PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1664886

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1664886

Diesel Common Rail Injection System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

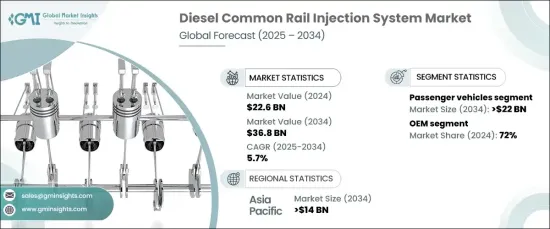

The Global Diesel Common Rail Injection System Market, valued at USD 22.6 billion in 2024, is expected to experience robust growth at a CAGR of 5.7% from 2025 to 2034. This growth is primarily driven by increasingly stringent emission regulations designed to reduce harmful pollutants like nitrogen oxides (NOx) and particulate matter. Governments across the globe are enforcing stricter standards, urging manufacturers to adopt advanced fuel injection technologies to meet compliance.

The rising demand for fuel-efficient, high-performance diesel engines further accelerates market expansion. Diesel common rail injection systems enhance fuel delivery, optimize combustion efficiency, and reduce emissions, aligning perfectly with evolving regulatory frameworks. As a result, these systems have become essential in modern diesel engines, ensuring not only compliance with stringent standards but also improved engine power and efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $22.6 Billion |

| Forecast Value | $36.8 Billion |

| CAGR | 5.7% |

The market is divided into two key categories: passenger vehicles and commercial vehicles. Passenger vehicles currently dominate, holding a 60% share in 2024, and are expected to reach USD 22 billion by 2034. Their widespread adoption, particularly in regions where diesel engines are favored for long-distance travel and superior fuel efficiency, fuels this dominance.

Sales channels in the market include both OEM (Original Equipment Manufacturer) and aftermarket segments. OEMs led the market with a 72% share in 2024, benefiting from close collaborations with automakers to integrate advanced injection systems directly into new vehicles. By prioritizing compliance with stringent emission standards and focusing on enhancing engine performance, OEMs are at the forefront of innovation in fuel-efficient technologies.

In the Asia Pacific region, the diesel common rail injection system market accounted for 35% of the global share in 2024 and is projected to reach USD 14 billion by 2034. This growth is driven by rapid industrialization, a booming automotive manufacturing sector, and increasing demand for commercial vehicles. Manufacturers in this region are increasingly adopting advanced injection systems to meet rigorous environmental regulations, fostering further innovation and widespread adoption.

The diesel common rail injection system market is poised for steady growth in the coming years as both regulatory pressures and fuel efficiency demands continue to rise. Ongoing investments in cleaner technologies, along with the global push toward reducing vehicle emissions, will drive further advancements in diesel injection systems. With strong demand across both the passenger and commercial vehicle sectors, the market is expected to experience significant expansion through 2034 and beyond.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component suppliers

- 3.2.2 System integrators

- 3.2.3 Engine manufacturers

- 3.2.4 Vehicle manufacturers

- 3.2.5 Aftermarket suppliers

- 3.3 Profit margin analysis

- 3.4 Cost breakdown analysis

- 3.5 Patent landscape

- 3.6 Technology & innovation landscape

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Stricter emission regulations worldwide

- 3.9.1.2 Increasing demand for fuel efficiency and performance

- 3.9.1.3 Growth in automotive manufacturing, particularly in Asia-Pacific and developing regions

- 3.9.1.4 Technological advancements in fuel injectors, such as piezoelectric injectors

- 3.9.1.5 The growing emphasis on vehicle safety

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Rising popularity of electric vehicles

- 3.9.2.2 CRDI systems are complex and require precise calibration and maintenance

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Fuel Injector, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Solenoid

- 5.3 Piezoelectric

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Diesel

- 7.3 Bio-diesel

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 BorgWarner

- 10.2 Continental

- 10.3 Cummins

- 10.4 Denso

- 10.5 Federal-Mogul Powertrain

- 10.6 FPT Industrial

- 10.7 Hella KGaA

- 10.8 Hitachi Automotive Systems

- 10.9 Hyundai Kefico

- 10.10 Isuzu Motors

- 10.11 Liebherr Group

- 10.12 Magneti Marelli

- 10.13 Mahle

- 10.14 Perkins Engines

- 10.15 Robert Bosch

- 10.16 Siemens

- 10.17 Stanadyne

- 10.18 Weichai Power

- 10.19 Woodward

- 10.20 Yanmar Co.