PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666637

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666637

Marine Diesel Engines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

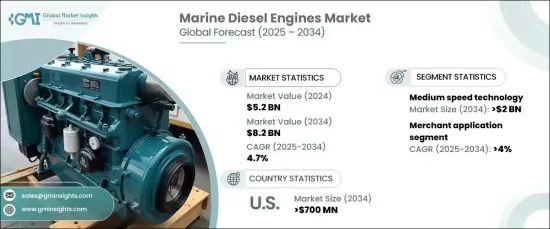

The Global Marine Diesel Engines Market is projected to grow significantly, with its value estimated at USD 5.2 billion in 2024 and a compound annual growth rate (CAGR) of 4.7% from 2025 to 2034. The rising global seaborne trade, especially in emerging economies, is anticipated to be a major driver of market growth. This surge aligns with the robust expansion of the shipping industry, which plays a pivotal role in global commerce. Diesel remains a preferred fuel choice for maritime applications due to its affordability and widespread availability, offering cost-effective solutions for long-distance and commercial shipping. Additionally, advancements in technology have focused on enhancing fuel efficiency, minimizing emissions, and ensuring compliance with stringent environmental regulations, all while improving the performance and reliability of these engines.

Marine diesel engines serve as critical components in ships and vessels, delivering power for propulsion and electricity generation. These engines are valued for their efficiency, dependability, and capability to endure harsh marine conditions. Their versatility in operating on various fuels makes them a practical option for maritime operations. Innovations in this sector are catering to the need for greener solutions while maintaining operational efficiency, aligning with evolving global environmental standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.2 Billion |

| Forecast Value | $8.2 Billion |

| CAGR | 4.7% |

The medium-speed segment of marine diesel engines is poised for notable growth, with its market share expected to exceed USD 2 billion by 2034. These engines, known for their balanced speed and performance, are gaining popularity due to their lightweight construction and reduced maintenance requirements. The demand for efficient, fuel-saving engines continues to rise, driven by a need for improved performance and adherence to evolving emission norms.

The merchant segment within the marine diesel engines market is projected to grow at a CAGR exceeding 4% through 2034. This trend reflects increasing government initiatives aimed at bolstering national security by investing in advanced fleets and fostering maritime infrastructure. Rising disposable incomes and growing interest in maritime tourism are further propelling demand for these engines. Enhanced consumer interest in premium travel experiences contributes to the industry's expansion, with an increasing focus on equipping vessels with high-performance diesel engines.

In the United States, the marine diesel engines market is forecasted to surpass USD 700 million by 2034. The country benefits from access to abundant raw materials and cost-effective labor, creating favorable conditions for market growth. Efforts to retrofit older vessels with environmentally friendly technologies are driving demand, alongside heightened activities in exploration and production. These factors are set to support the increasing use of diesel engines in a variety of maritime operations, highlighting their importance in addressing contemporary industry needs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 – 2034 (Units & USD Million)

- 5.1 Key trends

- 5.2 Low speed

- 5.3 Medium speed

- 5.4 High speed

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (Units & USD Million)

- 6.1 Key trends

- 6.2 Merchant

- 6.2.1 Container vessels

- 6.2.2 Tankers

- 6.2.3 Bulk carriers

- 6.2.4 Gas carriers

- 6.2.5 RO-RO

- 6.2.6 Others

- 6.3 Offshore

- 6.3.1 Drilling RIGS & ships

- 6.3.2 Anchor handling vessels

- 6.3.3 Offshore support vessels

- 6.3.4 Floating production units

- 6.3.5 Platform supply vessels

- 6.4 Cruise & ferry

- 6.4.1 Cruise vessels

- 6.4.2 Passenger vessels

- 6.4.3 Passenger/cargo vessels

- 6.4.4 Others

- 6.5 Navy

- 6.6 Others

Chapter 7 Market Size and Forecast, By Power, 2021 – 2034 (Units & USD Million)

- 7.1 Key trends

- 7.2 < 1,000 HP

- 7.3 1,000 - 5,000 HP

- 7.4 5,001 - 10,000 HP

- 7.5 10,001 - 20,000 HP

- 7.6 > 20,000 HP

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (Units & USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Norway

- 8.3.6 Russia

- 8.3.7 Denmark

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 South Korea

- 8.4.4 India

- 8.4.5 Australia

- 8.4.6 Vietnam

- 8.5 Middle East & Africa

- 8.5.1 UAE

- 8.5.2 Saudi Arabia

- 8.5.3 Iran

- 8.5.4 Angola

- 8.5.5 Egypt

- 8.5.6 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Mexico

Chapter 9 Company Profiles

- 9.1 AB Volvo

- 9.2 Anglo Belgian Corporation

- 9.3 Caterpillar

- 9.4 Cummins

- 9.5 Daihatsu Diesel

- 9.6 Deere & Company

- 9.7 DEUTZ

- 9.8 Hyundai

- 9.9 IHI Corporation

- 9.10 Kawasaki Heavy Industries

- 9.11 MAN Energy Solutions

- 9.12 Rolls-Royce

- 9.13 Scania

- 9.14 Siemens

- 9.15 STX Heavy Industries

- 9.16 Wartsila

- 9.17 Yanmar

- 9.18 Yuchai International