PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773232

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773232

Infant Formula Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

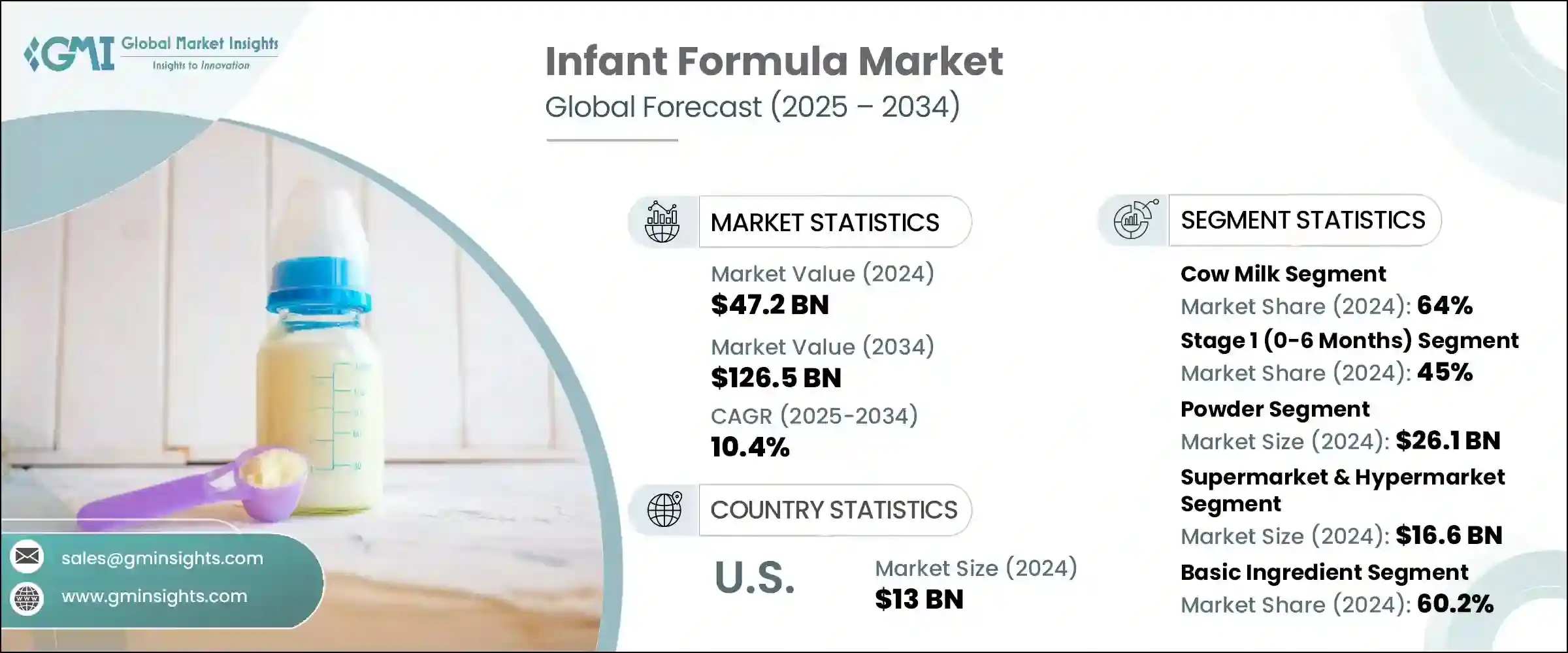

The Global Infant Formula Market was valued at USD 47.2 billion in 2024 and is estimated to grow at a CAGR of 10.4% to reach USD 126.5 billion by 2034. The growth is largely attributed to rising awareness around infant nutrition, the increasing number of working mothers, and higher birth rates, especially in developing nations. Urbanization, an increase in disposable income, and higher female workforce participation are also contributing factors to the market expansion. Additionally, parents are becoming more concerned with product safety, digestibility, and nutritional value, leading to a surge in demand for premium formulas, including organic, lactose-free, and hypoallergenic options.

