PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876795

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876795

Connected Trucks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

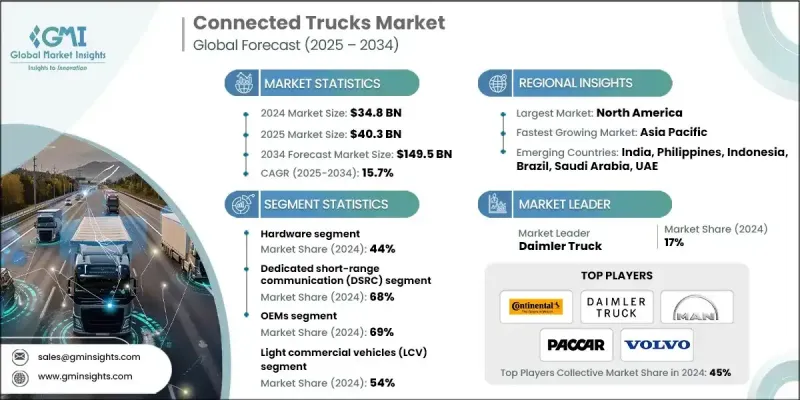

The Global Connected Trucks Market was valued at USD 34.8 billion in 2024 and is estimated to grow at a CAGR of 15.7% to reach USD 149.5 billion by 2034.

The growing demand for connected truck technologies is reshaping logistics and long-haul transportation networks worldwide. Advanced telematics, predictive fleet analytics, and in-cabin connectivity are transforming the way operators monitor routes, forecast delivery times, optimize loads, and minimize idle or empty trips. The use of digital-twin simulations enables fleet managers and OEMs to test operational models virtually, leading to cost reduction, enhanced safety, and improved delivery reliability. As the industry transitions toward electric and low-emission fleets, connected truck platforms are being utilized to manage energy distribution, schedule charging, and optimize range efficiency. Integration of smart charging and vehicle-to-grid communication systems ensures balanced energy usage and reduced grid strain. Furthermore, in mixed fleet operations, connected systems enable dynamic load balancing and route optimization to preserve battery life. The rapid integration of advanced driver assistance technologies such as automated braking, lane keeping, and truck platooning further underscores the importance of reliable, low-latency connectivity. OEMs and fleet operators are increasingly investing in sensor fusion and cloud analytics to turn real-time data into actionable safety and compliance insights.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $34.8 Billion |

| Forecast Value | $149.5 Billion |

| CAGR | 15.7% |

The hardware segment held a 44% share in 2024 and is projected to grow at a CAGR of 13.9% through 2034. Hardware continues to lead the market as it forms the essential framework that enables connectivity, communication, and telematics integration. Key components, including telematics control units (TCUs), GPS/GNSS devices, sensors, and wireless communication modules, serve as the backbone for collecting and transmitting real-time operational data. These systems support seamless interaction between vehicles, cloud platforms, and fleet management networks, forming the physical layer that powers digital transport ecosystems.

The dedicated short-range communication (DSRC) segment accounted for a 68% share in 2024 and is projected to grow at a CAGR of 15.1% from 2025 to 2034. DSRC technology remains the preferred communication method for connected trucks due to its robust performance and low latency, which are crucial for real-time vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication. This enables instantaneous data exchange for applications that enhance safety, such as collision detection, lane-changing alerts, and emergency response systems. Its proven reliability and regulatory alignment continue to strengthen its adoption in modern trucking operations.

United States Connected Trucks Market held an 85% share, generating USD 12.3 billion in 2024. The U.S. market benefits from early adoption of advanced connectivity systems, extensive telematics infrastructure, and strong participation from global truck manufacturers. OEMs have integrated factory-installed digital connectivity platforms that support real-time monitoring, remote diagnostics, and performance optimization, driving rapid market penetration. Additionally, growing demand for fleet efficiency, stringent safety regulations, and the presence of major telematics providers are accelerating technology deployment across regional fleets.

