PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858991

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858991

Corrugated Box Making Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

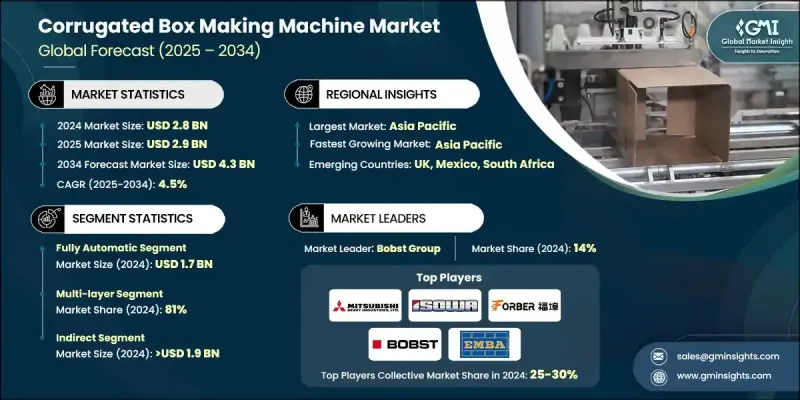

The Global Corrugated Box Making Machine Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 4.5% to reach USD 4.3 billion by 2034.

The surge in demand across industries like electronics, food & beverage, personal care, and pharmaceuticals is significantly driving market expansion. Corrugated boxes continue to be the most favored packaging solution, thanks to their durability, lightweight structure, and recyclability. As developing economies push forward with urbanization and industrial growth, demand for packaging machinery that delivers high-speed, multi-format box production has intensified. E-commerce has become a pivotal force, transforming packaging needs through increased requirements for custom, protective, and brandable box solutions. The shift toward personalized packaging has led to more investment in machines capable of multi-layer production, custom die-cutting, and advanced printing. Manufacturers are responding by developing modular machines with smarter, energy-efficient designs to improve box quality while boosting throughput and operational efficiency. This evolution is creating new opportunities for automation and innovation within the corrugated box machinery space.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $4.3 Billion |

| CAGR | 4.5% |

The fully automatic machines segment generated USD 1.7 billion in 2024, dominating demand due to their ability to produce hundreds of boxes per minute with precision and consistency. These systems are critical to high-volume sectors like logistics and food services, where performance and reduced defect rates are key. Their precision in gluing, folding, and size control improves product quality and ensures reliable output in demanding production cycles.

The multi-layer box machine category held an 81% share in 2024. Designed to produce packaging with two or more fluted layers, these machines offer higher structural strength and greater product protection. Multi-layer packaging is highly valued in sectors handling fragile or heavyweight items, such as automotive, electronics, and heavy industrial tools. Demand for these systems is rising in industries that prioritize transportation safety and secure long-haul packaging.

U.S. Corrugated Box Making Machine Market generated USD 550 million and held 88.7% share in 2024. Its leadership is backed by a robust manufacturing infrastructure and consistent packaging standards. The growing influence of automation and the adoption of energy-efficient and smart technologies are enabling faster production, lower operational costs, and easier integration into high-speed production lines. Demand from sectors like e-commerce and high-tech manufacturing continues to drive growth in the U.S. market.

Key players in the Corrugated Box Making Machine Market include EMBA Machinery, ISOWA, Bobst Group, Packsize International, Mitsubishi Heavy Industries, Shrink Machine, Serpa Packaging Solutions, ACME Machinery, Zemat Technology Group, Hebei Shengli Carton Equipment, KOLBUS, Saro Packaging Machine Industries, Fosber, Wenzhou Zhongke Packaging Machinery, and Shanghai Printyoung International Industry. To strengthen their market position, companies in the corrugated box making machine industry are prioritizing product innovation, modular system development, and digital integration. Leading manufacturers are introducing machines with remote monitoring, IoT connectivity, and AI-based diagnostics to boost efficiency. Strategic investments in R&D and energy-efficient systems help meet evolving customer expectations for automation, reduced downtime, and sustainability.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Box type

- 2.2.4 Capacity

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing consumer goods production

- 3.2.1.2 E-commerce expansion

- 3.2.1.3 Automation & smart manufacturing

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Maintenance and repair costs

- 3.2.3 Opportunities

- 3.2.3.1 Industry 4.0 integration

- 3.2.3.2 Sustainability and ecofriendly packaging

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Semi-automatic

- 5.3 Fully-automatic

Chapter 6 Market Estimates and Forecast, By Box Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Single-layer

- 6.3 Multi-layer

Chapter 7 Market Estimates and Forecast, By Capacity, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low (1-3 tons)

- 7.3 Mid (3-5 tons)

- 7.4 High (above 5 tons)

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.3 Electronics & consumer goods

- 8.4 Home & personal goods

- 8.5 Textile goods

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 ACME Machinery

- 11.2 Bobst Group

- 11.3 EMBA Machinery

- 11.4 Fosber

- 11.5 ISOWA

- 11.6 KOLBUS

- 11.7 Mitsubishi Heavy Industries

- 11.8 Packsize International

- 11.9 Saro Packaging Machine Industries.

- 11.10 Serpa packaging Solutions

- 11.11 Shanghai Printyoung International Industry

- 11.12 Hebei Shengli Carton Equipment

- 11.13 Shrink Machine

- 11.14 Wenzhou Zhongke Packaging Machinery

- 11.15 Zemat Technology Group