PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666914

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666914

Thiamine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

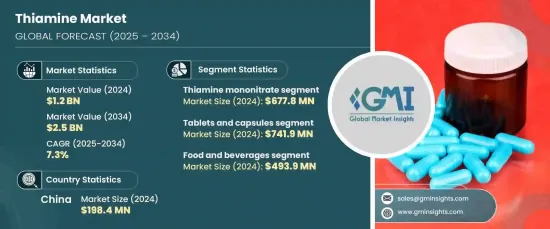

The Global Thiamine Market, valued at USD 1.2 billion in 2024, is projected to grow at a CAGR of 7.3% from 2025 to 2034. Thiamine, also known as Vitamin B1, plays a vital role in supporting human health by assisting in energy metabolism, nerve function, and DNA and RNA synthesis. Its growing importance in maintaining a balanced diet has led to increased demand for thiamine supplements and fortified food products. This surge is further amplified by rising consumer awareness of health and nutritional deficiencies.

The versatility of thiamine is evident in its applications across multiple industries, such as pharmaceuticals, food and beverages, and animal feed. In pharmaceuticals, thiamine is widely used to treat conditions resulting from its deficiency, such as nerve and cardiovascular issues. It is also a key ingredient in multivitamins, helping to address a broad spectrum of nutritional gaps. In the food sector, thiamine is frequently added to staple items like cereals, bread, and supplements, enhancing their nutritional value. The growing preference for fortified foods is driving innovation, allowing manufacturers to incorporate thiamine into a wide variety of products, boosting market demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.5 Billion |

| CAGR | 7.3% |

Among the various forms of thiamine, thiamine mononitrate holds a significant market share due to its stability and versatility. As a more stable derivative, it withstands environmental factors like heat and light, making it ideal for use in food fortification and pharmaceuticals. It is commonly found in fortified cereals, bread, and supplements, ensuring essential nutrient delivery. In the pharmaceutical industry, thiamine mononitrate is commonly used in multivitamin tablets and injectable formulations. It is also an important ingredient in animal feed, supporting livestock health and productivity.

The tablets and capsules segment leads the thiamine market, generating significant revenue due to their precise dosing, convenience, and widespread availability. Tablets are favored for their cost-effectiveness and ease of mass production, making them a staple in healthcare and retail markets worldwide. On the other hand, capsules appeal to those looking for faster absorption and less gastrointestinal discomfort. Both formats are highly portable and have a long shelf life, further boosting their popularity.

In the food and beverage sector, thiamine's contribution to fortified products and nutritional supplements is substantial, and the segment is expected to grow steadily. It is frequently added to foods like cereals, bread, and energy drinks, addressing nutritional deficiencies. The increasing consumer demand for healthier food options and functional beverages, combined with regulatory requirements for fortification, ensures the continued growth of this market segment.

China is expected to maintain a strong position in the thiamine market, benefiting from abundant raw materials, cost-effective manufacturing, and a solid production infrastructure. With a strong focus on expanding exports and investing in research and development, China remains a major player in the global thiamine market, ensuring a steady supply and fostering innovations in thiamine production.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing awareness of the importance of a balanced diet

- 3.6.1.2 Rising demand for dietary supplements and fortified foods

- 3.6.1.3 Adoption of thiamine in animal feed for livestock health

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Price volatility and fluctuations in raw material costs

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Thiamine mononitrate

- 5.3 Thiamine hydrochloride

- 5.4 Thiamine pyrophosphate

Chapter 6 Market Estimates & Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Tablets & capsules

- 6.3 Liquid

- 6.4 Powder

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Pharmaceutical

- 7.4 Animal feed

- 7.5 Dietary supplements

- 7.6 Other

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 BASF

- 9.2 DSM

- 9.3 Chemizo Enterprise

- 9.4 Lonza Group AG

- 9.5 Jiangsu Jubang Pharmaceutical

- 9.6 Huazhong Pharmaceutical

- 9.7 HPC Standards

- 9.8 McCartan’s Pharmacy

- 9.9 Nutricost

- 9.10 PharmoVit

- 9.11 Molekula Group

- 9.12 Caisson Labs

- 9.13 Brother Enterprises Holding

- 9.14 Loba Chemie

- 9.15 TCI Chemicals