PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858995

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858995

Sphygmomanometer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

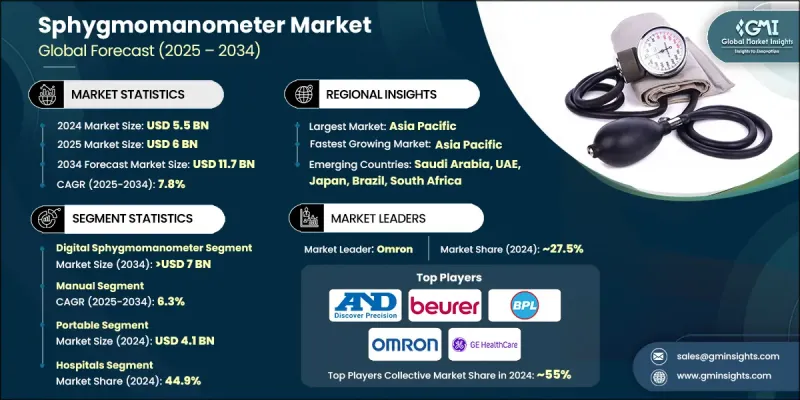

The Global Sphygmomanometer Market was valued at USD 5.5 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 11.7 billion by 2034.

This growth is fueled by the increasing global incidence of hypertension and cardiovascular conditions, the aging population, growing health awareness, and strong initiatives by governments promoting preventive care and early diagnosis. A major contributing factor is the surge in demand for home healthcare and remote monitoring solutions. Lifestyle shifts characterized by poor nutrition, physical inactivity, and elevated stress levels have intensified the prevalence of high blood pressure. As more individuals seek reliable and simple solutions to track their health, demand for user-friendly blood pressure monitors continues to rise. A sphygmomanometer is a medical device used to measure blood pressure and typically consists of a cuff, a pressure gauge, and an inflation mechanism, which may be manual or automated. The growing focus on self-monitoring and early detection has placed these devices at the center of modern healthcare trends, supporting both clinical applications and personal wellness tracking. A notable transformation in the market is the shift toward digital technology. Automated sphygmomanometers have gained significant traction due to advanced features such as internal memory, progress tracking, and wireless data transmission. These digital tools enable seamless integration with health apps and cloud-based systems, making it easier for users to manage their health and communicate readings with medical professionals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.5 Billion |

| Forecast Value | $11.7 Billion |

| CAGR | 7.8% |

The digital segment held a 56.7% share in 2024, owing to its user-friendliness, precise readings, and rapid uptake in personal and clinical environments. These devices use oscillometric measurement methods, which eliminate the need for manual auscultation, minimizing human error and allowing for more consistent readings. Additionally, the integration of Bluetooth and app compatibility has allowed for wider adoption in telemedicine and virtual healthcare models.

The manual sphygmomanometers segment is expected to grow at a CAGR of 6.3% through 2034. Despite the popularity of digital devices, manual monitors remain highly regarded in medical settings for their unmatched accuracy. They continue to be relied upon in clinical assessments, especially where auscultation is preferred for precise evaluation, such as in high-risk patient populations or clinical studies. These devices are also favored in healthcare environments that prioritize diagnostic reliability over convenience.

North America Sphygmomanometer Market is projected to grow at a CAGR of 5.3% through 2034, supported by a well-established healthcare system, high awareness of cardiovascular health, and growing consumer adoption of remote patient monitoring technologies. The region also benefits from favorable healthcare reimbursement policies that improve access to home monitoring devices. Regulatory agencies such as the FDA ensure product safety and performance, which supports market confidence and drives demand. Widespread insurance coverage, including Medicare and private plans, further supports the growth of home-use blood pressure monitors.

Key industry players leading the Global Sphygmomanometer Market include GE Healthcare, beurer, OMRON, BPL, ADC, ACCOSON, BOSCH + SOHN, PRESTIGE MEDICAL, SUNTECH, Riester, microlife, Little Doctor, Rossmax, Spengler, and AND. To strengthen their presence in the Global Sphygmomanometer Market, leading companies are focusing on several strategic moves. These include continuous product innovation, integrating advanced digital features like app connectivity and AI-based analytics, and expanding their global distribution networks. Many firms are investing in R&D to enhance accuracy, comfort, and usability, catering to both professional healthcare providers and home users. Strategic partnerships with telehealth platforms and healthcare institutions also play a key role in increasing adoption. Additionally, companies are tailoring product lines for various user needs from compact devices for travel to professional-grade monitors for clinics ensuring a strong foothold across multiple customer segments.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Operation trends

- 2.2.4 Configuration trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of hypertension and cardiovascular diseases

- 3.2.1.2 Government initiatives promoting preventive healthcare and early diagnosis

- 3.2.1.3 Technological advancements

- 3.2.1.4 Increasing demand for home healthcare and remote patient monitoring.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory approvals and compliance

- 3.2.3 Market opportunities

- 3.2.3.1 Expanding healthcare infrastructure in emerging economies

- 3.2.3.2 Adoption of digital sphygmomanometer

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological landscape

- 3.5.1 Current technologies

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Consumer behavior analysis

- 3.8 Number of cases of hypertension, by region, 2021 - 2024

- 3.8.1 North America

- 3.8.2 Europe

- 3.8.3 Asia Pacific

- 3.8.4 Latin America

- 3.8.5 MEA

- 3.9 Reimbursement scenario

- 3.10 Pipeline analysis

- 3.11 Investment landscape

- 3.12 Pricing analysis, 2024

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

- 3.15 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 North America

- 4.3.2 Europe

- 4.3.3 Asia Pacific

- 4.3.4 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Digital sphygmomanometer

- 5.2.1 Arm electronic sphygmomanometer

- 5.2.2 Wrist electronic sphygmomanometer

- 5.3 Aneroid sphygmomanometer

- 5.4 Mercury sphygmomanometer

Chapter 6 Market Estimates and Forecast, By Operation, 2021 - 2034 ($ Mn, Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Automatic

- 6.4 Semi-automatic

Chapter 7 Market Estimates and Forecast, By Configuration, 2021 - 2034 ($ Mn, Units)

- 7.1 Key trends

- 7.2 Portable

- 7.3 Desk mounted

- 7.4 Floor standing

- 7.5 Wall mounted

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Homecare

- 8.4 Ambulatory surgical centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ACCOSON

- 10.2 ADC

- 10.3 AND

- 10.4 beurer

- 10.5 BOSCH + SOHN

- 10.6 BPL

- 10.7 GE Healthcare

- 10.8 Little Doctor

- 10.9 microlife

- 10.10 Omron

- 10.11 PRESTIGE MEDICAL

- 10.12 Riester

- 10.13 rossmax

- 10.14 Spengler

- 10.15 SUNTECH