Key companies operating in the Global Connected Trucks Market include Trimble, Continental, Daimler Truck, BYD Company, Tata Motors, PACCAR, MAN Truck & Bus, Scania, Geotab, and Volvo. Leading players in the Connected Trucks Market are implementing multiple strategies to strengthen their market presence. Many are focusing on developing advanced connectivity ecosystems combining hardware, software, and telematics to deliver integrated fleet intelligence. Strategic collaborations with logistics providers and OEMs are being pursued to expand product portfolios and ensure large-scale deployment. Companies are also investing heavily in AI and data-driven analytics to enhance predictive maintenance, driver safety, and energy optimization.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Technology

- 2.2.4 Range

- 2.2.5 Vehicle

- 2.2.6 Application

- 2.2.7 Sales Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for fleet management efficiency

- 3.2.1.2 Integration of 5G and IoT technologies

- 3.2.1.3 Government regulations on safety and emissions

- 3.2.1.4 Increasing adoption of cloud-based telematics platforms

- 3.2.1.5 Growing demand for predictive maintenance

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial implementation and maintenance costs

- 3.2.2.2 Concerns over data security and privacy

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of autonomous and semi-autonomous trucks

- 3.2.3.2 Emergence of edge computing for real-time analytics

- 3.2.3.3 Increasing electrification of commercial vehicles

- 3.2.3.4 Rising adoption in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import

- 3.11 Cost breakdown analysis

- 3.12 Sustainability and environmental impact analysis

- 3.12.1 Lifecycle assessment and environmental modeling

- 3.12.2 Sustainable design and optimization

- 3.12.3 Environmental compliance and reporting

- 3.12.4 Green technology and innovation

- 3.13 Business Case & ROI Analysis

- 3.13.1 Total cost of ownership framework

- 3.13.2 ROI calculation methodologies

- 3.13.3 Implementation timeline & milestones

- 3.13.4 Risk assessment & mitigation strategies

- 3.14 Performance Benchmarking & KPIs

- 3.14.1 Operational efficiency metrics

- 3.14.2 Safety & compliance indicators

- 3.14.3 Financial performance benchmarks

- 3.14.4 Driver performance scoring systems

- 3.15 Industry Standards & Protocols

- 3.15.1 SAE J1939 communication standards

- 3.15.2 TMC recommended practices

- 3.15.3 Interoperability & data exchange protocols

- 3.15.4 Cybersecurity & functional safety standards

- 3.16 Implementation Best Practices

- 3.16.1 Deployment strategies & methodologies

- 3.16.2 Change management & driver training

- 3.16.3 Data integration & analytics setup

- 3.16.4 Maintenance & support optimization

- 3.17 Vendor Selection & Evaluation Framework

- 3.17.1 Technology evaluation criteria

- 3.17.2 Integration capability assessment

- 3.17.3 Scalability & future-proofing considerations

- 3.17.4 Support & service level requirement

- 3.18 Future outlook & technology roadmap

- 3.18.1 Technology evolution timeline

- 3.18.2 Autonomous trucking integration

- 3.18.3 Electric truck connectivity

- 3.18.4 Data monetization strategies

- 3.18.5 Regulatory evolution impact

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Telematics control units (TCUS)

- 5.2.2 On-board diagnostics (OBD) devices

- 5.2.3 Communication modules (cellular, wi-fi, Bluetooth)

- 5.2.4 Sensors & data collection devices

- 5.2.5 GPS/GNSS positioning systems

- 5.2.6 Others

- 5.3 Software

- 5.3.1 Fleet management software platforms

- 5.3.2 Mobile applications & driver interfaces

- 5.3.3 Analytics & business intelligence tools

- 5.3.4 Integration & API management software

- 5.3.5 Cybersecurity & data protection software

- 5.3.6 Others

- 5.4 Services

- 5.4.1 Installation & integration services

- 5.4.2 Data analytics & consulting services

- 5.4.3 Maintenance & technical support

- 5.4.4 Training & change management services

- 5.4.5 Managed services & outsourcing

- 5.4.6 Others

Chapter 6 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Vehicle-to-Infrastructure (V2I) Communication

