PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913440

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913440

Oxo Alcohol Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

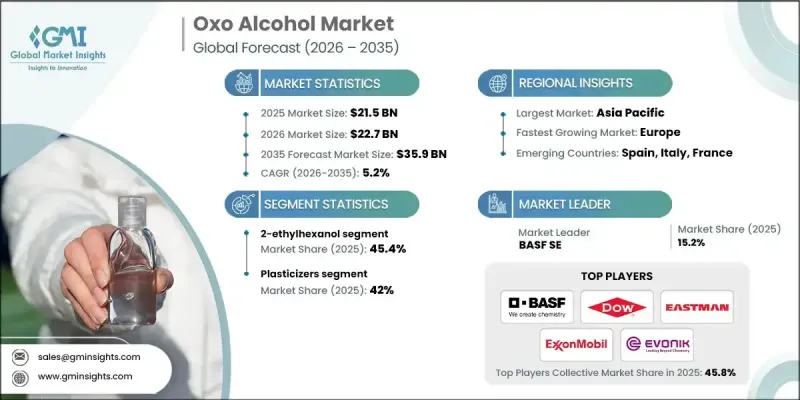

The Global Oxo Alcohol Market was valued at USD 21.5 billion in 2025 and is estimated to grow at a CAGR of 5.2% to reach USD 35.9 billion by 2035.

The market is witnessing steady growth as oxo alcohols continue to play a vital role across multiple downstream manufacturing chains. Demand is being reinforced by sustained expansion across several high-volume industrial sectors, supported by rising consumption of finished goods worldwide. Increasing emphasis on product performance, material efficiency, and compliance with evolving environmental standards is shaping purchasing behavior and encouraging broader adoption. Manufacturers are increasingly focused on developing formulations aligned with sustainability goals, which is strengthening long-term demand patterns. Regulatory pressure to reduce harmful chemical usage has further accelerated innovation, opening new growth avenues for oxo alcohol-based solutions. At the same time, industrialization and infrastructure development across emerging economies are contributing to higher consumption levels. Growing awareness around responsible production and material sourcing is also influencing market dynamics, as producers invest in cleaner processes and improved operational efficiencies. These combined factors continue to support stable market expansion while reinforcing the strategic importance of oxo alcohols in global chemical value chains.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $21.5 Billion |

| Forecast Value | $35.9 Billion |

| CAGR | 5.2% |

The 2-ethylhexanol accounted for 45.4% share in 2025 and is expected to grow at a CAGR of 5.7% through 2035. Its dominance is supported by consistent demand across multiple industrial applications, driven by favorable performance characteristics and broad compatibility with diverse formulations. Stable consumption trends from large-scale manufacturing sectors continue to underpin segment growth.

The plasticizers segment held a 42% share in 2025. Oxo alcohols remain essential to plasticizer production due to their ability to enhance material flexibility, durability, and processing efficiency. The ongoing shift toward safer and more sustainable material solutions is driving reformulation efforts, supporting continued demand within this segment.

North America Oxo Alcohol Market is projected to grow at a CAGR of 5% from 2026 to 2035. Growth in the region is supported by stringent emission regulations, increased adoption of low-emission materials, and rising investments in sustainable production practices. Innovation in renewable feedstocks and waste reduction technologies is further influencing regional market momentum.

Key companies operating in the Global Oxo Alcohol Market include ExxonMobil Corporation, BASF SE, SABIC, Dow Chemical Company, Evonik Industries AG, LG Chem, INEOS, Eastman Chemical Company, Sasol Limited, Grupa Azoty, Hanwha Chemical Corporation, and Andhra Petrochemicals Limited. Companies in the Global Oxo Alcohol Market are reinforcing their market position through capacity expansions, process optimization, and strategic investments in sustainable manufacturing technologies. A strong focus on improving production efficiency and reducing environmental impact is shaping corporate strategies. Firms are actively diversifying product portfolios to meet evolving regulatory and customer requirements while strengthening long-term supply agreements with downstream industries. Investments in research and development are supporting innovation in formulation performance and alternative feedstocks. Additionally, players are enhancing regional presence through strategic partnerships and infrastructure upgrades to improve supply reliability. A

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 End Use industry

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for consumer products and personal care items

- 3.2.1.2 Growth in the automotive and construction industries

- 3.2.1.3 Rising focus on sustainable and eco-friendly production practices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Volatility in raw material prices and supply chain disruptions

- 3.2.2.2 Stringent environmental regulations on VOC emission

- 3.2.3 Market opportunities

- 3.2.3.1 Bio-based oxo alcohols market development

- 3.2.3.2 Emerging applications in specialty chemicals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 N-butanol

- 5.3 2-ethylhexanol

- 5.4 Iso-butanol

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Plasticizers

- 6.2.1 Phthalate plasticizers

- 6.2.2 Non-phthalate plasticizers

- 6.3 Acrylate

- 6.3.1 N-butyl acrylate

- 6.3.2 2-ethylhexyl acrylate

- 6.3.3 Methyl methacrylate (MMA)

- 6.4 Acetate

- 6.4.1 N-butyl acetate

- 6.4.2 Isobutyl acetate

- 6.4.3 Oxo-alcohol acetates (C6-C13)

- 6.5 Glycol ether

- 6.5.1 Butyl glycol ethers

- 6.5.2 2-butoxyethanol

- 6.5.3 Ethylene glycol & propylene glycol ethers

- 6.6 Solvents

- 6.6.1 Industrial solvents

- 6.6.2 Specialty solvents

- 6.7 Adhesives

- 6.8 Lube oil additive

- 6.9 Others

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Construction

- 7.3 Automotive

- 7.4 Packaging

- 7.5 Paint & coatings

- 7.6 Consumer goods

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 BASF SE

- 9.2 Andhra Petrochemicals Limited

- 9.3 Dow Chemical Company

- 9.4 Eastman Chemical Company

- 9.5 Evonik Industries AG

- 9.6 ExxonMobil Corporation

- 9.7 Grupa Azoty

- 9.8 Hanwha Chemical Corporation

- 9.9 INEOS

- 9.10 LG Chem

- 9.11 SABIC

- 9.12 Sasol Limited