Technological advancements in formula composition, like incorporating prebiotics, probiotics, HMOs (human milk oligosaccharides), and DHA/ARA, are further boosting the acceptance of these products. However, challenges remain, including the high cost of these products, complex regulations, and strong cultural preferences for breastfeeding, particularly in regions where public health campaigns are prevalent. Market growth is also limited by a lack of consumer trust in some markets due to fears about counterfeit formulas. There is a noticeable shift towards clean-label, organic, and plant-based formulas, as parents demand products free of synthetic additives, GMOs, and artificial sweeteners.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $47.2 Billion |

| Forecast Value | $126.5 Billion |

| CAGR | 10.4% |

In 2024, the cow milk-based formula segment commanded a 64% share and is expected to maintain steady growth with a CAGR of 10.4% through 2034. This formula remains the most preferred due to its nutritional profile, which is like breast milk, especially when fortified with DHA, ARA, and iron. Standard cow's milk formula is typically chosen for healthy, full-term infants who are not breastfed. Manufacturers have also developed varieties like partially and extensively hydrolyzed formulas to cater to infants with digestive issues or mild cow's milk intolerance.

Among different stages, the Stage 1 (for infants aged 0-6 months) segment holds the largest share, accounting for 45% in 2024. This segment is expected to see rapid growth, driven by a CAGR of 10.6% through 2034. At this critical stage of infancy, babies rely solely on breast milk or formula for nourishment as their digestive systems are still maturing. Stage 1 formulas are designed to be gentle on the stomach, containing essential nutrients like DHA, ARA, prebiotics, and iron to promote cognitive, immune, and digestive health. Regulatory bodies ensure that strict safety and efficacy standards are met for these products, thereby enhancing consumer confidence.

U.S. Infant Formula Market generated USD 13 billion in 2024 and is set to grow at a CAGR of 8.4% by 2034. The U.S. leads due to its high birth rates, advanced healthcare systems, widespread availability of infant formula, and strong brand loyalty. The market here is characterized by the increasing popularity of premium and speciality formulas, including organic, non-GMO, and plant-based options, as well as formulas enriched with HMOs and DHA/ARA.

Leading companies in this space include Nestle, Abbott Nutrition, Arla Food, Bellamy's Organic, and Bubs Australia, each vying for a stronger market presence. Infant formula companies have been adopting several strategic initiatives to strengthen their market position and expand their influence. They are focusing heavily on innovation, particularly in formula composition, by incorporating nutrients that closely mimic those found in breast milk, such as HMOs, DHA, ARA, and prebiotics. These improvements aim to enhance cognitive development, immunity, and digestive health for infants. Moreover, these companies are significantly increasing their investments in research and development to create new, more advanced products that cater to the growing demand for speciality formulas, such as lactose-free, organic, and hypoallergenic varieties.

The shift toward clean-label, non-GMO, and plant-based formulas is also being embraced to meet the preferences of health-conscious parents. Additionally, companies are enhancing their distribution networks, strengthening retail partnerships, and expanding in emerging markets to ensure the wider availability of their products. Leading brands are also focusing on building consumer trust by adhering to the highest safety standards and offering transparent product labeling, which is increasingly important in today's market.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Stage

- 2.2.4 Form

- 2.2.5 Distribution channel

- 2.2.6 Ingredient

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Nutritional Science & product development

- 3.13.1 Nutritional Requirements for Infants

- 3.13.1.1 Macronutrient requirements

- 3.13.1.1.1 Protein requirements

- 3.13.1.1.2 Carbohydrate requirements

- 3.13.1.1.3 Fat requirements

- 3.13.1.2 Micronutrient requirements

- 3.13.1.2.1 Vitamin requirements

- 3.13.1.2.2 Mineral requirements

- 3.13.1.3 Age-Specific nutritional needs

- 3.13.1.4 Special dietary requirements

- 3.13.1.1 Macronutrient requirements

- 3.13.2 Formula composition & standards

- 3.13.2.1 International standards

- 3.13.2.2 Regional variations

- 3.13.2.3 Quality specifications

- 3.13.2.4 Safety parameters

- 3.13.3 Functional ingredients innovation

- 3.13.3.1 Human Milk Oligosaccharides (HMO)

- 3.13.3.2 Probiotics & prebiotics

- 3.13.3.3 Long-Chain Polyunsaturated Fatty Acids

- 3.13.3.4 Nucleotides & growth factors

- 3.13.4 Product development process

- 3.13.4.1 Research & development

- 3.13.4.2 Clinical studies & trials

- 3.13.4.3 Regulatory approval process

- 3.13.4.4 Commercial launch

- 3.13.5 Nutritional claims & positioning

- 3.13.5.1 Health claims regulations

- 3.13.5.2 Scientific substantiation

- 3.13.5.3 Marketing communications

- 3.13.5.4 Consumer education

- 3.13.6 Future nutritional trends

- 3.13.6.1 Personalized nutrition

- 3.13.6.2 Microbiome research

- 3.13.6.3 Cognitive development support

- 3.13.6.4 Immune system enhancement

- 3.13.1 Nutritional Requirements for Infants

- 3.14 Manufacturing & quality control

- 3.14.1 Manufacturing process

- 3.14.1.1 Raw material preparation

- 3.14.1.2 Blending & mixing

- 3.14.1.3 Heat treatment

- 3.14.1.4 Spray drying

- 3.14.1.5 Packaging & sealing

- 3.14.2 Quality control systems

- 3.14.2.1 Good Manufacturing Practices (GMP)

