PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928917

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928917

Cable Fault Locator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

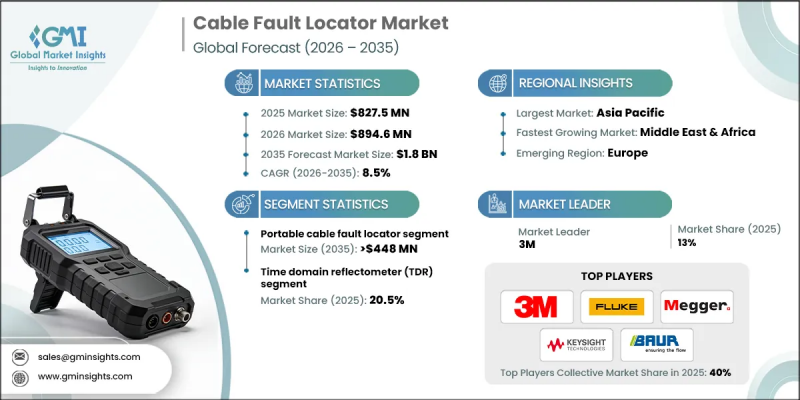

The Cable Fault Locator Market was valued at USD 827.5 million in 2025 and is estimated to grow at a CAGR of 8.5% to reach USD 1.8 billion by 2035.

Market momentum is driven by the increasing emphasis on building reliable, resilient, and efficient power networks across both developed and developing economies. As electricity consumption continues to rise and grid architecture becomes more complex, utilities and industrial operators are prioritizing technologies that help reduce service interruptions and improve operational continuity. Cable fault locators are widely regarded as essential tools for rapidly identifying and locating faults, which helps shorten outage durations and lower maintenance expenses. Global investment in power infrastructure modernization is further supporting market growth, particularly as electricity networks evolve to support higher loads and renewable energy integration. The industry is transitioning away from labor-intensive fault detection methods toward automated, digitally enabled, and predictive solutions. These technological advancements are reshaping cable fault locators into intelligent diagnostic systems that improve accuracy, reduce response times, and enhance overall grid performance while lowering long-term operational costs.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $827.5 Million |

| Forecast Value | $1.8 Billion |

| CAGR | 8.5% |

The portable cable fault locator segment is expected to reach USD 448 million by 2035, supported by strong demand for flexible and easy-to-deploy solutions. Portable systems are valued for their ability to support rapid field diagnostics and immediate troubleshooting, making them critical for restoring services quickly following faults. Their adaptability across varied operating environments has increased adoption among utilities, service providers, and industrial users seeking efficient maintenance solutions.

The time domain reflectometer technology segment accounted for a 20.5% share in 2025 and is forecast to grow at a CAGR of 8% through 2035. Rising urban development and the expansion of underground cable installations are increasing the need for accurate, non-invasive fault detection. This technology enables precise fault location without physical excavation and is favored for its portability, cost efficiency, and ease of operation compared to more complex diagnostic alternatives.

U.S Cable Fault Locator Market is projected to reach USD 639 million by 2035. The country represents a major contributor to global demand due to its extensive transmission and distribution networks and ongoing focus on improving grid reliability and resilience. The scale and complexity of its power infrastructure continue to drive strong adoption of advanced fault detection and monitoring technologies.

Key companies operating in the Global Cable Fault Locator Market include Megger, 3M, Fluke Corporation, Radiodetection Ltd., Yokogawa Electric Corporation, VIAVI Solutions Inc., AFL, Hubbell Incorporated, BAUR GmbH, HIOKI E.E. Corporation, Metrotech Corporation, SebaKMT, Exfo Inc., Keysight Technologies, Greenlee (Textron Inc.), Tempo Communications, Sumitomo Electric Lightwave, KomShine Technologies Limited, Ripley Tools LLC, Tessco Technologies, ETL Systems, Edgcumbe Instruments Ltd., Trotec, Telemetrics Equipments Private Limited, and Nanjing Dajiang Electronic Equipment Co., Ltd. Companies operating in the Cable Fault Locator Market are strengthening their market positions through continuous product innovation, technology integration, and strategic expansion initiatives. Many players are investing in digital platforms, automation, and predictive diagnostics to enhance accuracy and reduce fault detection time. Portfolio diversification across portable, fixed, and software-enabled solutions is helping companies address a wider range of customer needs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability landscape

