PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766346

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766346

Electronic Recloser Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

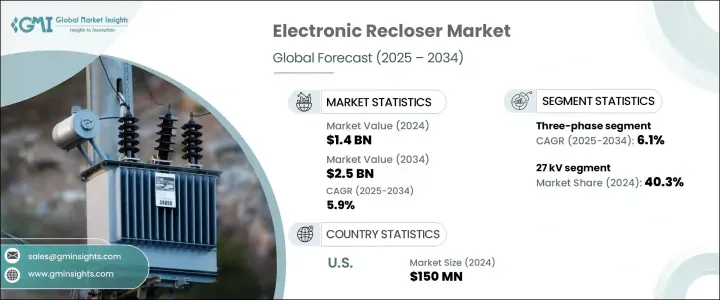

The Global Electronic Recloser Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 2.5 billion by 2034. This growth is driven by the need to modernize aging grid infrastructure, enhance power distribution efficiency, and integrate renewable energy sources. Electronic reclosers play a crucial role in smart grids by enabling automated fault detection and restoration, thereby reducing downtime and improving system reliability. Technological advancements have led to the development of reclosers with enhanced sensors, communication capabilities, and integration with Internet of Things (IoT) platforms, further boosting their adoption.

Additionally, the rising demand for dependable and intelligent grid systems, alongside favorable government incentives and large-scale investments in electrical infrastructure modernization, continues to fuel growth in the electronic recloser market. As utilities and grid operators shift toward automation and smarter energy management, electronic reclosers are being integrated to support rapid fault detection, minimize power interruptions, and enhance overall system resilience. Their role becomes even more critical with the growing deployment of distributed energy resources and renewable energy integration, where real-time grid responsiveness is essential for maintaining stability and service continuity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.5 Billion |

| CAGR | 5.9% |

The three-phase segment is anticipated to grow at a CAGR of 6.1% through 2034, reflecting installations in high-load and mission-critical distribution networks. These reclosers provide comprehensive protection across all three phases of power, making them well-suited for heavy-duty applications in large-scale commercial and industrial facilities. Their ability to isolate faults and automatically restore power without manual intervention makes them indispensable in high-capacity grids where downtime must be minimized.

In 2024, the 15kV segment reached a market valuation of USD 535.5 million. This voltage class is widely deployed in medium-voltage systems and serves as a standard specification for both urban and rural distribution networks. Its popularity stems from its ability to deliver cost-effective and reliable fault management in residential zones, light industrial parks, and utility substations, enabling utilities to maintain uninterrupted service in diverse operating conditions.

United States Electronic Recloser Market was valued at USD 150 million in 2024, reflecting consistent growth over the previous years. This upward trend is largely driven by the nation's focus on replacing aging power infrastructure and deploying advanced grid technologies. Upgrades to outdated systems are essential for addressing current energy demands, ensuring grid stability, and achieving future sustainability goals. Additionally, compliance with strict performance and reliability standards set by regulatory bodies has increased the adoption of next-generation reclosers, which offer advanced diagnostics, remote operation capabilities, and seamless grid integration.

Key players operating in the Global Electronic Recloser Market include ABB, Arteche, Eaton, Ensto, Entec Electric & Electronic, G&W Electric, Hubbell, Hughes Power System, NOJA Power Switchgear Pty Ltd, Rockwell, S&C Electric Company, Schneider Electric, Shinsung Industrial Electric, Siemens, and Tavrida Electric. These companies are focusing on product innovation, strategic partnerships, and expanding their market presence to strengthen their positions in the competitive landscape. To strengthen their market presence, companies in the electronic recloser industry are adopting several key strategies. They are investing in research and development to innovate and improve product offerings, ensuring they meet the evolving needs of modern power distribution systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic initiative

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Phase, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Single phase

- 5.3 Three phase

Chapter 6 Market Size and Forecast, By Interruption, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Oil

- 6.3 Vacuum

Chapter 7 Market Size and Forecast, By Voltage Rating, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 15 kV

- 7.3 27 kV

- 7.4 38 kV

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Russia

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Chile

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 ARTECHE

- 9.3 Eaton

- 9.4 ENSTO

- 9.5 ENTEC Electric & Electronic

- 9.6 G&W Electric

- 9.7 Hubbell

- 9.8 Hughes Power System

- 9.9 NOJA Power Switchgear Pty Ltd

- 9.10 Rockwill

- 9.11 S&C Electric Company

- 9.12 Schneider Electric

- 9.13 Shinsung Industrial Electric

- 9.14 Siemens

- 9.15 Tavrida Electric