PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892892

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892892

Autonomous Vehicle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

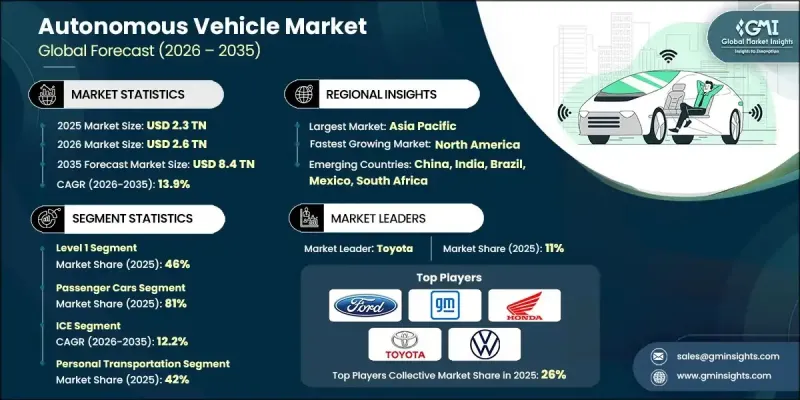

The Global Autonomous Vehicle Market was valued at USD 2.3 trillion in 2025 and is estimated to grow at a CAGR of 13.9% to reach USD 8.4 trillion by 2035.

This market is becoming a fundamental pillar in developing, validating, and refining autonomous driving systems. These simulation technologies create controlled, repeatable, and highly scalable virtual settings that allow developers to analyze how vehicles react to a wide range of complex driving scenarios. Automakers, technology providers, and research organizations increasingly depend on simulation throughout the entire lifecycle of autonomous vehicle development as they work to meet strict performance, safety, and regulatory requirements. Continuous progress in artificial intelligence, machine learning, and computing infrastructure is also improving the depth and accuracy of these platforms. Today's simulation environments span from detailed environment modeling to cloud-enabled simulations and expanded development pipelines that support full end-to-end testing workflows. As semi-autonomous systems mature, simulation tools play a crucial role in studying human-machine interaction, forecasting driver reactions, and evaluating shared decision-making, which requires richer, layered virtual assessments.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.3 Trillion |

| Forecast Value | $8.4 Trillion |

| CAGR | 13.9% |

The Level 1 segment held a 46% share in 2025 and is projected to grow at a CAGR of 13% between 2026 and 2035. This segment's strong performance is driven by regulatory support and its widespread adoption in mass-market vehicles. Level 1 systems offer single-function driver assistance, such as adaptive cruise control and lane-keeping support, while requiring the driver to remain fully attentive. Increasing regulatory focus on vehicle safety, along with insurance data highlighting reduced accident risks, is expected to create significant growth opportunities, with the Level 1 market projected to reach USD 3.69 trillion by 2035.

The passenger car segment accounted for an 81% share in 2025 and is expected to grow at a CAGR of 12.6% through 2035. Its dominance is due to the widespread integration of Level 1 and Level 2 advanced driver-assistance systems (ADAS), which are now standard in over 70% of new vehicles in developed regions. Government mandates, enhanced safety benefits, and increasing availability of these technologies across premium and mid-range vehicles are accelerating consumer acceptance of assisted driving, making it a mainstream feature globally.

U.S. Autonomous Vehicle Market reached USD 410.2 billion in 2025. Companies in the region are leveraging artificial intelligence and machine learning to enhance vehicle safety, improve traffic prediction, and enable smarter decision-making in complex urban and highway environments. Both major tech firms and innovative startups are exploring autonomous vehicles for applications such as ride-hailing and delivery services, offering cost-efficient, scalable solutions for urban mobility and transforming transportation operations.

Key companies active in the Global Autonomous Vehicle Market include aiMotive, Altair, Ansys, Dassault, Foretellix, Hexagon AB, IPG Automotive, LG, Mechanical Simulation, and Siemens. Companies in this market are reinforcing their competitive edge by enhancing simulation realism, building higher-fidelity digital twins, and integrating AI-driven analytics that improve scenario generation and automated validation. Many are expanding cloud-based platforms to support scalable testing for global teams, while still offering secure on-premises systems for customers with strict data governance needs. Vendors are also forming partnerships with OEMs, Tier 1 suppliers, and sensor manufacturers to create unified testing ecosystems that replicate full-vehicle behavior. Continuous updates that incorporate new driving regulations, road environments, and edge-case libraries help strengthen long-term customer reliance on their platforms.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Level of autonomy

- 2.2.3 Vehicle

- 2.2.4 Fuel

- 2.2.5 Application

- 2.2.6 Sensor

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for road safety

- 3.2.1.2 Advances in AI and sensor technologies

- 3.2.1.3 Government regulations and incentives

- 3.2.1.4 Growing ridesharing and mobility services

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory and legal uncertainties

- 3.2.2.2 High R&D and deployment costs

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in urban mobility solutions

- 3.2.3.2 Collaboration with tech startups and OEMs

- 3.2.3.3 Data monetization from autonomous fleets

- 3.2.3.4 Integration with smart city infrastructure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Global