- 3.1.2 Factors affecting the value chain

- 3.1.3 Disruptions

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter';s analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Emerging opportunities & trends

- 3.8 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share, by region, 2025

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking depictions

- 4.5 Strategy dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Type, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Portable cable fault locator

- 5.3 Handheld cable fault locator

- 5.4 Bench-top cable fault locator

- 5.5 Vehicle-mounted cable fault locator

- 5.6 Stationary cable fault locator

- 5.7 Others

Chapter 6 Market Size and Forecast, By Technology, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 Time domain reflectometer (TDR)

- 6.3 Bridge circuit

- 6.4 Capacitance measurement

- 6.5 Pulse echo technique

- 6.6 Frequency domain reflectometry (FDR)

- 6.7 Partial discharge method

- 6.8 Loop testing method

- 6.9 Others

Chapter 7 Market Size and Forecast, By Application, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 Underground cables

- 7.3 Overhead cables

- 7.4 Submarine cables

- 7.5 Indoor wiring

- 7.6 Others

Chapter 8 Market Size and Forecast, By Cable Type, 2022 - 2035 (USD Million)

- 8.1 Key trends

- 8.2 Power cables

- 8.3 Optical fiber cables

- 8.4 Coaxial cables

- 8.5 Twisted pair cables

- 8.6 Others

Chapter 9 Market Size and Forecast, By End Use, 2022 - 2035 (USD Million)

- 9.1 Key trends

- 9.2 Power industry

- 9.3 Telecommunications

- 9.4 Mining

- 9.5 Transportation

- 9.6 Oil & gas

- 9.7 Construction

- 9.8 Aerospace & defense

- 9.9 Marine

- 9.10 Data centers

- 9.11 Residential

- 9.12 Commercial

- 9.13 Others

Chapter 10 Market Size and Forecast, By Region, 2022 - 2035 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 France

- 10.3.3 Germany

- 10.3.4 Italy

- 10.3.5 Russia

- 10.3.6 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Australia

- 10.4.3 India

- 10.4.4 Japan

- 10.4.5 South Korea

- 10.5 Middle East & Africa

- 10.5.1 Saudi Arabia

- 10.5.2 UAE

- 10.5.3 Turkey

- 10.5.4 South Africa

- 10.5.5 Egypt

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Argentina

Chapter 11 Company Profiles

- 11.1 3M

- 11.2 AFL

- 11.3 BAUR GmbH

- 11.4 Edgcumbe Instruments Ltd.

- 11.5 ETL Systems

- 11.6 Exfo Inc.

- 11.7 Fluke Corporation

- 11.8 Greenlee (Textron Inc.)

- 11.9 HIOKI E.E. Corporation

- 11.10 Hubbell Incorporated

- 11.11 Keysight Technologies

- 11.12 KomShine Technologies Limited

- 11.13 Megger

- 11.14 Metrotech Corporation

- 11.15 Nanjing Dajiang Electronic Equipment Co., Ltd.

- 11.16 Radiodetection Ltd.

- 11.17 Ripley Tools LLC

- 11.18 SebaKMT

- 11.19 Sumitomo Electric Lightwave

- 11.20 Telemetrics Equipments Private Limited

- 11.21 Tempo Communications

- 11.22 Tessco Technologies

- 11.23 Trotec

- 11.24 VIAVI Solutions Inc.

- 11.25 Yokogawa Electric Corporation