PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928949

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928949

Industrial Pasteurizers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

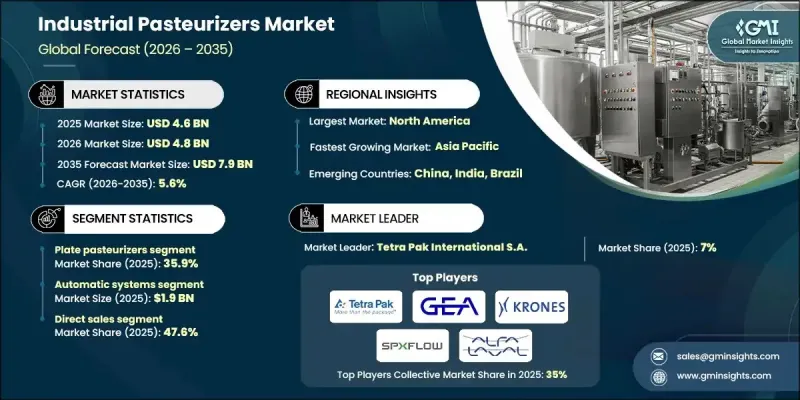

The Global Industrial Pasteurizers Market was valued at USD 4.6 billion in 2025 and is estimated to grow at a CAGR of 5.6% to reach USD 7.9 billion by 2035.

Market expansion is supported by rising awareness around food safety, operational efficiency, and sustainable processing practices. Growing consolidation activity among leading manufacturers is also influencing the competitive landscape, as mergers and acquisitions are strengthening innovation capabilities and expanding product offerings. At the same time, traditional manual heat treatment processes are increasingly viewed as inefficient and environmentally burdensome. Modern thermal processing solutions are gaining preference due to their ability to minimize energy usage and reduce environmental impact through advanced heat recovery and regenerative systems. These technologies align closely with the sustainability goals adopted across the liquid food production industry. Demand for automated liquid processing and aseptic filling facilities continues to rise in North America, while increasing investments in food and beverage infrastructure across Europe and parts of the Asia Pacific region are improving the commercial viability of industrial pasteurization equipment in local markets.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $4.6 Billion |

| Forecast Value | $7.9 Billion |

| CAGR | 5.6% |

The plate-based pasteurizers segment held 35.9% share in 2025. These systems remain widely adopted due to their ability to handle large processing volumes while maintaining efficient heat transfer and reduced energy consumption, particularly in liquid food production environments.

The automatic pasteurization systems segment accounted for 42.3% share in 2025 and generated USD 1.9 billion. Automation is increasingly favored as it enhances throughput, improves operational safety, and lowers labor dependency. Advanced control technologies are improving system accuracy and reliability, supporting compliance with strict quality and safety standards across regulated industries.

U.S. Industrial Pasteurizers Market held 5.8% CAGR through 2035, supported by strong investments in automated food processing and the expansion of premium beverage production. Pasteurization equipment plays a critical role in large-scale dairy distribution networks, where automated high-speed processing solutions are seeing increased adoption.

Leading companies active in the Global Industrial Pasteurizers Market include Tetra Pak International S.A., GEA Group AG, Alfa Laval AB, SPX FLOW, Inc., Krones AG, Sidel, JBT Corporation, KHS Group, Paul Mueller Company, Feldmeier Equipment, Inc., Milkron GmbH, HRS Heat Exchangers, IDMC Limited, Dion Engineering, and Hiperbaric. Companies operating in the Industrial Pasteurizers Market are reinforcing their market positions through technology upgrades, strategic partnerships, and portfolio diversification. Manufacturers are investing in energy-efficient designs and automation-ready systems to meet evolving customer requirements. Expansion into emerging markets and localized manufacturing strategies are helping improve market reach and cost competitiveness. Continuous investment in research and development is enabling companies to enhance system performance, reliability, and compliance with food safety standards.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Operation

- 2.2.4 Technology

- 2.2.5 Capacity

- 2.2.6 Application

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surge in clean-label and functional beverages

- 3.2.1.2 Strict food safety and FSMA regulations

- 3.2.1.3 Sustainability and thermal efficiency

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial CAPEX & long ROI

- 3.2.2.2 Complexity of retrofitting legacy sites

- 3.2.3 Opportunities

- 3.2.3.1 Digital twins and real-time monitoring

- 3.2.3.2 Hybrid and modular pasteurization units

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter';s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Plate pasteurizers

- 5.3 Tunnel pasteurizers

- 5.4 Batch pasteurizers

- 5.5 HTST (high temperature short time) systems

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Operation, 2022 - 2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Automatic

Chapter 7 Market Estimates and Forecast, By Technology, 2022 - 2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Electric pasteurizers

- 7.3 Gas pasteurizers

- 7.4 Steam pasteurizers

Chapter 8 Market Estimates and Forecast, By Capacity, 2022 - 2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Below 1000 litres

- 8.3 Between 1000-5000 litres

- 8.4 Above 5000 litres

Chapter 9 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Dairy industry

- 9.2.1 Milk and cream

- 9.2.2 Cheese production

- 9.2.3 Yogurt manufacturing

- 9.2.4 Ice cream processing

- 9.3 Beverage industry

- 9.3.1 Alcoholic beverage

- 9.3.2 Non-Alcoholic beverage

- 9.4 Food processing

- 9.5 Others (pharmaceuticals, pet food, etc.)

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Alfa Laval AB

- 12.2 Dion Engineering

- 12.3 Feldmeier Equipment, Inc.

- 12.4 GEA Group AG

- 12.5 Hiperbaric

- 12.6 HRS Heat Exchangers

- 12.7 IDMC Limited

- 12.8 JBT Corporation

- 12.9 KHS Group

- 12.10 Krones AG

- 12.11 Milkron GmbH

- 12.12 Paul Mueller Company

- 12.13 Sidel

- 12.14 SPX FLOW, Inc.

- 12.15 Tetra Pak International S.A.