PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665277

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665277

Down Alternative Mattresses Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

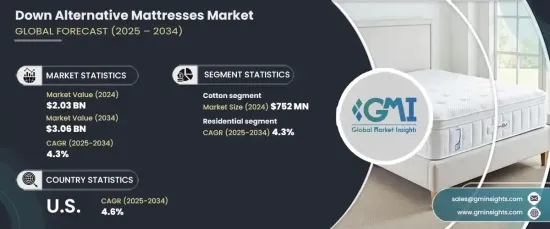

The Global Down Alternative Mattresses Market was valued at USD 2.03 billion in 2024 and is projected to grow at a steady CAGR of 4.3% from 2025 to 2034. This growth is driven by a rising consumer preference for hypoallergenic and sustainable bedding solutions, particularly among individuals with allergies or sensitivities. As more shoppers seek alternatives to traditional down and feather materials, the demand for down alternative mattresses continues to surge.

When categorized by materials, the market includes wool, cotton, polyester, bamboo, silk, and others. Among these, the cotton segment emerged as the market leader in 2024, generating USD 752 million in revenue and projected to grow at a CAGR of 4.5% through 2034. Cotton's natural hypoallergenic properties make it a preferred choice for consumers with sensitivities, as it resists common allergens like dust mites. This makes it particularly appealing to health-conscious shoppers. Additionally, the growing trend toward eco-friendly and sustainable products has amplified the popularity of cotton-based mattresses. With an increasing emphasis on organic cotton sourced from sustainable farms, consumers are aligning their bedding choices with environmentally conscious purchasing behaviors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.03 Billion |

| Forecast Value | $3.06 Billion |

| CAGR | 4.3% |

The market is further segmented by end-use into residential and commercial categories. The residential sector dominated in 2024, accounting for a 79% market share, and is expected to maintain a CAGR of 4.3% over the forecast period. Households, especially those with allergy-prone individuals, are turning to down alternative mattresses for their hypoallergenic benefits. These mattresses are a popular choice for creating allergen-free sleep environments, catering to the growing consumer focus on wellness and luxury within personalized living spaces. The increasing demand for high-quality yet affordable bedding solutions is propelling the adoption of down alternative mattresses in homes worldwide.

In the U.S., the down alternative mattress market generated USD 615 million in 2024 and is forecasted to expand at a CAGR of 4.6% between 2025 and 2034. Growing awareness of allergies and sensitivities is driving American consumers toward hypoallergenic bedding options. The shift to down alternative mattresses, which offer the comfort of traditional materials without the associated animal-based allergens, underscores a broader preference for bedding that enhances sleep hygiene and overall well-being.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis.

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for hypoallergenic products

- 3.6.1.2 Rising awareness of sustainable materials

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Limited market awareness

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021-2034 (USD Million) (Million Units)

- 5.1 Key trends

- 5.2 Wool

- 5.3 Cotton

- 5.4 Polyester

- 5.5 Bamboo

- 5.6 Silk

- 5.7 Others (kapok, etc.)

Chapter 6 Market Estimates & Forecast, By Size, 2021-2034 (USD Million) (Million Units)

- 6.1 Key trends

- 6.2 Twin or single size

- 6.3 Twin XL size

- 6.4 Full or double size

- 6.5 Queen size

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Price Range, 2021-2034 (USD Million) (Million Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Firmness Level, 2021-2034 (USD Million) (Million Units)

- 8.1 Key trends

- 8.2 Soft

- 8.3 Medium

- 8.4 Firm

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million) (Million Units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.3.1 Hotel

- 9.3.2 Hospital

- 9.3.3 Others (educational institutions, etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Million Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce website

- 10.2.2 Company owned website

- 10.3 Offline

- 10.3.1 Hypermarket/supermarket

- 10.3.2 Specialized stores

- 10.3.3 Other retail stores

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Avocado Green Mattress, LLC

- 12.2 Brooklyn Bedding, LLC

- 12.3 Casper Sleep Inc.

- 12.4 DreamCloud (Resident Home LLC)

- 12.5 Helix Sleep, Inc.

- 12.6 Layla Sleep

- 12.7 Nest Bedding, Inc.

- 12.8 Puffy Mattress

- 12.9 Purple Innovation, Inc.

- 12.10 Saatva Inc.

- 12.11 Serta Simmons Bedding, LLC

- 12.12 Signature Sleep

- 12.13 Sleep Number Corporation

- 12.14 Tempur Sealy International, Inc.

- 12.15 Tuft & Needle