PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666894

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666894

Cloud-native Application Protection Platform (CNAPP) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

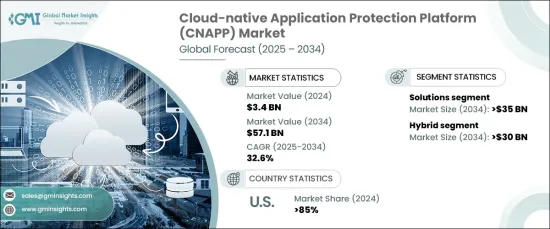

The Global Cloud-Native Application Protection Platform Market, valued at USD 3.4 billion in 2024, is projected to expand at a staggering CAGR of 32.6% from 2025 to 2034. This growth is primarily driven by the increasing sophistication of phishing attempts and cyberattacks targeting cloud infrastructure. As businesses adopt cloud-native environments with containerized applications and complex cloud configurations, new security challenges are emerging. These include issues like misconfigurations and increasingly intricate attack surfaces, leaving organizations vulnerable to advanced threats. In response, CNAPP solutions are evolving to meet the demands of modern cloud infrastructures, offering a much-needed shield against evolving cyber risks.

The market is segmented into solutions and services, with solutions commanding the largest share, accounting for 70% of the market in 2024. This segment is expected to generate USD 35 billion by 2034. As threats continue to escalate, CNAPP solutions are incorporating cutting-edge threat intelligence by integrating global databases and collective intelligence. These platforms are shifting towards predictive security models, which help anticipate vulnerabilities and proactively address emerging threats before they can cause damage. Context-aware tools are gaining traction, offering cross-domain threat correlation for enhanced risk assessments and more agile responses to security breaches.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 Billion |

| Forecast Value | $57.1 Billion |

| CAGR | 32.6% |

By deployment type, the market is divided between hybrid and multi-cloud environments. The hybrid segment is set to reach USD 30 billion by 2034, driven by the increasing need for consistent security governance across both on-premises and cloud infrastructures. As enterprises adopt multi-cloud strategies, the demand for unified security management tools is surging. These tools ensure centralized visibility, enabling businesses to enforce compliance and manage risk across diverse systems effectively. CNAPP platforms are evolving to bridge the gap between traditional data center security and modern cloud-native architectures, ensuring a seamless integration of security measures without compromising on compliance or risk management standards.

The U.S. dominates the CNAPP market, capturing 85% of the share in 2024, bolstered by growing cyber threats and stringent federal regulations. In this highly regulated environment, organizations are increasingly prioritizing security frameworks that emphasize continuous verification, least-privilege access, and granular visibility. Investments in adaptive authentication tools and real-time risk assessment capabilities are becoming more common as organizations look to protect their distributed cloud ecosystems from potential cyberattacks.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Cloud service providers

- 3.2.2 Technology providers

- 3.2.3 Application developers

- 3.2.4 System integrators

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Technology differentiators

- 3.4.1 Unified platform approach

- 3.4.2 DevSecOps integration

- 3.4.3 Zero-trust security models

- 3.4.4 Runtime Application Self-Protection (RASP)

- 3.4.5 Others

- 3.5 Key news & initiatives

- 3.6 Patent analysis

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Growing adoption of cloud-based platforms

- 3.8.1.2 Rising cybersecurity threats

- 3.8.1.3 Stringent data protection regulations

- 3.8.1.4 Adoption of DevSecOps practices

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Complex cloud environments

- 3.8.2.2 Performance overhead

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 Identity-Based Security and Cloud Infrastructure Entitlement Management (CIEM)

- 5.2.2 cloud workload protection CWPP

- 5.2.3 Infrastructure as a Code (IAC)

- 5.2.4 Kubernetes Security Posture Management (KSPM)

- 5.2.5 Cloud Security Posture Management (CSPM)

- 5.3 Services

- 5.3.1 Professional services

- 5.3.2 Managed services

Chapter 6 Market Estimates & Forecast, By Cloud, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Hybrid cloud

- 6.3 Multi-cloud

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 SME

- 7.3 Large Enterprise

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Retail

- 8.3 BFSI

- 8.4 Healthcare

- 8.5 Government

- 8.6 IT & Telecom

- 8.7 Manufacturing

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aqua Security

- 10.2 Checkpoint Security

- 10.3 CrowdStrike

- 10.4 Data Theorem

- 10.5 Fortinet

- 10.6 LaceWorks

- 10.7 McAfee

- 10.8 Orca Security

- 10.9 Palo Alto Networks

- 10.10 Qualys

- 10.11 Runecast Solutions

- 10.12 Skyhigh Security

- 10.13 Sonrai

- 10.14 Sysdig

- 10.15 Tenable

- 10.16 Tigera

- 10.17 Trend Micro

- 10.18 Uptycs

- 10.19 Wiz.io

- 10.20 Zscaler

- 10.21 Others