PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666989

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666989

Search and Rescue (SAR) Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

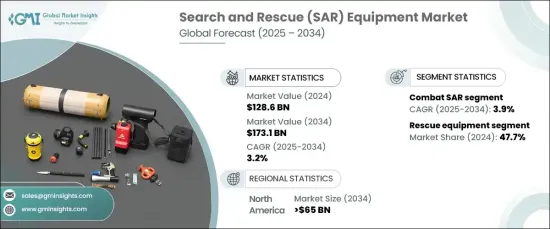

The Global Search And Rescue Equipment Market was valued at USD 128.6 billion in 2024 and is projected to grow at a CAGR of 3.2% from 2025 to 2034. The integration of real-time communication technologies is transforming search and rescue operations, enabling faster coordination and improved response times. Advanced connectivity solutions, such as satellite communication systems and IoT platforms, allow seamless interaction between rescue teams, command centers, and equipment. These innovations enhance situational awareness, particularly in challenging conditions, by enabling GPS tracking, live video feeds, and instant data sharing. Tools like SAR drones and wearable devices now transmit critical data in real-time, facilitating quick decision-making and higher success rates. The rising emphasis on efficient rescue efforts has positioned real-time communication systems as an essential component of SAR equipment.

Increasing natural disasters caused by climate change have spurred global demand for search and rescue equipment. The growing frequency of hurricanes, floods, earthquakes, and wildfires underscores the urgent need for advanced tools to support disaster response. Governments, humanitarian organizations, and defense agencies are heavily investing in innovative technologies to improve their disaster management capabilities. This shift towards heightened preparedness and swift action is a key driver for the market, with a significant focus on safeguarding lives and minimizing damage in crisis scenarios.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $128.6 billion |

| Forecast Value | $173.1 billion |

| CAGR | 3.2% |

In 2024, rescue equipment dominated the market, holding a 47.7% share. These tools play a critical role in SAR missions, providing essential support for extracting victims from perilous situations. Innovations in lightweight materials and ergonomic designs have improved the functionality and durability of items such as stretchers, life rafts, and harnesses. Modular systems allow customization for different rescue scenarios, offering adaptability across mountain, flood, and maritime environments. The integration of GPS, communication devices, and thermal imaging further enhances the precision and efficiency of rescue operations, reducing response times and enabling remote deployments in hazardous areas.

The combat search and rescue segment emerged as the fastest-growing application category in 2024, with a CAGR of 3.9% projected during the forecast period. This sector focuses on retrieving personnel from high-risk zones, often requiring advanced technologies for rapid execution. Enhanced GPS tracking and real-time communication systems improve coordination between units, while advanced medical equipment supports immediate care during extractions. Military investments in tactical drones and armored vehicles continue to expand the capabilities of combat SAR operations, prioritizing safety and operational speed in dangerous conditions.

North America remains a significant market, expected to surpass USD 65 billion by 2034. The region's growing focus on disaster readiness is driving investments in advanced SAR technologies to strengthen emergency response efforts. Collaborative efforts between public and private sectors are fostering innovation and ensuring access to cutting-edge rescue equipment.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Real-time communication advancements are revolutionizing SAR equipment operations

- 3.6.1.2 Global demand for SAR equipment surges in response to escalating natural disasters

- 3.6.1.3 Governments worldwide are ramping up investments in SAR technology development programs

- 3.6.1.4 Drones are becoming increasingly integral to contemporary search and rescue missions

- 3.6.1.5 Technological innovations are amplifying the effectiveness of SAR equipment systems

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High costs hinder the adoption of SAR equipment technology

- 3.6.2.2 SAR equipment faces operational challenges in extreme environments

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Equipment, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Rescue equipment

- 5.3 Search Equipment

- 5.3.1 Radar

- 5.3.2 Sonar

- 5.3.3 Cameras

- 5.3.4 Beacons

- 5.4 Communication Equipment

- 5.4.1 Telecommunications equipment

- 5.4.2 Portable radios

- 5.4.3 Transponders

- 5.4.4 Repeaters

- 5.5 Medical equipment

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Platform, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Airborne

- 6.2.1 Fixed wing

- 6.2.2 Rotary wing

- 6.2.3 Unmanned Aerial Vehicles (UAVS)

- 6.3 Marine

- 6.3.1 Autonomous Underwater Vehicles (AUVS)

- 6.3.2 Remotely Operated Underwater Vehicles (ROVS)

- 6.3.3 Amphibious crafts

- 6.3.4 Life Rafts

- 6.3.5 Special Boat Unit (SBU) Crafts

- 6.4 Ground-based

- 6.4.1 Ambulances

- 6.4.2 Fire & Rescue vehicles

- 6.4.3 Unmanned Ground Vehicles (UGVS)

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Combat SAR

- 7.3 Urban SAR

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Acr Electronics, Inc

- 9.2 Aeromarine Srt

- 9.3 Cubic Corporation

- 9.4 Elbit Systems Ltd.

- 9.5 Garmin Ltd.

- 9.6 General Dynamics Corporation

- 9.7 Honeywell International Inc.

- 9.8 Leonardo S.P.A.

- 9.9 Raytheon Company

- 9.10 Rockwell Collins, Inc.

- 9.11 Thales Group