PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684527

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684527

Food Antimicrobials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

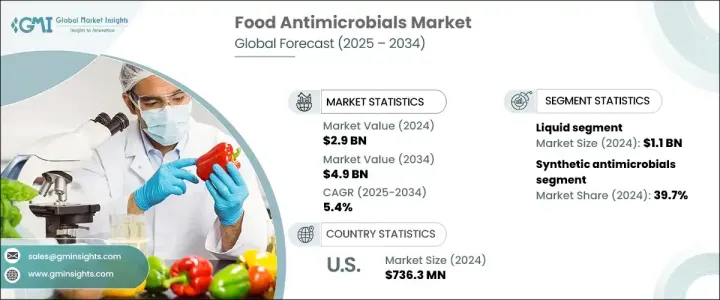

The Global Food Antimicrobials Market, valued at USD 2.9 billion in 2024, is expected to expand at a CAGR of 5.4% from 2025 to 2034. This growth is driven by the essential role of food antimicrobials in preventing the growth of harmful microorganisms, ensuring the safety and extended shelf life of food products. These additives are particularly critical for perishable items such as meats, dairy products, and baked goods, which are especially prone to microbial contamination. With rising concerns over food safety and increasing consumer demand for long-lasting and fresh food products, the adoption of food antimicrobials is gaining traction across the food processing industry. As manufacturers aim to meet stringent food safety regulations and cater to health-conscious consumers, advancements in antimicrobial solutions are reshaping the market landscape. Moreover, the trend toward clean-label, natural, and chemical-free products is encouraging a shift toward innovative, sustainable alternatives.

The market is segmented by the form of antimicrobials, with liquid, powder, and other forms as primary categories. Liquid antimicrobials dominated in 2024, generating USD 1.1 billion in revenue, primarily due to their ease of application and uniform distribution in food products. These features make liquid antimicrobials a popular choice for beverages, sauces, and other liquid-based items, where high solubility is essential for effective microbial prevention. Powder antimicrobials, on the other hand, hold significant market value due to their stability and suitability for dry and packaged foods, offering a longer shelf life. This versatility in application has solidified their presence across a range of food categories.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.9 Billion |

| Forecast Value | $4.9 Billion |

| CAGR | 5.4% |

The market is also categorized by type, including natural, nature-identical, and synthetic antimicrobials. In 2024, synthetic antimicrobials held the largest share, accounting for 39.7% of the market. Synthetic options remain widely favored in food processing due to their cost-effectiveness and proven ability to prevent spoilage in processed and packaged foods. However, growing consumer demand for natural and chemical-free alternatives is driving a noticeable shift toward clean-label products. Natural antimicrobials, derived from sources such as plant extracts and organic acids, are becoming increasingly popular among health-conscious consumers seeking safer and more transparent food options.

The U.S. food antimicrobials market reached USD 736.3 million in 2024, driven by heightened awareness of food safety and an increasing preference for clean-label products. The country benefits from a robust food processing industry, a strong regulatory framework, and rising adoption of natural preservatives. With consumers prioritizing healthier and sustainable food choices, the U.S. remains a key contributor to the North American market's growth. Regulatory measures aimed at preventing foodborne illnesses further bolster demand for both natural and synthetic antimicrobials, positioning the U.S. as a leader in this evolving market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for natural preservatives in food processing

- 3.6.1.2 Growing consumer preference for clean label and chemical-free food products

- 3.6.1.3 Rising incidences of foodborne illnesses globally

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High production costs of natural food antimicrobial additives

- 3.6.2.2 Limited shelf life of some antimicrobial agents

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Form, 2021-2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Liquid

- 5.3 Powder

- 5.4 Others

Chapter 6 Market Size and Forecast, By Type, 2021-2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Natural

- 6.3 Nature identical

- 6.4 Synthetic

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Meat and poultry

- 7.3 Bakery and confectionary

- 7.4 Dairy and frozen desserts

- 7.5 Beverages

- 7.6 Snacks

- 7.7 Others

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Celanese

- 9.2 Corbion

- 9.3 Dsm-firmenich

- 9.4 Eastman

- 9.5 Galactic

- 9.6 International Flavors & Fragrances

- 9.7 Jungbunzlauer

- 9.8 Kalsec

- 9.9 Kerry Group

- 9.10 Mitsubishi Chemical

- 9.11 Novonesis