- 3.14.2.2 Hazard Analysis Critical Control Points (HACCP)

- 3.14.2.3 Quality assurance testing

- 3.14.2.4 Batch testing protocols

- 3.14.3 Safety & contamination control

- 3.14.3.1 Microbiological safety

- 3.14.3.2 Chemical contaminant control

- 3.14.3.3 Physical hazard prevention

- 3.14.3.4 Allergen management

- 3.14.4 Equipment & technology

- 3.14.4.1 Processing equipment

- 3.14.4.2 Testing & analysis equipment

- 3.14.4.3 Packaging machinery

- 3.14.4.4 Automation & control systems

- 3.14.5 Supply chain management

- 3.14.5.1 Raw material sourcing

- 3.14.5.2 Supplier qualification

- 3.14.5.3 Inventory management

- 3.14.5.4 Cold chain management

- 3.14.6 Regulatory compliance

- 3.14.6.1 Manufacturing standards

- 3.14.6.2 Facility inspections

- 3.14.6.3 Documentation requirements

- 3.14.6.4 Recall procedures

- 3.14.1 Manufacturing process

- 3.15 Consumer behavior & market dynamics

- 3.15.1 Consumer demographics

- 3.15.1.1 Parental age groups

- 3.15.1.2 Income levels

- 3.15.1.3 Education levels

- 3.15.1.4 Geographic distribution

- 3.15.2 Purchase decision factors

- 3.15.2.1 Nutritional benefits

- 3.15.2.2 Brand trust & reputation

- 3.15.2.3 Price sensitivity

- 3.15.2.4 Healthcare provider recommendations

- 3.15.2.5 Convenience factors

- 3.15.3 Feeding patterns & preferences

- 3.15.3.1 Exclusive formula feeding

- 3.15.3.2 Mixed feeding (breast + formula)

