PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666706

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666706

Industrial Garnet Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

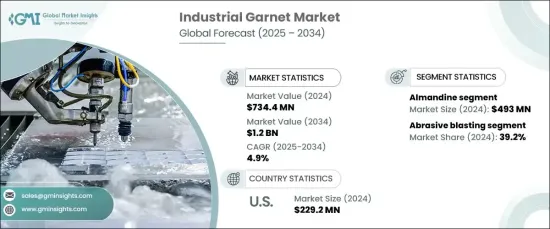

The Global Industrial Garnet Market was valued at USD 734.4 million in 2024 and is projected to grow at a CAGR of 4.9% from 2025 to 2034. Industrial garnet is a natural mineral widely recognized for its hardness, durability, and angular structure, making it an essential abrasive material. It plays a critical role in various applications, including waterjet cutting, surface preparation, and filtration systems.

The market is primarily driven by the growth of the construction and infrastructure sectors, which increasingly require precise and efficient cutting tools. Industrial garnet is extensively used in waterjet cutting, a technology that offers high precision without generating heat, thereby minimizing material wastage. This method aligns with the growing demand for cost-effective and environmentally friendly solutions across industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $734.4 Million |

| Forecast Value | $1.2 Billion |

| CAGR | 4.9% |

Additionally, garnet's role in water filtration is gaining prominence as concerns about water pollution and resource management intensify. Its ability to remove impurities makes it an invaluable material for industries such as mining, food processing, and wastewater treatment. By contributing to cutting-edge technologies in filtration and surface preparation, Garnet supports sustainability initiatives and industrial efficiency.

In terms of type, the market includes almandine, andradite, grossular, pyrope, spessartine, and uvarovite. Almandine, known for its durability and widespread availability, dominated the market in 2024 with a valuation of USD 493 million. Its cost-effectiveness and suitability for demanding applications have established it as the preferred choice for industries requiring high-performance abrasives.

The application-based segmentation highlights key areas such as abrasive blasting, waterjet cutting, filtration, and abrasive powders. Abrasive blasting held the largest market share in 2024, accounting for 39.2%. Garnet's recyclability and efficiency make it ideal for surface preparation, addressing the rising need for cleaner and more sustainable methods.

In 2024, the U.S. industrial garnet market generated USD 229.2 million, driven by its growing use across waterjet cutting, abrasive blasting, and filtration processes. The expanding construction and infrastructure sectors, combined with a focus on adopting eco-friendly technologies, have been instrumental in this growth. The U.S. continues to lead the market due to its robust industrial base and technological advancements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Infrastructure development and construction

- 3.6.1.2 Technological advancements in waterjet cutting

- 3.6.1.3 Water filtration and environmental concerns

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Supply chain disruptions

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Type, 2021-2034 (USD Million, Kilo Tons)

- 5.1 Key trends

- 5.2 Almandine

- 5.3 Andradite

- 5.4 Grossular

- 5.5 Pyrope

- 5.6 Spessartine

- 5.7 Uvarovite

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Million, Kilo Tons)

- 6.1 Key trends

- 6.2 Abrasive blasting

- 6.3 Water jet cutting

- 6.4 Filtration

- 6.5 Abrasive powders

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021-2034 (USD Million, Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Balaji Group

- 8.2 Barton International

- 8.3 GMA Garnet

- 8.4 Krystal Abrasive

- 8.5 Opta Group

- 8.6 Rizhao Garnet

- 8.7 Super Garnet Services

- 8.8 Trimex Sands

- 8.9 VV Mineral

- 8.10 Wester Carbon