PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750524

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750524

High Temperature Industrial Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

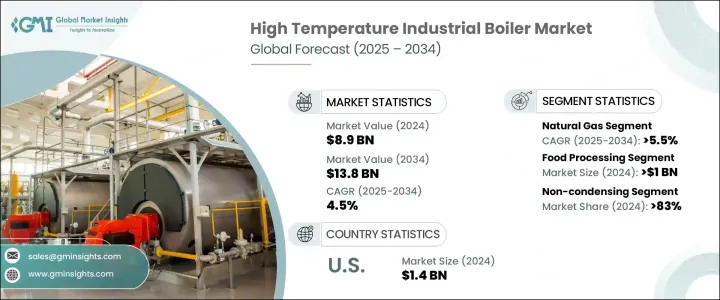

The Global High Temperature Industrial Boiler Market was valued at USD 8.9 billion in 2024 and is estimated to grow at a CAGR of 4.5% to reach USD 13.8 billion by 2034, driven by the surge in industrial production with rapid urban expansion across developing nations. As countries implement stricter regulations to boost energy efficiency, demand for advanced boiler technologies is expected to grow significantly. Rising population levels influence consumption patterns, particularly for heating solutions in commercial and industrial spaces. With infrastructure development gaining momentum and renewable energy integration becoming more widespread, industries are under increased pressure to adopt greener, low-emission technologies. These trends are expected to fuel demand for sustainable high-temperature boiler systems.

The industry is also being shaped by growing investments in modern manufacturing processes and eco-conscious policies at the global level. With emissions control becoming a priority, there's a growing preference for energy-efficient solutions that align with climate goals. The high temperature industrial boiler market is further benefiting from the increased use of integrated systems across sectors seeking to reduce operational costs and energy consumption. Energy security and the expanding availability of natural gas infrastructure continue to support the adoption of gas-powered high-temperature boilers. With industries demanding reliable high-temperature steam solutions, especially in heat-intensive environments, the business outlook remains strong. Trade policies and component pricing are additional factors shaping global competitiveness.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.9 Billion |

| Forecast Value | $13.8 Billion |

| CAGR | 4.5% |

Natural gas-fired high temperature boilers are projected to grow at a CAGR of 5.5% through 2034, as industries continue shifting toward cleaner energy sources. Increasing concerns around air quality, rising natural gas availability, and expanding supportive infrastructure make these systems more viable and cost-effective. Many governments and private entities are actively investing in gas-powered heating technologies to reduce dependence on coal and oil, which emit higher levels of greenhouse gases. The ability of natural gas boilers to deliver consistent high-temperature output while maintaining lower emission levels positions them as a preferred option across energy-intensive sectors such as manufacturing, processing, and chemicals.

Non-condensing high temperature boilers segment held an 83% share in 2024. These boilers are favored for their simple design, durability, and ability to perform in demanding environments. Industries with continuous heating needs rely heavily on non-condensing systems due to their high heat retention and quick response time. Despite growing environmental regulations, these boilers remain popular where infrastructure or cost considerations prevent a shift to condensing or hybrid models. However, to meet changing efficiency standards, manufacturers are enhancing non-condensing models with better control systems and advanced combustion technologies.

United States High Temperature Industrial Boiler Market reached USD 1.4 billion in 2024, reflecting strong domestic demand. A major portion of this growth is attributed to replacing aging and inefficient boiler systems in older industrial facilities. As new regulations on energy consumption and emissions become more stringent, industries modernize their operations. Federal and state-level incentives are encouraging this shift by offering support for the adoption of cleaner, high-efficiency equipment. The increased focus on sustainability, coupled with economic investments in energy infrastructure, is driving the need for technologically advanced boilers that align with future-ready energy policies.

Leading companies contributing to the market landscape include Siemens, Thermax, Mitsubishi Heavy Industries, Hurst Boiler and Welding, Babcock and Wilcox Enterprises, Sofinter, Forbes Marshall, GE Vernova, Victory Energy Operations, Cleaver-Brooks, Viessmann, Clayton Industries, Cochran, Doosan Heavy Industries & Construction, FONDITAL, Bharat Heavy Electricals, FERROLI, Hoval, John Wood Group, Groupe Atlantic, IHI Corporation, Walchandnagar Industries, John Cockerill, Miura America, The Fulton Companies, Robert Bosch, Fonderie Sime, and Rentech Boilers. To reinforce their position in the market, major players are focusing on innovation, sustainability, and strategic alliances. Companies invest in R&D to develop compact, energy-efficient boilers that meet stringent emissions standards. Partnerships with governments and other industrial firms help expand operational reach and streamline supply chains. Many enhance digital control systems to optimize boiler performance and minimize downtime, while expanding aftermarket services to build long-term client relationships.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for automatic bench-top dental autoclaves

- 3.2.1.2 Growing focus on infection control

- 3.2.1.3 Technological advancement in autoclave

- 3.2.1.4 Rising prevalence of dental disorders

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adoption of refurbished dental autoclaves

- 3.2.2.2 Limited awareness in developing economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technological landscape

- 3.5 Regulatory landscape

- 3.6 Trump administration tariffs

- 3.6.1 Impact on trade

- 3.6.1.1 Trade volume disruptions

- 3.6.1.2 Country-wise response

- 3.6.2 Impact on the industry

- 3.6.2.1 Supply-side impact (Cost of manufacturing)

- 3.6.2.1.1 Price volatility in key materials

- 3.6.2.1.2 Supply chain restructuring

- 3.6.2.1.3 Production cost implications

- 3.6.2.2 Demand-side impact (Cost to consumers)

- 3.6.2.2.1 Price transmission to end markets

- 3.6.2.2.2 Market share dynamics

- 3.6.2.2.3 Consumer response patterns

- 3.6.2.1 Supply-side impact (Cost of manufacturing)

- 3.6.3 Key companies impacted

- 3.6.4 Strategic industry responses

- 3.6.4.1 Supply chain reconfiguration

- 3.6.4.2 Pricing and product strategies

- 3.6.4.3 Policy engagement

- 3.6.5 Outlook and future considerations

- 3.6.1 Impact on trade

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Automatic

- 5.3 Semi-automatic

- 5.4 Manual

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pre and post vacuum

- 6.3 Gravity

Chapter 7 Market Estimates and Forecast, By Class, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Class B

- 7.3 Class N

- 7.4 Class S

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and dental clinics

- 8.3 Dental laboratories

- 8.4 Academic and research institutes

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Biolab Scientific

- 10.2 Bionics Scientific

- 10.3 Dentsply Sirona

- 10.4 Flight Dental Systems

- 10.5 FONA

- 10.6 Labocon

- 10.7 Life Steriware

- 10.8 Matachana

- 10.9 Midmark Corporation

- 10.10 NSK

- 10.11 RAYPA

- 10.12 Steelco

- 10.13 Thermo Fisher Scientific

- 10.14 Tuttnauer

- 10.15 W&H