PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822633

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822633

Plant Protein Hydrolysate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

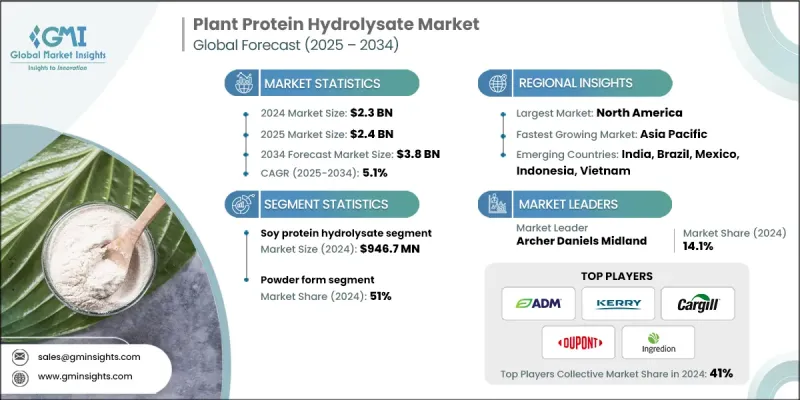

The global plant protein hydrolysate market was estimated at USD 2.3 billion in 2024 and is expected to grow from USD 2.4 billion in 2025 to USD 3.8 billion by 2034, at a CAGR of 5.1%, according to the latest report published by Global Market Insights Inc.

The increasing consumer shift toward plant-based diets and clean-label products is a major driver for the plant protein hydrolysate market. More people are prioritizing health, sustainability, and ethical considerations when choosing what to eat, leading to a surge in demand for plant-derived ingredients.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $3.8 Billion |

| CAGR | 5.1% |

Rising Adoption of Soy Protein Hydrolysate

The soy protein hydrolysate segment held a notable share in 2024, driven by soy's rich amino acid profile and widespread availability. As a versatile and cost-effective source, soy hydrolysates are extensively used in sports nutrition, infant formulas, and functional foods. Their superior digestibility and allergen-friendly nature position them well against animal-based alternatives. Market players are capitalizing on soy protein's nutritional benefits while investing in processing technologies to reduce bitterness and enhance flavor, making soy hydrolysates more appealing to health-conscious consumers.

Powder To Gain Traction

The powder form segment held a significant share in 2024, driven by its convenience, longer shelf life, and ease of incorporation into various food and beverage products. Powders provide manufacturers with the flexibility to formulate everything from protein shakes to bakery items without compromising texture or nutritional content. Consumers also prefer powdered hydrolysates for their portability and straightforward usage in daily diets. Companies are focusing on improving the solubility and taste profiles of powdered plant protein hydrolysates to broaden their application scope and increase consumer acceptance globally.

North America to Emerge as a Propelling Region

North America plant protein hydrolysate market will witness robust growth through 2034, fueled by increasing consumer awareness of plant-based nutrition and health trends. Manufacturers are leveraging partnerships with food and beverage brands to innovate and expand product portfolios tailored to North American tastes and regulatory standards. Investments in R&D and marketing strategies emphasizing sustainability and health benefits are further strengthening the market presence across the region.

Major players involved in the plant protein hydrolysate market are Ingredion Incorporated, DuPont, Archer Daniels Midland Company (ADM), Kerry Group, and Cargill.

To solidify their market foothold, companies in the plant protein hydrolysate market are emphasizing product innovation, focusing on flavor improvement and enhanced bioavailability. Strategic collaborations with food manufacturers and nutrition brands enable wider application and faster market penetration. Expanding production capacities and sourcing sustainable raw materials help meet rising demand while aligning with consumer values. Additionally, companies invest in educational marketing campaigns to raise awareness about the benefits of plant protein hydrolysates, thereby driving adoption and customer loyalty in an increasingly competitive landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Source

- 2.2.2 Form

- 2.2.3 Application

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Soy protein hydrolysate

- 5.3 Wheat protein hydrolysate

- 5.4 Pea protein hydrolysate

- 5.5 Rice protein hydrolysate

- 5.6 Hemp protein hydrolysate

- 5.7 Sunflower protein hydrolysate

- 5.8 Others

Chapter 6 Market Size and Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Liquid

- 6.3 Powder

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Nutritional supplements

- 7.4 Animal feed

- 7.5 Others

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Archer Daniels Midland Company

- 9.2 Kerry Group

- 9.3 DuPont

- 9.4 Ingredion Incorporated

- 9.5 Cargill

- 9.6 Evonik Industries

- 9.7 Koninklijke DSM

- 9.8 Glanbia

- 9.9 Tate & Lyle

- 9.10 Bunge Limited

- 9.11 Roquette Freres

- 9.12 Brenntag

- 9.13 Associated British Foods

- 9.14 Novozymes

- 9.15 Givaudan