PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665402

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665402

Automotive Belt Starter Generator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

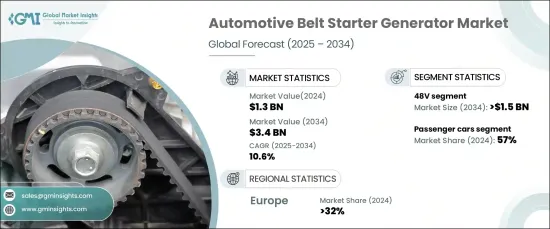

The Global Automotive Belt Starter Generator Market was valued at USD 1.3 billion in 2024 and is anticipated to grow at a CAGR of 10.6% from 2025 to 2034. The increasing demand for 48V systems, known for their superior performance and affordability, is propelling the adoption of BSG systems, particularly in mild-hybrid vehicles. These systems outperform traditional 12V counterparts by delivering higher power output, which boosts the efficiency of mild-hybrid powertrains. They also enhance regenerative braking capabilities, capturing and storing more energy during braking to optimize fuel efficiency. By reducing the engine's workload and enabling better energy management, these systems contribute significantly to sustainability in transportation.

The shift towards hybrid and electric vehicles also plays a critical role in driving the BSG market. Automakers are integrating these systems to align with stricter emissions regulations and meet the growing demand for eco-friendly mobility solutions. BSG systems, which combine starter motor and generator functions, are vital components in hybrid and electric powertrains. They improve energy utilization, support regenerative braking, and enhance overall vehicle performance, making them a key innovation in the transition to greener automotive technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $3.4 Billion |

| CAGR | 10.6% |

The market is segmented by product into 12V and 48V systems. In 2024, the 48V segment accounted for over 58% of the market share and is projected to surpass USD 1.5 billion by 2034. These systems are preferred due to their ability to deliver additional electrical power for critical vehicle functions like electric power steering, air conditioning, and regenerative braking. They ensure smoother acceleration, improved fuel economy, and more effective energy recovery, positioning themselves as the ideal choice for automakers addressing stringent emissions standards.

In terms of vehicle type, the market is categorized into passenger cars, off-highway vehicles, and commercial vehicles. Passenger cars held approximately 57% of the market share in 2024. These vehicles leverage 48V BSG systems to achieve better fuel efficiency and reduced emissions, catering to consumers seeking cost-effective solutions without transitioning fully to electric vehicles. Features like start-stop functionality, regenerative braking, and additional torque for internal combustion engines make these systems highly attractive for the passenger car segment, further driving their market penetration.

Europe emerged as the leading region, capturing more than 32% of the global market share in 2024, with Germany being a significant contributor. The country's robust automotive sector, featuring key players heavily investing in hybrid and electric vehicle technologies, supports this dominance. Strict regulations to curb CO2 emissions and a focus on sustainable transportation have led to widespread adoption of 48V BSG systems among automakers, reinforcing Germany's leadership in the market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Automotive OEMs

- 3.2.2 Technology providers

- 3.2.3 Aftermarket and service providers

- 3.2.4 End users

- 3.3 Profit margin analysis

- 3.4 Cost breakdown analysis

- 3.5 Technology & innovation landscape

- 3.6 Key news & initiatives

- 3.7 Pricing analysis

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising implementation of stringent emission regulations

- 3.9.1.2 Growing demand for fuel efficiency

- 3.9.1.3 Increasing adoption of hybrid and electric vehicles

- 3.9.1 Growth drivers

3.9.1.4. Improved performance and cost-effectiveness of 48 V systems

- 3.9.1.5 Technological advancements in belt starter generator design

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Technological and integration challenges

- 3.9.2.2 Competition from full hybrid and electric powertrains

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Mild hybrid

- 5.3 Micro hybrid

Chapter 6 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 12V

- 6.3 48V

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 Sedan

- 7.2.2 SUV

- 7.2.3 Hatchback

- 7.3 Commercial vehicle

- 7.3.1 LCV

- 7.3.2 HCV

- 7.4 Off highway vehicle

Chapter 8 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Motor/generator

- 8.3 Power electronics

- 8.4 Mechanical coupling

- 8.5 Control systems

Chapter 9 Market Estimates & Forecast, By Cooling Type, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Air-cooled

- 9.3 Liquid-cooled

- 9.4 Hybrid-cooled

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Bosch

- 12.2 Continental

- 12.3 Dayco

- 12.4 Hyundai

- 12.5 Infineon

- 12.6 Magneti Marelli

- 12.7 MTA

- 12.8 Nexteer

- 12.9 Onsemi

- 12.10 Schaeffler Group

- 12.11 SEG Automotive

- 12.12 Sona Comstar

- 12.13 Syensqo

- 12.14 Valeo

- 12.15 Vitesco Technologies

- 12.16 ZF Friedrichshafen