PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773271

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773271

Residential Micro Inverter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

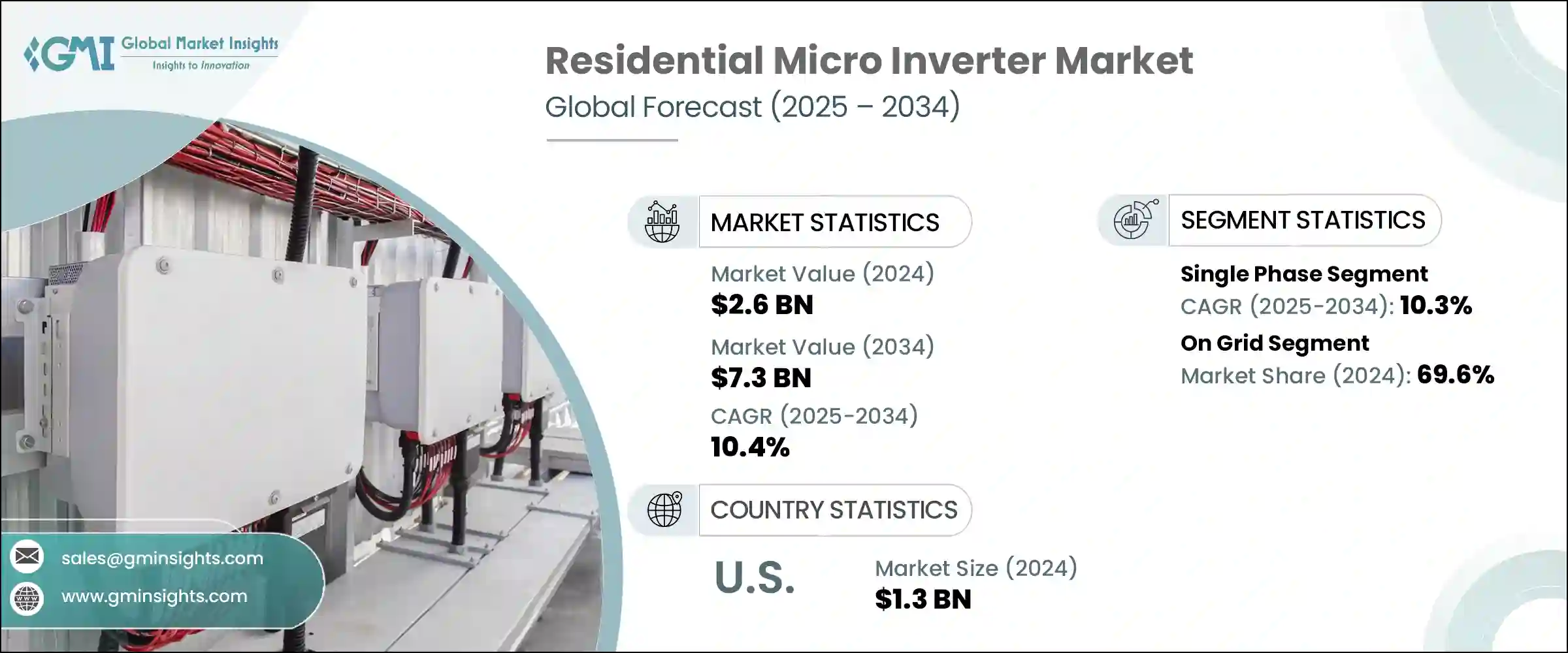

The Global Residential Micro Inverter Market was valued at USD 2.6 billion in 2024 and is estimated to grow at a CAGR of 10.4% to reach USD 7.3 billion by 2034. Rising interest in energy self-reliance and greater control over household electricity consumption is driving the adoption of residential microinverter solutions. As electricity costs continue to rise and utility grids face growing instability, more homeowners are investing in reliable solar rooftop systems. Microinverters are favored for their ability to deliver consistent performance and maintain system integrity during fluctuations. Government-backed incentive programs and improved access to financing for home solar installations are also encouraging adoption, especially in markets where policy support boosts distributed energy resources like PV modules and microinverters.

Growing demand for compact, modular solar installations is supporting the residential deployment of microinverter systems. These devices allow homeowners to track each panel's output while eliminating the vulnerability of a centralized system. Increasing emphasis on energy autonomy and regulatory alignment around safety is reinforcing market expansion. Adoption is accelerating in emerging economies where residential rooftop installations are rising in response to national solar targets. As these trends persist, microinverters are emerging as a critical technology to ensure long-term performance, flexibility, and system resilience.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $7.3 Billion |

| CAGR | 10.4% |

Single phase microinverter systems segment is predicted to grow at a CAGR of 10.3% through 2034. These solutions offer performance optimization at the individual panel level and are being enhanced through continuous innovation and cost-efficiency improvements. Consumer interest in pairing these systems with home battery storage and smart energy solutions is fueling their expansion in residential applications. Advancements in intelligent energy management features and remote monitoring capabilities are expected to push growth further.

The standalone residential systems segment is poised to grow at a 14.1% CAGR between 2025 and 2034, supported by the growing preference for off-grid energy solutions in remote regions. Homeowners looking for energy independence, especially in areas with unreliable grid access, are opting for microinverters integrated with battery storage. These systems enable homes to operate autonomously and provide backup during grid outages, improving energy security and appeal.

Asia Pacific Residential Micro Inverter Market will reach USD 900 million by 2034, driven by greater demand for smart, module-level energy management in residential PV setups. Continued development of smart grid systems and electrification of underserved regions is also propelling deployment. Greater public awareness about the benefits of self-sufficient energy use and the ability to optimize overall system output are enhancing market opportunities across the region.

Key players operating across this industry landscape include Sensata Technologies, Hoymiles, Envertech (Zhejiang Envertech), SMA Solar Technology, Chisageess, Sparq Systems, Fimer Group, Yotta Energy, Altenergy Power Systems, Lead Solar Energy, NingBo Deye Inverter Technology, TSUNESS, Enphase Energy, Growatt New Energy, Chilicon Power, and Darfon Electronics. To solidify their market presence, leading residential micro inverter companies are prioritizing technology differentiation through continuous R&D in smart grid compatibility, panel-level performance optimization, and integrated storage solutions. Firms are expanding their product lines to cater to a wider range of rooftop configurations and energy demands. Strategic alliances with solar panel manufacturers, distributors, and utility providers improve market access and brand positioning.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiative

- 4.4 Company market share

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Phase, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 Single phase

- 5.3 Triple phase

Chapter 6 Market Size and Forecast, By Connectivity, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Standalone

- 6.3 On grid

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 Italy

- 7.3.3 Poland

- 7.3.4 Netherlands

- 7.3.5 Austria

- 7.3.6 UK

- 7.3.7 France

- 7.3.8 Spain

- 7.3.9 Belgium

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Israel

- 7.5.2 Saudi Arabia

- 7.5.3 UAE

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.5.6 Nigeria

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Chile

- 7.6.3 Mexico

Chapter 8 Company Profiles

- 8.1 Altenergy Power Systems

- 8.2 Chilicon Power

- 8.3 Chisageess

- 8.4 Darfon Electronics

- 8.5 Enphase Energy

- 8.6 Envertech (Zhejiang Envertech)

- 8.7 Fimer Group

- 8.8 Growatt New Energy

- 8.9 Hoymiles

- 8.10 Lead Solar Energy

- 8.11 NingBo Deye Inverter Technology

- 8.12 Sensata Technologies

- 8.13 SMA Solar Technology

- 8.14 Sparq Systems

- 8.15 TSUNESS

- 8.16 Yotta Energy