PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740976

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740976

Automotive 3D Map System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

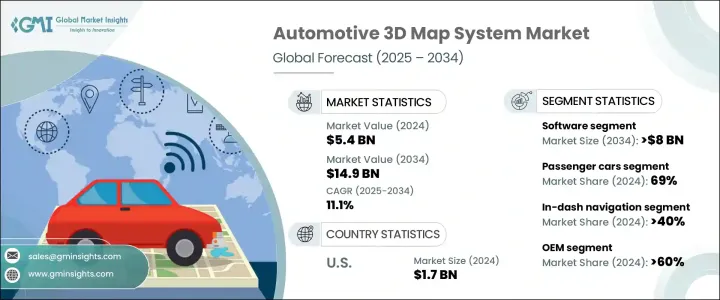

The Global Automotive 3D Map System Market was valued at USD 5.4 billion in 2024 and is estimated to grow at a CAGR of 11.1% to reach USD 14.9 billion by 2034. This growth is largely driven by the rapid expansion of autonomous vehicle technologies. As vehicles become increasingly automated, 3D maps are emerging as a critical enabler of advanced features such as precise lane localization, real-time obstacle detection, and intelligent route planning. High-definition mapping is essential for vehicles operating at Levels 3 to 5 autonomy, delivering an environmental context that goes beyond the line of sight of onboard sensors. Without these detailed maps, autonomous systems lack the necessary data for complex decision-making. As the industry pivots toward smarter mobility solutions, manufacturers are heavily investing in technologies that enhance the role of 3D maps. These maps not only boost safety and performance but also help create a better in-vehicle experience. Research and development in autonomous driving and advanced driver assistance systems (ADAS) continue to accelerate innovations in 3D mapping. With increasing consumer expectations for real-time, context-aware navigation, automakers are making 3D mapping systems a standard component across vehicle lineups. Collaborations between car manufacturers and digital map developers are becoming more common as they aim to deliver integrated and branded navigation experiences.

The market is segmented by component into hardware, software, and services. In 2024, the software segment dominated the industry with approximately 50% of the overall market share and is forecasted to surpass USD 8 billion by 2034. Advancements in artificial intelligence and cloud computing are transforming mapping software into highly dynamic platforms that adapt in real-time to changing traffic conditions, road closures, and environmental factors. Automakers are now favoring cloud-enabled mapping systems to improve predictive route planning and driving behavior analysis. As drivers increasingly seek personalized digital experiences, the demand for customizable map software continues to rise. Automakers are deploying versatile platforms that support unique user profiles, aesthetic themes, and data-rich overlays, making mapping software a key differentiator in infotainment systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.4 Billion |

| Forecast Value | $14.9 Billion |

| CAGR | 11.1% |

Hardware also plays a vital role in supporting 3D mapping technology. Vehicles equipped with LiDAR, radar, and HD cameras generate detailed spatial data essential for accurate map creation. These sensors contribute significantly to object detection, depth estimation, and road boundary recognition. As the cost of sensors drops, mid-range vehicles are also expected to feature such technologies, boosting the hardware segment's growth in the coming decade.

When segmented by vehicle type, the market includes passenger cars, commercial vehicles, and off-road vehicles. Passenger cars led the market in 2024, holding a 69% share. Drivers navigating increasingly dense and complex roadways are now relying on 3D maps for a clearer, more interactive understanding of their surroundings. Features like lane-keeping assistance and adaptive cruise control depend heavily on precision mapping, prompting automakers to incorporate advanced map systems into a wider range of car models. As digital cockpits become more sophisticated, 3D maps are turning into essential features that enhance the overall driving experience.

The market is also divided based on navigation display formats: in-dash systems, Heads-Up Displays (HUD), and Augmented Reality (AR) navigation. In-dash navigation currently leads the segment with over 40% market share. Consumers are gradually moving away from aftermarket GPS devices and favoring integrated, factory-installed systems. These in-dash displays offer seamless user experiences, enhanced reliability, and minimal driver distraction. Pairing in-dash maps with high-resolution displays and intelligent overlays further improves user satisfaction. Meanwhile, HUD technology is gaining traction as a safety-forward innovation, allowing drivers to keep their eyes on the road while receiving real-time route and hazard data. The integration of 3D mapping with AR will further strengthen HUD-based systems, making them interactive and visually intuitive.

From a sales channel perspective, OEMs dominate the market with a share exceeding 60% in 2024. This segment is projected to grow at over 11.5% CAGR through 2034. Automakers are embedding 3D map systems into vehicles at the factory level to ensure seamless integration with onboard sensors and to meet regulatory requirements associated with autonomous features. These built-in solutions offer better performance, system reliability, and consumer trust compared to aftermarket alternatives. That said, aftermarket 3D map systems continue to gain traction among owners of older vehicles and fleet operators looking for cost-effective upgrades. These systems offer scalable, retrofit-friendly solutions for enhancing navigation and ADAS capabilities without replacing entire vehicle fleets.

Regionally, North America led the global market in 2024, contributing over 35% of total revenue. The U.S. alone accounted for USD 1.7 billion, driven by growing advancements in autonomous vehicle testing, smart infrastructure initiatives, and increasing consumer demand for safety-oriented features. The country has become a central hub for innovation in 3D mapping technologies, thanks to a combination of legal frameworks, tech-sector investment, and an expansive transportation infrastructure. These factors enable the rapid deployment and real-time testing of high-definition mapping systems under a wide range of driving conditions.

The market features a mix of global tech providers, mapping software developers, and localized players. Tier 1 suppliers offer cloud-based platforms, AI-enhanced perception tools, and vehicle-to-everything (V2X) integration capabilities tailored to OEM needs. Meanwhile, regional firms are rapidly expanding in emerging markets, offering affordable, scalable, and adaptable solutions tailored to local road conditions and consumer needs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component supplier

- 3.2.2 Technology providers

- 3.2.3 Software providers

- 3.2.4 Distributors

- 3.2.5 End use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Trade impact

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (Cost to customers)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook & future considerations

- 3.3.1 Trade impact

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Use cases

- 3.10 Impact on forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising demand for autonomous vehicles requiring real-time, high-precision maps

- 3.10.1.2 Government regulations pushing adoption of ADAS and safety technologies

- 3.10.1.3 Integration of 3D maps into factory-installed infotainment systems by OEMs

- 3.10.1.4 Expansion of smart cities and connected infrastructure supporting V2X communication

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High development and maintenance costs for real-time, high-resolution maps

- 3.10.2.2 Data privacy and cybersecurity concerns related to location-based services

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Navigation, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 In-dash navigation

- 6.3 Heads-Up Display (HUD)

- 6.4 Augmented Reality (AR) navigation

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Medium Commercial Vehicles (MCV)

- 7.3.3 Heavy Commercial Vehicles (HCV)

- 7.4 Off-road vehicles

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 ADAS

- 8.3 Autonomous driving

- 8.4 In-vehicle navigation

- 8.5 Fleet and logistics management

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 3D Mapping

- 11.2 Carmera

- 11.3 Civil Maps

- 11.4 Deepmap

- 11.5 Dynamic Map Platform

- 11.6 Elektrobit

- 11.7 Garmin

- 11.8 Google

- 11.9 HERE Technologies

- 11.10 Inrix

- 11.11 MapBox

- 11.12 Microsoft

- 11.13 Mitsubishi

- 11.14 Mobileye

- 11.15 NavInfo

- 11.16 Nvidia

- 11.17 Telenav

- 11.18 TomTom

- 11.19 Trimble

- 11.20 Valeo