PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858965

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858965

Robotic Lawn Mower Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

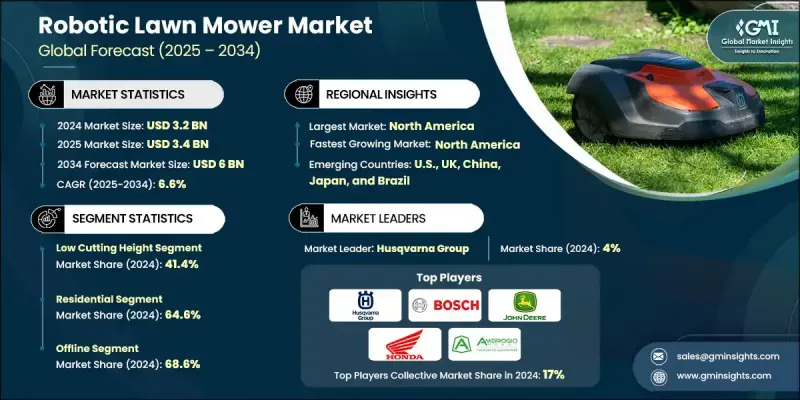

The Global Robotic Lawn Mower Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 6 billion by 2034.

As automation and eco-consciousness gain traction, consumers are increasingly gravitating toward robotic lawn mowers as a smart, hands-free alternative to traditional lawn maintenance. These mowers offer a blend of convenience, energy efficiency, and low environmental impact, making them a key part of the evolving outdoor power equipment landscape. Advancements in artificial intelligence, improved battery life, and seamless integration with smart home ecosystems continue to propel adoption. Manufacturers are heavily focused on enhancing device safety, operational time, and usability while investing in sustainable design practices. Additionally, digital platforms are helping brands deliver added value to customers through product education, remote diagnostics, and service assistance. By leveraging online engagement and brand storytelling, many companies are carving out strong identities and gaining competitive ground in an increasingly saturated market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $6 Billion |

| CAGR | 6.6% |

The low cutting height segment held a 41.4% share and is expected to grow at a 6.8% CAGR through 2034. This dominance is linked to consumer preferences for precisely cut lawns that align with modern landscaping aesthetics. Most robotic mowers are optimized for shorter grass, giving this segment an edge in versatility and performance. Users favor low-height trimming for a cleaner appearance in both residential gardens and small commercial properties, making this configuration the most practical and widely adopted option.

The residential segment held a 64.6% share in 2024 and is projected to grow at a CAGR of 6.8% from 2025 to 2034. Rising homeowner interest in low-maintenance and automated lawn care solutions continues to drive growth. Increased comfort with smart home devices, paired with higher disposable incomes, is encouraging more households to invest in robotic mowers. These consumers prioritize convenience, aesthetic results, and reduced time spent on upkeep, fueling residential market demand far beyond that of commercial applications, which typically involve more variables and complexity.

U.S. Robotic Lawn Mower Market held 87.4% share in 2024, with projected revenues reaching USD 2.1 billion by 2034. The dominance stems from widespread awareness of robotic solutions and a strong inclination toward smart technologies in household maintenance. Broad retail availability and infrastructure support nationwide product distribution. The combination of tech-savvy consumers, early adoption of battery-powered tools, and significant numbers of homeowners with medium to large lawns contributes to the market's momentum. In addition, U.S.-based innovation continues to push the boundaries in terms of performance, sustainability, and smart integration.

Key players in the Global Robotic Lawn Mower Market include Traqnology, Mammotion, Echo Robotics, Robomow, Ambrogio, Kress Robotics, Robert Bosch, Ecoflow, Worx Landroid, Honda Motor Company, Gardena, Husqvarna Group, Yarbo, John Deere, Dreame, and Nextmow. To strengthen their foothold, companies in the robotic lawn mower market are focusing on AI-driven navigation, quieter operation, and energy-efficient design. Several brands are expanding their product lines to cater to varied lawn sizes and terrains, targeting both budget-conscious and premium buyers. Advanced safety sensors, mobile app connectivity, and modular parts for easier maintenance are now common features. Firms are also pushing for regional expansion by forming dealer networks and offering after-sales services. Competitive pricing, along with brand-specific design elements and eco-friendly manufacturing processes, remains central to market positioning efforts.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Cutting height

- 2.2.4 Lawn size

- 2.2.5 Battery capacity

- 2.2.6 Price

- 2.2.7 End Use

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for smart home automation

- 3.2.1.2 Growing labor costs and aging population

- 3.2.1.3 Rising awareness about sustainable landscaping

- 3.2.1.4 Technological advancements (AI, sensors, GPS)

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment cost

- 3.2.2.2 Limited effectiveness on uneven or complex terrains

- 3.2.2.3 Battery limitations and maintenance requirements

- 3.2.3 Opportunities

- 3.2.3.1 Integration with IoT and smart assistants

- 3.2.3.2 Expansion into commercial and municipal landscaping

- 3.2.3.3 Subscription-based models and leasing options

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory framework

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behaviour analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behaviour

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Fully autonomous

- 5.3 Semi-autonomous

Chapter 6 Market Estimates & Forecast, By Cutting Height, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Low (0.5 inch to 1 inch)

- 6.3 Medium (1 inch to 1.5 inch)

- 6.4 High (1.5 inches to 2 inches)

Chapter 7 Market Estimates & Forecast, By Lawn Size, 2021-2034 (USD Billion) (Units)

- 7.1 Key trends

- 7.2 Small lawns (up to 0.25 acres)

- 7.3 Medium lawns (0.25 - 0.5 acres)

- 7.4 Large lawns (0.5 acres and above)

Chapter 8 Market Estimates & Forecast, By Battery Capacity, 2021-2034 (USD Billion) (Units)

- 8.1 Key trends

- 8.2 Up to 20V

- 8.3 20V to 30V

- 8.4 Above 30V

Chapter 9 Market Estimates & Forecast, By Price, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Low

- 9.3 Medium

- 9.4 High

Chapter 10 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Residential

- 10.3 Commercial

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Online

- 11.2.1 Company websites

- 11.2.2 E-commerce

- 11.3 Offline

- 11.3.1 Specialty stores

- 11.3.2 Hypermarket/Supermarket

- 11.3.3 Others

Chapter 12 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Ambrogio

- 13.2 Dreame

- 13.3 Echo Robotics

- 13.4 Ecoflow

- 13.5 Gardena

- 13.6 Honda Motor Company

- 13.7 Husqvarna Group

- 13.8 John Deere

- 13.9 Kress Robotics

- 13.10 Mammotion

- 13.11 Robert Bosch

- 13.12 Robomow

- 13.13 Traqnology

- 13.14 Worx Landroid

- 13.15 Yarbo