PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928879

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928879

Fish Collagen Peptides Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

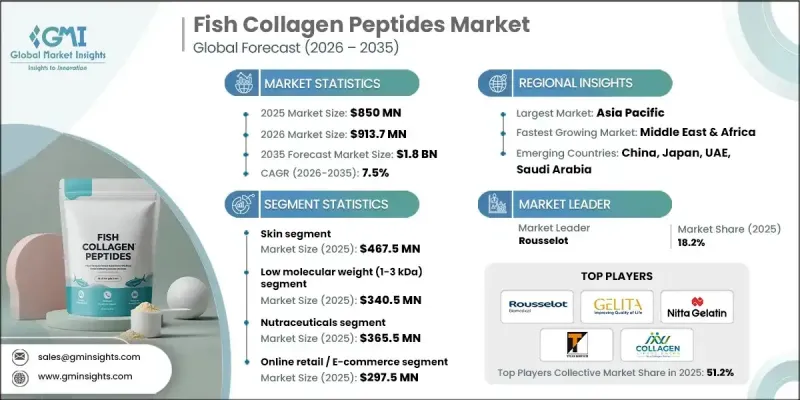

The Global Fish Collagen Peptides Market was valued at USD 850 million in 2025 and is estimated to grow at a CAGR of 7.5% to reach USD 1.8 billion by 2035.

The market is gaining strong traction as consumers increasingly favor clean-label, naturally sourced, and minimally processed ingredients within the health and wellness space. Fish-based collagen peptides align well with these preferences due to their marine origin, traceability, and association with the responsible use of seafood processing by-products. Regulatory emphasis on transparent labeling and ingredient clarity is encouraging manufacturers to reformulate and reposition products using familiar, easily identifiable components. Growing awareness around the role of collagen in maintaining skin strength, joint flexibility, and bone health is further accelerating demand. Preventive consumption of collagen supplements, particularly among middle-aged and aging populations, continues to rise as knowledge around healthy aging expands. Consumers are gradually shifting toward fish-derived collagen over mammalian alternatives because of its perceived higher absorption, broader dietary acceptance, and reduced cultural or allergen-related concerns. Fish collagen peptides are widely viewed as highly digestible and suitable for diverse consumer groups, including those avoiding bovine or porcine sources.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $850 Million |

| Forecast Value | $1.8 Billion |

| CAGR | 7.5% |

The fish skin segment accounted for USD 467.5 million in 2025. Skin-based raw materials dominate due to their high collagen content, consistent quality, and efficient extraction characteristics. This source enables the production of low-molecular-weight peptides that are widely used across nutraceutical, cosmetic, and functional food formulations, while also supporting sustainability by utilizing seafood by-products.

The nutraceutical applications segment generated USD 365.5 million in 2025, representing the largest application segment. Demand is supported by a strong consumer focus on preventive health, aging support, and beauty-from-within solutions. Fish collagen peptides are widely incorporated into supplements targeting skin condition, joint comfort, muscle recovery, and overall vitality, with growing availability across powders, capsules, gummies, and functional drinks through both retail and online channels.

North America Fish Collagen Peptides Market held 25% share in 2025 due to its mature nutraceutical sector, strong preventive healthcare culture, and high adoption of functional nutrition and beauty-oriented supplements. Demand continues to rise as interest in sustainably sourced marine ingredients and clean-label dietary products expands across physical and digital sales platforms.

Key companies active in the Global Fish Collagen Peptides Market include Gelita AG, Rousselot, Nitta Gelatin, Inc., Haihang Industry Co. Ltd, Titan Biotech Limited, Athos Collagen Pvt Ltd, Amar Aquatic, Collagen Life Sciences, Atom Pharma, and E-commerce Systems Pvt Ltd. Companies operating in the Global Fish Collagen Peptides Market are strengthening their positions by focusing on sustainable sourcing and full traceability of marine raw materials to meet clean-label expectations. Many players are investing in advanced extraction and hydrolysis technologies to improve peptide purity, bioavailability, and consistency. Product diversification across nutraceuticals, functional foods, and beauty-focused formulations helps address multiple consumer needs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Raw Material Source

- 2.2.3 Molecular Weight

- 2.2.4 Application

- 2.2.5 Distribution Channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising consumer demand for clean label & natural ingredients

- 3.2.1.2 Growing awareness of collagen benefits for skin, joint & bone health

- 3.2.1.3 Increasing preference for fish-derived collagen

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Standardization of bioactive peptide compositions

- 3.2.2.2 Variability in raw material quality & collagen content

- 3.2.3 Market opportunities

- 3.2.3.1 Development of species-specific premium products

- 3.2.3.2 Molecular weight-optimized peptides for targeted applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 Product type

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Raw Material Source, 2022 - 2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Skin

- 5.3 Bones

- 5.4 Scales

- 5.5 Fins

Chapter 6 Market Estimates and Forecast, By Molecular Weight, 2022 - 2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Ultra-low molecular weight (<1 kDa)

- 6.3 Low molecular weight (1-3 kDa)

- 6.4 Medium molecular weight (3-5 kDa)

- 6.5 High molecular weight (5-10 kDa)

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Application, 2022 - 2035 (USD million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & Beverage

- 7.3 Nutraceuticals

- 7.3.1 Dietary supplements

- 7.3.2 Functional Food

- 7.4 Cosmetics

- 7.4.1 Skincare

- 7.4.2 Haircare

- 7.4.3 Injectables

- 7.5 Pharmaceuticals

- 7.5.1 Musculoskeletal

- 7.5.2 Endocrine supplements

- 7.5.3 Cardiovascular diseases

- 7.5.4 Others

- 7.6 Animal Nutrition

- 7.6.1 Poultry

- 7.6.2 Pork/Swine

- 7.6.3 Cattle

- 7.6.4 Pets

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Online Retail / E-commerce

- 8.3 Pharmacies & Drug Stores

- 8.4 Supermarkets / Hypermarkets

- 8.5 Specialty stores

- 8.6 Direct-to-Consumer (DTC)

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 (USD million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Rousselot

- 10.2 Nitta Gelatin, Inc.

- 10.3 Gelita AG

- 10.4 Athos Collagen Pvt Ltd

- 10.5 Titan Biotech Limited

- 10.6 Atom pharma

- 10.7 Collagen Lifesciences

- 10.8 Haihang Industry Co. Ltd

- 10.9 Amar Aquatic

- 10.10 Acmefil Engineering Systems Pvt Ltd