- 3.4.1.1 UNECE WP.29 framework & working groups

- 3.4.1.2 UN Regulation 155

- 3.4.1.3 UN Regulation 156

- 3.4.1.4 UN Regulation 157

- 3.4.2 North America

- 3.4.2.1 United States federal framework

- 3.4.2.2 NHTSA automated vehicles policy & guidance

- 3.4.3 Europe

- 3.4.3.1 EU Type-Approval Regulation 2019/2144

- 3.4.3.2 Vehicle General Safety Regulation (GSR)

- 3.4.4 Asia Pacific

- 3.4.4.1 China MIIT & NDRC National Strategy

- 3.4.4.2 China Intelligent & Connected Vehicle Standards

- 3.4.5 Latin America

- 3.4.6 Middle East & Africa

- 3.4.1 Global

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 LiDAR Technology (Mechanical, Solid-State, FMCW)

- 3.7.1.2 Radar Technology (77-79 GHz, 4D Imaging Radar)

- 3.7.1.3 V2X communication protocols

- 3.7.1.4 5G network integration

- 3.7.2 Emerging technologies

- 3.7.2.1 Frequency-modulated continuous wave (FMCW) LiDAR

- 3.7.2.2 4D imaging radar with elevation detection

- 3.7.2.3 Thermal & infrared cameras

- 3.7.2.4 Hardware security modules (HSM)

- 3.7.1 Current technological trends

- 3.8 Pricing analysis

- 3.8.1.1 Component pricing trends

- 3.8.1.2 Vehicle incremental cost analysis

- 3.8.1.3 Service pricing models

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.10.1 Autonomous vehicle system cost structure

- 3.10.2 Manufacturing & production costs

- 3.10.3 Operating cost analysis

- 3.10.4 R&D investment requirements

- 3.10.5 Value chain margin analysis

- 3.11 Patent analysis

- 3.11.1 Global patent filing trends

- 3.11.2 Patent distribution by technology domain

- 3.11.3 Leading patent holders & innovation leaders

- 3.11.4 Geographic distribution of IP activity

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Investment & funding analysis

- 3.13.1 Venture capital & private equity investment trends

- 3.13.2 Corporate investment & strategic acquisitions

- 3.13.3 M&A activity & valuation multiples

- 3.13.4 Government funding & R&D programs by country

- 3.14 End use behavior & adoption analysis

- 3.14.1 Consumer passenger vehicle segment

- 3.14.2 Commercial fleet operator behavior

- 3.14.3 Ride-hailing & maas user behavior

- 3.14.4 Delivery service End use behavior

- 3.14.5 Industrial & off-road End use behavior

- 3.15 Risk assessment & mitigation framework

- 3.15.1 Technology risks

- 3.15.2 Cybersecurity risks

- 3.15.3 Safety & liability risks

- 3.15.4 Regulatory & policy risks

- 3.15.5 Supply chain risks

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Level of Autonomy, 2022 - 2035 ($Bn, Units)

- 5.1 Key trends

- 5.2 Level 1

- 5.3 Level 2

- 5.4 Level 3

- 5.5 Level 4

- 5.6 Level 5

Chapter 6 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 SUV

- 6.2.2 Sedan

- 6.2.3 Hatchback

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles (LCV)

- 6.3.2 Medium commercial vehicles (MCV)

- 6.3.3 Heavy commercial vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Fuel, 2022 - 2035 ($Bn, Units)

- 7.1 Key trends

- 7.2 ICE

- 7.3 Electric

- 7.4 Hybrid

Chapter 8 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn, Units)

- 8.1 Key trends

- 8.2 Personal transportation

- 8.3 Public transportation

- 8.4 Goods transportation

- 8.5 Industrial applications

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Sensor, 2022 - 2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 LiDAR

- 9.3 Radar

- 9.4 Cameras

- 9.5 Ultrasonic sensors

- 9.6 GPS/IMU systems

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.3.8 Poland

- 10.3.9 Romania

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Vietnam

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global companies

- 11.1.1 Toyota

- 11.1.2 Volkswagen

- 11.1.3 General Motors

- 11.1.4 Tesla

- 11.1.5 BMW

- 11.1.6 Mercedes-Benz

- 11.1.7 Ford

- 11.1.8 Nissan

- 11.1.9 Honda

- 11.1.10 Hyundai

- 11.1.11 Waymo (Alphabet)

- 11.2 Regional Champions

- 11.2.1 Aurora Innovation

- 11.2.2 AutoX

- 11.2.3 Einride

- 11.2.4 Motional (Hyundai-Aptiv JV)

- 11.2.5 Oxbotica

- 11.2.6 Plus (Formerly Plus.ai)

- 11.2.7 Pony.ai

- 11.2.8 Wayve Technologies

- 11.2.9 WeRide

- 11.2.10 Zoox

- 11.3 Emerging players

- 11.3.1 Beep

- 11.3.2 EasyMile SAS

- 11.3.3 Gatik

- 11.3.4 Ghost Autonomy

- 11.3.5 Helm.ai

- 11.3.6 Kodiak Robotics

- 11.3.7 May Mobility

- 11.3.8 Navya

- 11.3.9 Nuro