PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685102

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685102

Asia Pacific Instrumentation Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

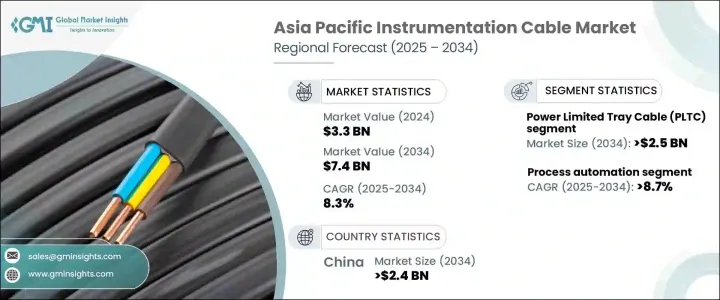

Asia Pacific Instrumentation Cable Market, valued at USD 3.3 billion in 2024, is poised for significant growth, with a projected CAGR of 8.3% from 2025 to 2034. This robust expansion is driven by rapid industrialization and urbanization, coupled with substantial investments in energy and infrastructure projects throughout the region. Instrumentation cables, essential for precise data transmission and operational efficiency, are experiencing surging demand across sectors such as power generation, oil & gas, telecommunications, and manufacturing. The rise in automation technologies and smart systems further accelerates market growth as industries increasingly prioritize efficiency, real-time monitoring, and seamless communication between systems. Additionally, the expanding deployment of renewable energy solutions, including wind and solar power, has spurred the need for advanced cabling systems to support sophisticated monitoring and control applications.

Among the market's key segments, the power-limited tray cable (PLTC) category is projected to generate USD 2.5 billion by 2034. These cables have gained significant traction due to their cost-effectiveness, enhanced safety features, and adherence to stringent regulatory standards. PLTC cables are widely utilized in industries where reliable power distribution and signal transmission are critical. Their resilience to mechanical stress and harsh environmental conditions positions them as the preferred choice for demanding applications in energy, oil & gas, and manufacturing sectors. As industries continue to adopt advanced technologies, the need for durable, high-performance cables like PLTC remains critical for ensuring operational efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $7.4 Billion |

| CAGR | 8.3% |

The process automation sector is forecasted to grow at an impressive CAGR of 8.7% through 2034, underlining the region's increasing reliance on automation technologies. Industries such as petrochemicals, power generation, and oil & gas are at the forefront of adopting process automation, driven by the growing demand for precision, efficiency, and real-time monitoring. High-performance instrumentation cables capable of supporting specific voltage requirements are essential for these applications, ensuring seamless connectivity and control in sophisticated automated systems.

China instrumentation cable market is expected to generate USD 2.4 billion by 2034, reflecting the country's ongoing industrial growth and infrastructure investments. With a rapidly expanding manufacturing base and a strong commitment to renewable energy projects, China is experiencing heightened demand for advanced instrumentation cables. The widespread deployment of automation and advanced control systems in industries such as power generation and manufacturing further contributes to this demand. Moreover, the nation's focus on scaling up renewable energy solutions, including wind and solar power, underscores the critical role of instrumentation cables in facilitating efficient monitoring and control within these sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Industry Insights

- 2.1 Industry ecosystem analysis

- 2.2 Regulatory landscape

- 2.3 Industry impact forces

- 2.3.1 Growth drivers

- 2.3.2 Industry pitfalls & challenges

- 2.4 Growth potential analysis

- 2.5 Porter's analysis

- 2.5.1 Bargaining power of suppliers

- 2.5.2 Bargaining power of buyers

- 2.5.3 Threat of new entrants

- 2.5.4 Threat of substitutes

- 2.6 PESTEL analysis

Chapter 3 Competitive landscape, 2024

- 3.1 Strategic dashboard

- 3.2 Innovation & sustainability landscape

Chapter 4 Market Size and Forecast, By Product, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 4.1 Key trends

- 4.2 PLTC cable

- 4.3 ITC cable

- 4.4 TC cable

- 4.5 Others

Chapter 5 Market Size and Forecast, By End Use, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 5.1 Key trends

- 5.2 Oil & gas

- 5.3 Chemical

- 5.4 Process automation

- 5.5 Manufacturing

- 5.6 Others

Chapter 6 Market Size and Forecast, By Region, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 6.1 Key trends

- 6.2 China

- 6.3 Australia

- 6.4 India

- 6.5 Japan

- 6.6 South Korea

Chapter 7 Company Profiles

- 7.1 Belden

- 7.2 CommScope

- 7.3 Elsewedy Electric

- 7.4 Fujikura

- 7.5 Helukabel

- 7.6 Hellenic Group

- 7.7 Lapp Group

- 7.8 LS Cable & Systems

- 7.9 Nexans

- 7.10 NKT

- 7.11 Polycab

- 7.12 Prysmian Group

- 7.13 Shawcor

- 7.14 Sumitomo Belden