PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797847

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797847

Smart Implants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

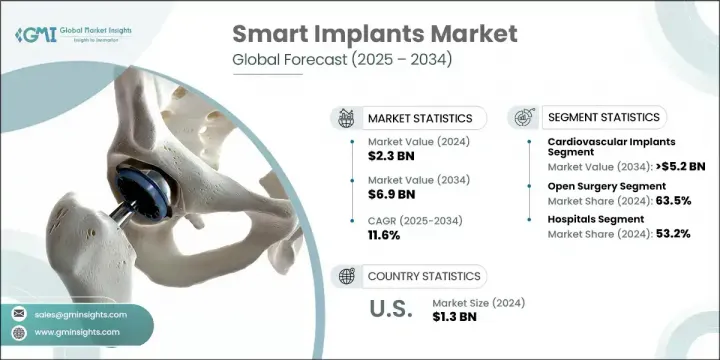

The Global Smart Implants Market was valued at USD 2.3 billion in 2024 and is estimated to grow at a CAGR of 11.6% to reach USD 6.9 billion by 2034. This significant expansion is being propelled by a combination of rising cardiovascular disease prevalence, rapid advancements in smart medical technology, and increasing demand for devices that offer real-time patient monitoring. Smart implants play a transformative role in modern medicine by not only offering therapeutic support but also collecting real-time physiological data that aids in diagnosis and treatment optimization. These technologies are gaining momentum as healthcare systems shift toward personalized and proactive care. With the global aging population growing and disposable income rising in several developed economies, the market is experiencing a steady increase in demand for technologically advanced implants that can adapt to various health conditions. The consistent increase in orthopedic surgeries, expanding adoption of neurostimulation devices, and growing investment in R&D activities for next-generation implantable devices are also accelerating growth across multiple clinical segments.

In 2024, the cardiovascular implants segment held 78.1% share. This dominance is fueled by the widespread need for pacing systems, insertable monitors, and other implantable devices aimed at managing the increasing number of individuals with cardiac conditions. These smart cardiac devices are being deployed at a higher rate as their therapeutic and diagnostic capabilities continue to improve, offering physicians real-time insight into patient health and facilitating more targeted treatment strategies. The large number of patients dealing with chronic cardiovascular disorders is a driving factor, and ongoing advancements in implant functionality continue to strengthen their clinical value in everyday cardiology practice.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $6.9 Billion |

| CAGR | 11.6% |

The open surgery segment held a 63.5% share in 2024 and is projected to maintain steady growth over the coming years. This surgical approach remains the preferred method in cases where enhanced anatomical visibility and precision are critical, especially in complex cardiovascular and orthopedic procedures. Open surgery is also widely used in trauma care and in regions where access to minimally invasive techniques is limited. Surgeons in orthopedic and neurology disciplines often favor open procedures for their reliability, particularly when treating patients with multiple comorbidities or anatomical challenges.

United States Smart Implants Market reached USD 1.3 billion in 2024 and is set to grow at a CAGR of 11.5% through 2034. Growth in this region is fueled by the presence of a robust healthcare infrastructure, high research and development activity, and an increasing volume of surgical procedures conducted in outpatient and ambulatory surgical centers. As patient preference shifts toward shorter hospital stays and same-day surgical interventions, the adoption of intelligent implantable devices is surging. Additionally, the growing prevalence of neurological and cardiovascular conditions continues to increase the demand for advanced implant technologies that offer continuous monitoring and targeted therapy delivery.

Key players in the Smart Implants Market include NeuroPace, Boston Scientific, DirectSync Surgical, Zimmer Biomet, Intelligent Implants, Biotronik, Abbott, and Medtronic. These companies are actively contributing to shaping the direction of the industry through technological innovation and patient-centric product design. Companies operating in the smart implants market are implementing strategic initiatives focused on product innovation, clinical validation, and market penetration to enhance their competitive edge. Leading players are investing heavily in R&D to design devices that integrate AI, wireless communication, and sensor technology for real-time health tracking. Collaborations with academic institutions and research bodies are helping to accelerate the development of implants tailored to specific diseases. To expand their geographic footprint, companies are entering into strategic distribution partnerships and expanding manufacturing capabilities in key regions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Implant type trends

- 2.2.3 Surgery trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surging demand for real-time health monitoring

- 3.2.1.2 Growing incidence of cardiovascular disorders

- 3.2.1.3 Rise in number of accidents and sport injuries

- 3.2.1.4 Technological advancements in smart implants

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory framework

- 3.2.2.2 High cost of implants

- 3.2.3 Market opportunities

- 3.2.3.1 Rising preference for minimally invasive surgery

- 3.2.3.2 Growing focus towards development of energy-harvesting and battery-less implants

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends, by implant type

- 3.7 Future market trends

- 3.8 Role of cybersecurity in smart implants

- 3.9 Comparative analysis: Smart vs. conventional implants

- 3.10 Consumer behaviour analysis

- 3.11 Reimbursement scenario

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

- 3.14 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Rest of the world (RoW)

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Implant Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Cardiovascular implants

- 5.3 Orthopedic implants

- 5.4 Neurostimulation implants

Chapter 6 Market Estimates and Forecast, By Surgery, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Open surgery

- 6.3 Minimally invasive surgery

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Cardiac care centers

- 7.4 Ambulatory surgical centers

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott

- 9.2 Biotronik

- 9.3 Boston Scientific

- 9.4 DirectSync Surgical

- 9.5 Intelligent Implants

- 9.6 Medtronic

- 9.7 NeuroPace

- 9.8 Zimmer Biomet