PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928889

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928889

Nuclear Robots Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

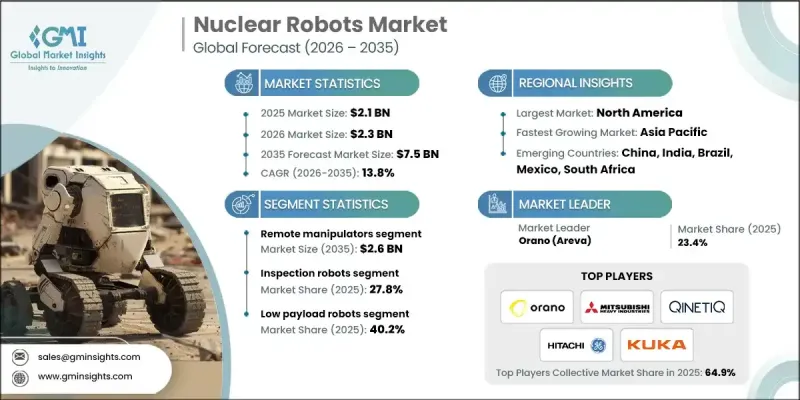

The Global Nuclear Robots Market was valued at USD 2.1 billion in 2025 and is estimated to grow at a CAGR of 13.8% to reach USD 7.5 billion by 2035.

Market growth is driven by the rising number of aging nuclear facilities worldwide, particularly in Europe and North America, where reactors and fuel cycle plants are exceeding their operational lifespans. Decommissioning these facilities involves working in highly radioactive and hazardous environments, which makes remote handling, inspection, and waste management critical for worker safety and regulatory compliance. Government funding and public sector investment in nuclear safety and modernization programs are further propelling demand for advanced robotics. Nuclear robots are specifically engineered for inspection, maintenance, deconstruction, and radioactive waste management, offering enhanced accuracy, operational efficiency, and minimized human exposure. The integration of artificial intelligence and autonomous technologies allows these machines to operate independently in challenging radioactive environments, reducing the need for expert personnel while increasing performance and safety. Decommissioning and site remediation programs continue to drive steady demand for these advanced solutions.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.1 Billion |

| Forecast Value | $7.5 Billion |

| CAGR | 13.8% |

The remote manipulators segment is projected to reach USD 2.6 billion by 2035. Remote manipulators are widely adopted in radiation-heavy zones due to their capability to assemble, maintain, and handle nuclear components safely. Innovations in haptic feedback and intuitive control interfaces have improved operator precision while keeping exposure risks low.

The inspection robots segment accounted for 27.8% share in 2025. These robots are evolving with AI-powered navigation and sensor-based anomaly detection, enabling autonomous inspection of reactors, pipelines, and storage facilities. They reduce manual labor, operational downtime, and radiation exposure for personnel while ensuring continuous monitoring.

North America Nuclear Robots Market held a 38.9% share in 2025. Growth in the region is driven by extensive nuclear infrastructure, large-scale decommissioning activities, and strong regulatory policies emphasizing safety and automation. Increasing adoption of AI-driven inspection, maintenance, and waste management robots, combined with government-funded R&D initiatives, is bolstering market expansion.

Leading players in the Global Nuclear Robots Market include Hitachi-GE Nuclear Energy, Ltd., KUKA AG, ABB Ltd., Honeybee Robotics, Ltd., Boston Dynamics, Inc., Inuktun Services Ltd., Babcock International Group plc, QinetiQ Group plc, Orano, Framatome, Westinghouse Electric Company LLC, Nuvia Group, Amentum Services, Inc., GE Inspection Robotics, Mitsubishi Heavy Industries, Ltd., Veolia Environnement S.A., Oceaneering International, Inc., Cybernetix (TechnipFMC), James Fisher & Sons plc, and Mirion Technologies, Inc. Companies in the Global Nuclear Robots Market are strengthening their positions through continuous R&D investments to develop autonomous, AI-enabled systems capable of operating in extreme radiation environments. They are forming strategic partnerships with nuclear operators and government agencies to expand adoption. Geographic expansion into regions with aging nuclear infrastructure and decommissioning requirements is another key strategy.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Type trends

- 2.2.2 Robot type trends

- 2.2.3 Payload capacity trends

- 2.2.4 End-use industry trends

- 2.2.5 Regional trends

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increased focus on accident prevention and emergency response preparedness

- 3.2.1.2 Increasing decommissioning of aging nuclear facilities

- 3.2.1.3 Labor shortages and skill gaps in nuclear operations

- 3.2.1.4 Government funding and public sector investment in nuclear safety infrastructure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital and lifecycle costs

- 3.2.2.2 Limited standardization and interoperability across nuclear sites

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of robotics-as-a-service models for decommissioning projects

- 3.2.3.2 Development of modular, reconfigurable robots for multi-site applicability

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Patent and IP analysis

- 3.11 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Type, 2022 - 2035 ($ Mn & Units)

- 5.1 Key trends

- 5.2 Remote manipulators

- 5.3 Crawlers

- 5.4 Aerial drones

- 5.5 Underwater robots (ROVs)

- 5.6 Humanoid robots

Chapter 6 Market Estimates and Forecast, By Robot Type, 2022 - 2035 ($ Mn & Units)

- 6.1 Key trends

- 6.2 Inspection robots

- 6.3 Decontamination robots

- 6.4 Maintenance & repair robots

- 6.5 Waste handling robots

- 6.6 Emergency response robots

Chapter 7 Market Estimates and Forecast, By Payload Capacity, 2022 - 2035 ($ Mn & Units)

- 7.1 Key trends

- 7.2 Low payload robots

- 7.3 Medium payload robots

- 7.4 High payload robots

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2022 - 2035 ($ Mn & Units)

- 8.1 Key trends

- 8.2 Nuclear waste handling

- 8.3 Nuclear decommissioning

- 8.4 Radiation cleanup

- 8.5 Nuclear power plants

- 8.6 Research & exploration

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Key Players

- 10.1.1 Orano

- 10.1.2 Mitsubishi Heavy Industries

- 10.1.3 Hitachi-GE Nuclear Energy

- 10.1.4 Westinghouse Electric Company

- 10.2 Regional Key Players

- 10.2.1 North America

- 10.2.1.1 Amentum Services

- 10.2.1.2 Mirion Technologies

- 10.2.1.3 GE Inspection Robotics

- 10.2.2 Europe

- 10.2.2.1 QinetiQ Group

- 10.2.2.2 Framatome

- 10.2.2.3 Babcock International Group

- 10.2.3 APAC

- 10.2.3.1 KUKA AG

- 10.2.3.2 ABB

- 10.2.3.3 Cybernetix (TechnipFMC)

- 10.2.1 North America

- 10.3 Niche Players / Disruptors

- 10.3.1 Boston Dynamics

- 10.3.2 James Fisher & Sons

- 10.3.3 Veolia Environnement

- 10.3.4 Nuvia Group

- 10.3.5 Oceaneering International

- 10.3.6 Honeybee Robotics

- 10.3.7 Inuktun Services