PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892884

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892884

Portable Gas Detector Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

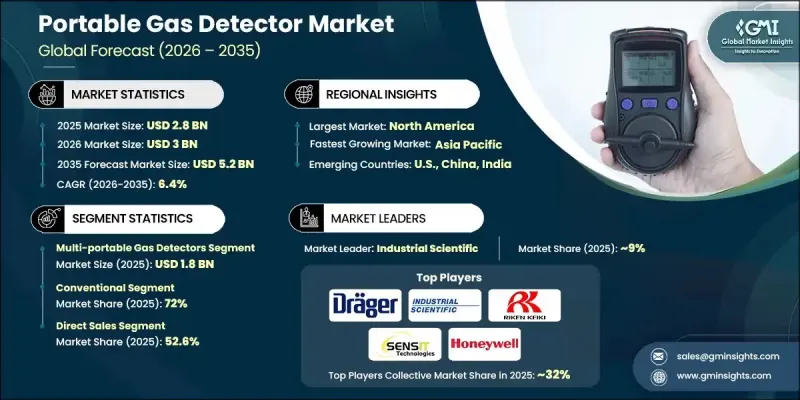

The Global Portable Gas Detector Market was valued at USD 2.8 billion in 2025 and is estimated to grow at a CAGR of 6.4% to reach USD 5.2 billion by 2035.

The need for portable gas detection devices continues to rise as regulatory bodies and the public push for better air quality and stronger workplace safety practices. Industries with significant exposure risks, such as chemical production, mining, oil and gas, face heightened oversight, which is accelerating the adoption of handheld detection devices. Businesses are becoming more aware of how hazardous gas leaks can threaten workers' health and harm the surrounding environment, prompting investments in reliable detection systems. Portable gas detectors are increasingly viewed as essential tools for ensuring compliance with safety standards, mitigating toxic exposure, and reducing operational liabilities. Improved awareness and stricter enforcement of occupational health guidelines are reinforcing the demand for advanced detection technologies across industrial sectors.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.8 Billion |

| Forecast Value | $5.2 Billion |

| CAGR | 6.4% |

The multi-gas portable detectors generated USD 1.8 billion in 2025 and are projected to grow at a CAGR of 6.4% from 2026 to 2035. Their ability to detect multiple hazardous gases at once has made them the standard among industries that require comprehensive monitoring, especially in environments with complex gas exposure risks.

The conventional portable gas detectors held a 72% share in 2025 and are expected to grow at a CAGR of 5.5% through 2035. Their popularity persists due to affordability, ease of operation, and straightforward maintenance, making them suitable for businesses operating under budget constraints or limited technical support capabilities. These detectors continue to serve as dependable options in settings that require baseline gas monitoring.

U.S Portable Gas Detector Market generated USD 670 million in 2025 and is forecasted to grow at a CAGR of 6.2% from 2026 to 2035. Strict workplace safety requirements and consistent industrial activity, particularly in energy, mining, and chemicals, sustain demand for advanced multi-gas detection equipment. Adoption of IoT-integrated devices and strong commitments to worker protection further cement U.S. market leadership.

Major companies in the Global Portable Gas Detector Market include Thermo Fisher, Industrial Scientific, MSA Safety, Sensitron, Blackline Safety Corp, Honeywell, Dragerwerk, Riken Keiki, GfG, Teledyne Technologies, AIYI Technologies, RKI Instruments, ABB, Sensit Technologies, Uniphos, and Zetron Technology. Companies in the Global Portable Gas Detector Market are strengthening their market presence through innovations centered on connectivity, durability, and precision. Many manufacturers are integrating IoT capabilities, real-time alerts, and cloud-based data platforms to enhance monitoring accuracy and streamline compliance reporting. Product portfolios are being diversified with multi-gas systems that reduce device redundancy and improve cost efficiency for industrial users. Strategic partnerships with industrial operators and safety service providers help expand distribution networks and accelerate adoption. Companies are also focusing on rugged designs suitable for harsh environments, extended battery life, and faster calibration systems to reduce downtime.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Category

- 2.2.4 Gas type

- 2.2.5 End use

- 2.2.6 Distribution channels

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Industrial Safety Regulations

- 3.2.1.2 Rise in Hazardous Work Environments

- 3.2.1.3 Technological Advancements

- 3.2.2 Pitfalls & Challenges:

- 3.2.2.1 High Initial Cost

- 3.2.2.2 Maintenance & Calibration Complexity

- 3.2.3 Opportunities

- 3.2.3.1 Smart & Connected Solutions

- 3.2.3.2 Emerging Markets Expansion

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By Region

- 3.6.2 By Product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2022 - 2035, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Single-portable gas detectors

- 5.3 Multi-portable gas detectors

- 5.3.1 Upto 4 gases

- 5.3.2 4 to 6 gases

- 5.3.3 above 6 gases

Chapter 6 Market Estimates & Forecast, By Category, 2022 - 2035, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Smart

- 6.3 Conventional

Chapter 7 Market Estimates & Forecast, By Gas Type, 2022 - 2035, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Oxygen

- 7.3 Flammable gases

- 7.4 Toxic gases

- 7.5 Vocs

- 7.6 Combustible gas

- 7.7 Others (CFC-based & incomplete combustion gas)

Chapter 8 Market Estimates & Forecast, By End Use, 2022 - 2035, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Oil & gas

- 8.3 Chemicals & petrochemicals

- 8.4 Metal & mining

- 8.5 Fire services

- 8.6 Power generation & transmission

- 8.7 Others (construction)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 ABB

- 11.2 AIYI Technologies

- 11.3 Blackline Safety Corp

- 11.4 Dragerwerk

- 11.5 GfG

- 11.6 Honeywell

- 11.7 Industrial Scientific

- 11.8 MSA Safety

- 11.9 Riken Keiki

- 11.10 Sensit Technologies

- 11.11 Sensitron

- 11.12 Teledyne Technologies

- 11.13 Thermo Fisher

- 11.14 Uniphos

- 11.15 Zetron Technology