PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665047

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665047

EV EMC Battery Filter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

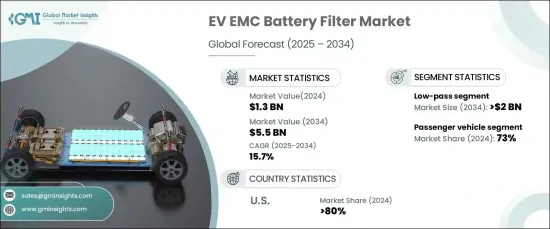

The Global EV EMC Battery Filter Market, valued at USD 1.3 billion in 2024, is projected to experience remarkable growth with a CAGR of 15.7% from 2025 to 2034. This surge is driven by the rising adoption of electric vehicles (EVs) worldwide, supported by stricter environmental policies and government incentives designed to accelerate EV usage. As the demand for EVs continues to grow, the need for advanced electromagnetic compatibility (EMC) battery filter solutions is expanding significantly.

Safety concerns and stringent automotive regulatory standards are further propelling the market. The increasing integration of advanced electronic components in EVs makes compliance with EMC requirements essential to ensure systems remain protected from electromagnetic interference (EMI). Regulatory bodies like the International Electrotechnical Commission (IEC) and ISO have established rigorous performance standards to enhance the safety and reliability of EV systems. These regulatory demands are driving innovation and adoption in the EMC battery filter sector, fostering a robust market outlook.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $5.5 Billion |

| CAGR | 15.7% |

The market is segmented by filter type, including low-pass, high-pass, band-pass, and band-stop filters. In 2024, low-pass filters held a dominant 40% market share and are anticipated to grow to USD 2 billion by 2034. Low-pass filters are critical in mitigating high-frequency EMI, which can disrupt sensitive EV components such as battery management systems and powertrains. As EV designs incorporate increasingly sophisticated electronics-spanning sensors, control systems, and communication technologies-the demand for low-pass filters continues to rise. These filters improve system performance and reliability by letting low-frequency signals to pass through while blocking disruptive high-frequency noise.

By vehicle type, passenger vehicles led the market in 2024, capturing a commanding 73% share. The rapid adoption of EVs in personal transportation is driven by heightened environmental awareness and stringent emissions regulations. As consumers transition to electric mobility, the demand for EMC battery filters to ensure optimal performance and safety in passenger vehicles is increasing.

In the United States, the EV EMC battery filter market accounted for 80% of the regional share in 2024. This growth is attributed to robust government support for EV adoption, including tax credits, subsidies, and investments in EV infrastructure development. Regulatory agencies enforcing strict emissions and safety standards further boost the demand for advanced EMC solutions, ensuring compliance and seamless functionality in electric vehicles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material providers

- 3.1.2 Component providers

- 3.1.3 Manufacture

- 3.1.4 Distributors

- 3.1.5 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Cost analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Growing demand for electric vehicles

- 3.9.1.2 Stringent regulatory standards for EMC

- 3.9.1.3 Advancements in EV battery technology

- 3.9.1.4 Increased focus on power efficiency and noise reduction

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Complex regulatory compliance

- 3.9.2.2 Integration challenges with existing EV systems

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Filter, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Low-pass

- 5.3 High-pass

- 5.4 Band-pass

- 5.5 Band-stop

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Powertrain EMC filtering

- 6.3 Battery management system

- 6.4 Charging infrastructure

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicle

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial Vehicle

- 7.3.1 Light Commercial Vehicles (LCVs)

- 7.3.2 Heavy Commercial Vehicles (HCVs)

Chapter 8 Market Estimates & Forecast, By Battery, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Lead acid battery

- 8.3 Lithium-ion battery

- 8.4 Nickel metal hydride battery

- 8.5 Solid-state battery

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 AstrodyneTDI

- 10.2 AVX

- 10.3 Bourns

- 10.4 Cooper

- 10.5 Delta

- 10.6 Eaton

- 10.7 Epcos

- 10.8 InTiCa

- 10.9 KEMET

- 10.10 Littelfuse

- 10.11 MAHLE

- 10.12 Molex

- 10.13 Mouse

- 10.14 Murata

- 10.15 NXP

- 10.16 STMicroelectronics

- 10.17 TDK

- 10.18 TE Connectivity

- 10.19 Vishay

- 10.20 Wurth Elektronik