing:

- Sales data and market shares of top lighting fixtures companies.

- Company profiles of selected leading market players providing sales performance and strategies.

- Focus on European lighting fixtures exports outside Europe (Middle East and Africa, Asia-Pacific, North, Central and South America).

7. ANNEXES: INTERNATIONAL TRADE AND FINANCIAL ANALYSIS

- International trade tables by country. Detailed tables on lighting fixtures exports and imports by single country (30 European Countries considered), for the last 6 years, broken down by country and by geographic area of destination/origin.

- Financial Analysis builds on a sample of around 120 European companies active in the lighting sector, a study of their main profitability ratios (ROA, ROE, and EBITDA), and measures their employee ratios.

- Directory of companies mentioned in this report: around 450 companies included

The CSIL Market Research Report "The European Market for Lighting Fixtures" offers comprehensive analysis and data to help answer relevant questions:

- What is the size of the Lighting Fixtures Market in Europe, and the largest consuming and importing countries in the area?

- How is the European lighting fixtures market structured and segmented?

- What are the leading groups and companies in the European Lighting Fixtures industry?

- How is the distribution of Lighting Fixtures in Europe structured? And, what are the main channels?

- What are the main innovation trends in the European lighting sector?

- What is the forecast for the lighting market in Europe and by Country?

NOTES:

- CONSIDERED PRODUCTS: Batten lights, Bollards, Ceiling luminaires, Chandeliers, Christmas lighting, Downlights, Embedded, Emergency lighting, Floodlights, Floor light, High and Low Bay, LED panels, Light poles, Linear lighting, Modular systems, Projectors, Spotlights, Step lighting / Guide Light, Strip lighting, Suspensions, Table lighting, Track lights, Wall luminaires.

- DESTINATIONS: Residential; Commercial (Hospitality; Office; Retail; Museums and Art venues; Entertainment; Schools and Infrastructure); Industrial (Industrial plants; Hazardous environments; Marine; Horticulture; Healthcare; Emergency); Outdoor (Residential outdoor; Urban Landscape; Christmas and Events; Streets and major roads; Tunnels and Galleries; Sport facilities, parking, oil stations).

- GEOGRAPHICAL COVERAGE: Austria (AT), Belgium (BE), Bulgaria (BG), Croatia (HR), Cyprus (CY), Czech Republic (CZ), Denmark (DK), Estonia (EE), Finland (FI), France (FR), Germany (DE), Greece (GR), Hungary (HU), Ireland (IE), Italy (IT), Latvia (LV), Lithuania (LT), Malta (MT), Netherlands (NL), Norway (NO), Poland (PL), Portugal (PT), Romania (RO), Slovakia (SK), Slovenia (SL), Spain (ES), Sweden (SE), Switzerland (CH), United Kingdom (UK).

Selected companies

Among the companies mentioned in this study:

|

|

|

Highlights:

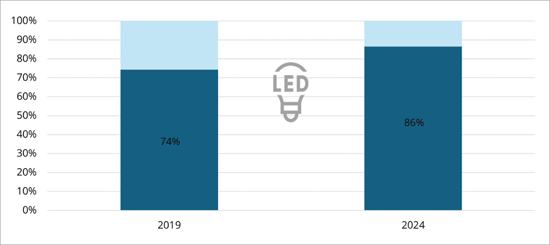

Europe. Incidence of LED on total lighting fixtures market,

2019 and 2024.

Percentage share

Source: CSIL

The European market for lighting fixtures amounts to around EUR 20 billion. Germany, the United Kingdom, and France are the largest consuming countries of this segment within Europe.

According to CSIL, the lighting fixtures market perspectives appear to be solid. The growing demand for efficient lighting solutions, driven by greater focus on energy savings and increasingly stringent environmental regulations, presents promising growth opportunities. This has driven LED products, an established and mature technology, to account for nearly 90% of total lighting fixtures consumption in Europe and is driving the expansion of connected and smart lighting, one of the key emerging sector trends, which is progressively reshaping the competitive landscape.

Table of Contents (Abstract)

Methodology

- Research tools and terminology, Contents

Executive summary

1. Scenario: Trends, market segment and figures by country

- 1.1. Market evolution and figures by country

- 1.2. LED installed stock in Europe

- 1.2. Leading groups in Europe and their market shares

- 1.3. Forecasts 2025-2027

2. Business performance: basic data and macroeconomic indicators by country

- 2.1. Northern Europe (Denmark, Finland, Norway, Sweden)

- 2.2. Western Europe (Belgium, France, Ireland, Netherlands, United Kingdom)

- 2.3. Central Europe (DACH: Austria, Germany, Switzerland)

- 2.4. Southern Europe (Greece, Italy, Portugal, Spain)

- 2.5. Central-Eastern Europe (Bulgaria, Croatia, Cyprus, Czech Republic, Estonia, Hungary, Lithuania, Latvia, Malta, Poland, Romania, Slovenia, Slovakia)

3. International trade

- 3.1. Trade balance, exports and imports evolution

- 3.2. Top 10 exporting/importing Countries, exports/imports by main destinations/origin, export/import by product segment

- 3.3. Exports and imports by country and by geographical area of destination/origin

4. Market structure

- 4.1. Products and applications

- 4.2. Residential (indoor) lighting: sales breakdown by style and products

- 4.3. Professional (indoor) lighting: sales breakdown by products

- 4.3.1. Commercial lighting: sales breakdown by destinations

- 4.3.2. Industrial lighting: sales breakdown by destinations

- 4.4. Outdoor lighting: sales breakdown by products and destinations

- 4.5. Forecasts by destination segments

- 4.6. LED lighting

- 4.7. Innovation trends

- 4.8. Connected lighting

- 4.9. Connected applications

- 4.10. Intellectual Property

5. Distribution channels

- 5.1. Overview: Total Lighting, Residential and Professional Lighting Market

- 5.2. Lighting specialists

- 5.3. Furniture chains, furniture stores, department stores

- 5.4. Wholesalers

- 5.5. E-commerce

6. The competitive system: company market shares by application

- 6.1. Total lighting fixtures: leading players in Europe and market shares (consumption and production)

- 6.2. The European competitive system by market destination: Residential indoor (with a focus on design segment), Hospitality, Office, Retail, Art venues, Entertainment, Schools & Infrastructure, Industrial plants, Hazardous conditions, Marine, Healthcare, Emergency, Horticulture, Residential outdoor, Architectural outdoor, Street, Tunnel, Christmas and Area Lighting

7. The competitive system: company market shares by Country

- 7.1. The European competitive system by Country (Northern Europe, Western Europe, Central Europe (DACH), Southern Europe, Central-Eastern Europe)

- 7.2. Exports from Europe to Extra-European markets and Overseas

Annexes

- Annex 1. International trade tables by Country

- Annex 2. Financial Analysis: Key financial indicators and Employment analysis in a sample of over 100 manufacturers

- Annex 3. List of selected European lighting companies mentioned in the Report