PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665378

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665378

Agriculture Fertilizer Spreader Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

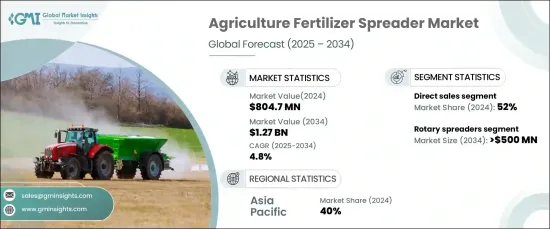

The Global Agriculture Fertilizer Spreader Market, valued at USD 804.7 million in 2024, is projected to grow at a 4.8% CAGR from 2025 to 2034. This expansion is driven by the rising global demand for food, necessitated by population growth. As urbanization and environmental challenges reduce arable land, efficient farming techniques become essential. Fertilizer spreaders play a critical role by applying nutrients precisely, minimizing waste, and boosting crop yields. This efficiency also aligns with sustainability objectives, reducing environmental impact while improving food production. Challenges like soil degradation, climate change, and poor agricultural practices exacerbate the need for such advanced tools, which address soil erosion and nutrient loss. Modern fertilizer spreaders, featuring advanced technologies like variable rate application and soil monitoring, are indispensable for ensuring global food security and optimizing agricultural output.

Government initiatives promoting agricultural modernization further bolster market growth. Subsidies, grants, and financial incentives encourage farmers to adopt advanced equipment like fertilizer spreaders. For instance, a significant portion of budgets in agrarian economies is allocated to food and fertilizer subsidies, underscoring the commitment to modernizing agriculture. These financial aids not only support the initial investment in advanced tools but also help small-scale farmers overcome economic barriers, fostering broader adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $804.7 Million |

| Forecast Value | $1.27 Billion |

| CAGR | 4.8% |

The market is segmented based on spreader types, including rotary, dry, drop, pendulum, and liquid spreaders. Among these, rotary spreaders held a dominant market share of over 40% in 2024, with projections exceeding USD 500 million by 2034. Their popularity stems from their ability to cover large areas efficiently and handle diverse fertilizer types. This adaptability makes them suitable for various agricultural applications, enhancing their demand across the farming sector.

The distribution of fertilizer spreaders occurs through direct sales, retail, and online platforms, with direct sales leading the market at 52% in 2024. Farmers favor direct sales due to personalized consultations and tailored solutions that ensure the right equipment for their needs. These channels also facilitate after-sales services, warranties, and flexible financing options like leasing and installment plans, enabling easier access for farmers, particularly in developing regions.

Asia Pacific dominated the market with a 40% share in 2024, led by countries like China. The region is experiencing rapid agricultural mechanization to address labor shortages and increasing food demands. Fertilizer spreaders are integral to improving productivity supported by government policies and initiatives aimed at modernizing farming practices. The adoption of precision farming techniques and sustainable practices further accelerates the demand for these tools, ensuring efficient resource use and reduced environmental impact.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material and component suppliers

- 3.1.2 Manufacturers

- 3.1.3 Technology providers

- 3.1.4 Distributors

- 3.1.5 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Pricing analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing global food demand necessitates efficient agricultural practices

- 3.9.1.2 Adoption of precision agriculture technologies such as GPS-enabled spreaders

- 3.9.1.3 Sustainability efforts drive demand for efficient fertilizer application tools

- 3.9.1.4 Government subsidies and support for modern farming equipment

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial costs of advanced fertilizer spreaders

- 3.9.2.2 Lack of awareness and technical expertise among small-scale farmers

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Spreader, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Rotary spreaders

- 5.3 Dry spreaders

- 5.4 Drop spreaders

- 5.5 Pendulum spreaders

- 5.6 Liquid spreaders

Chapter 6 Market Estimates & Forecast, By Fertilizer, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Granular fertilizers

- 6.3 Liquid fertilizers

- 6.4 Organic fertilizers

- 6.5 Chemical fertilizers

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Manual

- 7.3 Hydraulic

- 7.4 GPS-enabled

- 7.5 Variable rate technology (VRT)

- 7.6 Wireless communication systems

Chapter 8 Market Estimates & Forecast, By Power Source, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Tractor-mounted

- 8.3 Self-propelled

- 8.4 Hand-pushed

- 8.5 ATV/UTV mounted

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Row crops

- 9.3 Orchards

- 9.4 Commercial lawns & gardens

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Retail

- 10.4 Online platforms

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 AGCO

- 12.2 Bogballe

- 12.3 Bredal

- 12.4 Claas

- 12.5 CNH Industrial

- 12.6 Dalton

- 12.7 Fertilizer Equipment Specialists

- 12.8 IRIS Spreaders

- 12.9 John Deere

- 12.10 Kasco Manufacturing

- 12.11 Kubota

- 12.12 Kuhn

- 12.13 Kverneland

- 12.14 Mahindra & Mahindra

- 12.15 Maschio Gaspardo

- 12.16 Monosem

- 12.17 Rauch Landmaschinenfabrik

- 12.18 Sulky Burel

- 12.19 Techint

- 12.20 Vicon