- 3.15.3.3 Transitional feeding

- 3.15.3.4 Cultural feeding practices

- 3.15.4 Information sources & influences

- 3.15.4.1 Healthcare professionals

- 3.15.4.2 Online resources

- 3.15.4.3 Family & friends

- 3.15.4.4 Social media influence

- 3.15.5 Brand loyalty & switching behavior

- 3.15.5.1 Brand loyalty factors

- 3.15.5.2 Switching triggers

- 3.15.5.3 Trial & adoption patterns

- 3.15.5.4 Recommendation behavior

- 3.15.6 Regional consumer variations

- 3.15.6.1 North American consumers

- 3.15.6.2 European consumers

- 3.15.6.3 Asia-Pacific consumers

- 3.15.6.4 Other regional patterns

- 3.15.1 Consumer demographics

- 3.16 Marketing & distribution strategies

- 3.16.1 Marketing strategies

- 3.16.1.1 Brand positioning

- 3.16.1.1.1 Premium positioning

- 3.16.1.1.2 Value positioning

- 3.16.1.1.3 Specialty positioning

- 3.16.1.2 Target audience segmentation

- 3.16.1.3 Marketing channels

- 3.16.1.3.1 Healthcare professional engagement

- 3.16.1.3.2 Digital marketing

- 3.16.1.3.3 Traditional media

- 3.16.1.3.4 Educational programs

- 3.16.1.1 Brand positioning

- 3.16.2 Distribution strategies

- 3.16.2.1 Multi-channel distribution

- 3.16.2.2 Channel partner management

- 3.16.2.3 Geographic expansion

- 3.16.2.4 Market penetration strategies

- 3.16.3 Pricing strategies

- 3.16.3.1 Premium pricing

- 3.16.3.2 Competitive pricing

- 3.16.3.3 Value-based pricing

- 3.16.3.4 Regional pricing variations

- 3.16.4 Promotional activities

- 3.16.4.1 Healthcare professional programs

- 3.16.4.2 Consumer education campaigns

- 3.16.4.3 Sampling programs

- 3.16.4.4 Loyalty programs

- 3.16.5 Digital transformation

- 3.16.5.1 E-commerce strategies

- 3.16.5.2 Digital customer engagement

- 3.16.5.3 Data analytics & insights

- 3.16.5.4 Omnichannel integration

- 3.16.6 Regulatory marketing considerations

- 3.16.6.1 WHO code compliance

- 3.16.6.2 Advertising restrictions

- 3.16.6.3 Health claims regulations

- 3.16.6.4 Ethical marketing practices

- 3.16.1 Marketing strategies

- 3.17 Innovation & future trends

- 3.17.1 Current innovation trends

- 3.17.1.1 Functional ingredients

- 3.17.1.2 Organic & clean label

- 3.17.1.3 Personalized nutrition

- 3.17.1.4 Sustainable packaging

- 3.17.2 Emerging technologies

- 3.17.2.1 Precision nutrition

- 3.17.2.2 Microencapsulation

- 3.17.2.3 Novel processing technologies

- 3.17.2.4 Smart packaging

- 3.17.3 Research & development focus

- 3.17.3.1 Gut microbiome research

- 3.17.3.2 Cognitive development

- 3.17.3.3 Immune system support

- 3.17.3.4 Allergy prevention

- 3.17.4 Sustainability initiatives

- 3.17.4.1 Sustainable sourcing

- 3.17.4.2 Carbon footprint reduction

- 3.17.4.3 Circular economy principles

- 3.17.4.4 Environmental impact mitigation

- 3.17.5 Digital innovation

- 3.17.5.1 Smart feeding solutions

- 3.17.5.2 Mobile applications

- 3.17.5.3 IoT integration

- 3.17.5.4 AI-Powered recommendations

- 3.17.6 Future market trends

- 3.17.6.1 Market consolidation

- 3.17.6.2 Premium segment growth

- 3.17.6.3 Emerging market expansion

- 3.17.6.4 Regulatory evolution

- 3.17.1 Current innovation trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trend

- 5.2 Cow's milk-based formula

- 5.2.1 Standard cow's milk formula

- 5.2.2 Partially hydrolyzed formula

- 5.2.3 Extensively hydrolyzed formula

- 5.3 Soy-based formula

- 5.4 Protein hydrolysate formula

- 5.5 Specialty formula

- 5.5.1 Premature infant formula

- 5.5.2 Anti-reflux formula

- 5.5.3 Lactose-free formula

- 5.5.4 Amino acid-based formula

- 5.5.5 Other specialty formulas

- 5.6 Organic formula

- 5.7 Goat milk-based formula

Chapter 6 Market Estimates & Forecast, By Stage, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trend

- 6.2 Stage 1 (0–6 months)

- 6.3 Stage 2 (6–12 months)

- 6.4 Stage 3 (12–24 months)

- 6.5 Stage 4 (24+ months)

Chapter 7 Market Estimates & Forecast, By Form, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trend

- 7.2 Powder

- 7.3 Liquid concentrate

- 7.4 Ready-to-feed

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trend

- 8.2 Supermarkets & Hypermarkets

- 8.3 Pharmacies & Drug Stores

- 8.4 Online Retail

- 8.4.1 E-commerce Platforms

- 8.4.2 Direct-to-Consumer Websites

- 8.5 Specialty Baby Stores

- 8.6 Hospitals & Clinics

- 8.7 Convenience Stores

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Ingredient, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trend

- 9.2 Basic Ingredients

- 9.2.1 Proteins

- 9.2.1.1 Whey Protein

- 9.2.1.2 Casein

- 9.2.1.3 Soy Protein

- 9.2.2 Carbohydrates

- 9.2.2.1 Lactose

- 9.2.2.2 Corn Syrup Solids

- 9.2.2.3 Other Carbohydrates

- 9.2.3 Fats & Oils

- 9.2.3.1 Vegetable Oils

- 9.2.3.2 DHA & ARA

- 9.2.1 Proteins

- 9.3 Functional Ingredients

- 9.3.1 Prebiotics

- 9.3.2 Probiotics

- 9.3.3 Human Milk Oligosaccharides (HMO)

- 9.3.4 Nucleotides

- 9.4 Vitamins & Minerals

- 9.4.1 Vitamins

- 9.4.2 Minerals

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East & Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East & Africa

Chapter 11 Company Profiles

- 11.1 Abbott Nutrition

- 11.2 Arla Food

- 11.3 Bellamy's Organic

- 11.4 BUBS Australia

- 11.5 Hero Group

- 11.6 Mead Johnson Nutrition

- 11.7 Nestle

- 11.8 Nutricia

- 11.9 The Kraft Heinz Company

- 11.10 Danone S.A.

- 11.11 Reckitt Benckiser Group plc (Mead Johnson)

- 11.12 Perrigo Company plc