PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716635

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716635

Cordless Power Tools Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

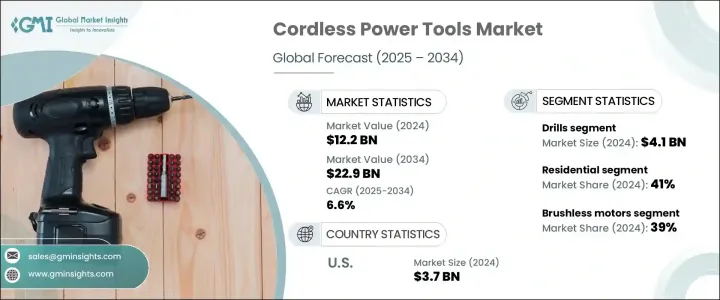

The Global Cordless Power Tools Market was valued at USD 12.2 billion in 2024 and is projected to expand at a CAGR of 6.6% from 2025 to 2034. The growth is fueled by rapid advancements in battery technologies, growing interest in DIY home projects, and rising construction and industrial activities worldwide. The growing demand for portable, easy-to-use, and efficient tools has transformed the power tools industry, making cordless power tools an essential part of both professional and personal toolkits. The increasing shift from corded to cordless variants is largely driven by the convenience, flexibility, and performance offered by modern cordless tools, allowing users to work more efficiently without worrying about power outlets or tangled cords.

With urbanization and industrialization accelerating globally, especially in emerging economies, construction, and infrastructure development are surging, further supporting market growth. In addition, the rising popularity of smart and connected tools with advanced features is appealing to both residential and professional users, as consumers are increasingly seeking tools that offer higher productivity, better ergonomics, and added safety features. Growing concerns around environmental sustainability and the need for energy-efficient solutions are also prompting manufacturers to adopt eco-friendly materials and technologies in cordless tool production.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.2 Billion |

| Forecast Value | $22.9 Billion |

| CAGR | 6.6% |

Lithium-ion batteries have emerged as the dominant power source for most cordless tools, enabling longer operating times, faster charging, and superior efficiency compared to traditional alternatives. These batteries are known for their low self-discharge rates, allowing them to hold a charge longer during inactivity. Unlike nickel-cadmium or other older battery types, lithium-ion batteries do not contain harmful cadmium, making them a safer and more environmentally responsible option. The integration of advanced lithium-ion battery technologies is driving significant improvements in the performance, durability, and sustainability of cordless tools, thus attracting a broader user base ranging from professionals in construction to casual DIY enthusiasts.

Cordless power tools encompass a wide range of equipment, including drills, saws, lawnmowers, impact wrenches, sanders, grinders, and more. Among these, the drills segment generated USD 4.1 billion in 2024, backed by strong demand from both commercial and residential users. As innovation evolves, cordless drills are getting smarter with built-in Bluetooth connectivity and app-based controls, allowing users to track tool usage, monitor performance, and even locate lost tools. This level of intelligence and integration is reshaping how users interact with their tools, delivering enhanced convenience and efficiency.

The market is segmented by end users into residential, commercial, and industrial categories, with the residential segment accounting for a 41% share in 2024, driven by rising home improvement and DIY trends. As residential and commercial construction projects continue to grow, so does the need for multi-functional and high-performing cordless tools. The U.S. Cordless Power Tools Market generated USD 3.7 billion in 2024, supported by advanced tool technologies, growing consumer spending on home upgrades, and surging DIY activities. Enhanced battery life, rapid charging, and ergonomic designs are making cordless tools a preferred choice for users across industries.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Technological landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Advancement in battery technological

- 3.6.1.2 Increased demand in DIY and home improvement

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial costs

- 3.6.2.2 Fluctuations in raw material prices

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Tool Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Drills

- 5.3 Saws

- 5.4 Lawn mower

- 5.5 Impact wrench

- 5.6 Sander

- 5.7 Grinder

- 5.8 Others (nail guns, staplers etc.)

Chapter 6 Market Estimates & Forecast, By Motor Type, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Brushed motor

- 6.3 Brushless motor

Chapter 7 Market Estimates & Forecast, By Voltage, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 12V

- 7.3 18V

- 7.4 20V

- 7.5 40V

- 7.6 Above 40V

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Industrial

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Construction

- 9.3 Automotive

- 9.4 Aerospace

- 9.5 Energy

- 9.6 Electronics

- 9.7 DIY

- 9.8 Others (manufacturing etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Apex Tool

- 12.2 Dynabrade Power Tools

- 12.3 Festool

- 12.4 Hilti

- 12.5 Hitachi Koki

- 12.6 KEN Holding

- 12.7 Makita

- 12.8 Robert Bosch

- 12.9 Ryobi

- 12.10 Snap-on Tools Company

- 12.11 Stanley Black & Decker

- 12.12 Stihl

- 12.13 Techtronic

- 12.14 TTI Group

- 12.15 Yamabiko