- 6.2.1 Traffic signal integration

- 6.2.2 Smart highway systems

- 6.2.3 Toll collection & payment systems

- 6.2.4 Weigh station communication

- 6.2.5 Parking & loading zone management

- 6.3 Vehicle-to-Cloud (V2C) Communication

- 6.3.1 Fleet management platforms

- 6.3.2 Remote diagnostics & monitoring

- 6.3.3 Over-the-air updates & configuration

- 6.3.4 Data analytics & business intelligence

- 6.3.5 Regulatory compliance reporting

- 6.4 Vehicle-to-Vehicle (V2V) Communication

- 6.4.1 Platooning & convoy operations

- 6.4.2 Collision avoidance systems

- 6.4.3 Traffic flow optimization

- 6.4.4 Emergency vehicle communication

- 6.4.5 Cooperative adaptive cruise control

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Range, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Dedicated short range communication (DSRC)

- 7.3 Long range

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Light Commercial Vehicles (LCV)

- 8.2.1 Class 1-2 vehicles

- 8.2.2 Pickup trucks & cargo vans

- 8.2.3 Small delivery vehicles

- 8.2.4 Service & utility vehicles

- 8.2.5 Urban last-mile applications

- 8.3 Medium Commercial Vehicles (MCV)

- 8.3.1 Class 3-5 vehicles

- 8.3.2 Box trucks & step vans

- 8.3.3 Food service & beverage trucks

- 8.3.4 Utility & municipal vehicles

- 8.3.5 Regional distribution applications

- 8.3.6 Refrigerated transport (reefer) units

- 8.4 Heavy Commercial Vehicles (HCV)

- 8.4.1 Class 6-8 vehicles

- 8.4.2 Long-haul tractors & semi-trailers

- 8.4.3 Heavy duty trucks & trailers

- 8.4.4 Construction & vocational vehicles

- 8.4.5 Specialized heavy equipment

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Fleet management

- 9.3 Safety & compliance

- 9.4 Remote diagnostics & maintenance

- 9.5 Infotainment & connectivity

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 OEMs

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Philippines

- 11.4.7 Indonesia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 BYD Company

- 12.1.2 Daimler Truck

- 12.1.3 Iveco

- 12.1.4 MAN Truck & Bus

- 12.1.5 Navistar International

- 12.1.6 PACCAR

- 12.1.7 Scania

- 12.1.8 Tata Motors

- 12.1.9 Tesla

- 12.1.10 Volvo

- 12.2 Telematics Providers

- 12.2.1 Fleet Complete

- 12.2.2 Geotab

- 12.2.3 MiX Telematics

- 12.2.4 Omnitracs

- 12.2.5 Platform Science

- 12.2.6 Samsara Networks

- 12.2.7 Teletrac Navman

- 12.2.8 Trimble

- 12.2.9 Verizon Connect

- 12.2.10 Zonar Systems

- 12.3 ADAS & Component Suppliers

- 12.3.1 Aptiv

- 12.3.2 Autoliv

- 12.3.3 Continental

- 12.3.4 DENSO

- 12.3.5 Knorr-Bremse

- 12.3.6 Magna International

- 12.3.7 Mobileye

- 12.3.8 Robert Bosch

- 12.3.9 Valeo

- 12.3.10 ZF Friedrichshafen

- 12.4 Connectivity & Hardware

- 12.4.1 HARMAN International

- 12.4.2 Murata Manufacturing

- 12.4.3 NXP Semiconductors

- 12.4.4 Qualcomm Technologies

- 12.4.5 Sierra Wireless

- 12.4.6 TE Connectivity