PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684562

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684562

Integrated Quantum Optical Circuits Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

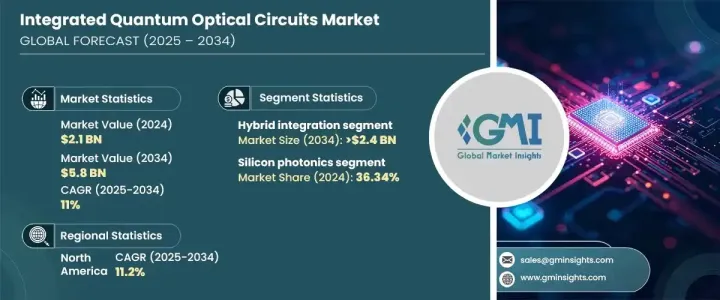

The Global Integrated Quantum Optical Circuits Market reached USD 2.1 billion in 2024 and is forecast to grow at an impressive CAGR of 11% from 2025 to 2034. This rapidly emerging market blends quantum mechanics with photonics and semiconductor engineering to create powerful systems that advance information processing and communication technologies. IQOCs integrate quantum capabilities into optical engineering, driving efficiency and power in computational systems while laying the foundation for the next generation of computing infrastructures. Their potential to revolutionize data transmission, computational performance, and overall efficiency has sparked intense interest across various sectors, positioning them as a key element in the future of technology.

The growth trajectory of the IQOCs market is fueled by substantial investments in research and development. Innovations in quantum computing, telecommunication, and defense are accelerating the adoption of these circuits, with various industries racing to harness their capabilities. By combining quantum properties with optical components, IQOCs enable new applications, from secure communication to ultra-powerful data processing systems, offering a vast range of benefits. As industries seek to enhance their technological infrastructures, the demand for IQOCs is only expected to intensify.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $5.8 Billion |

| CAGR | 11% |

Materials used in the construction of IQOCs vary, including silica glass, silicon photonics, lithium niobate, indium phosphide, and gallium arsenide. The silicon photonics segment is projected to dominate, holding a significant market share of 36.34% in 2024. This material is favored for its cost-effectiveness and ease of integration with complementary metal-oxide-semiconductor (CMOS) processes, enabling scalability and consistent quality. Silicon photonics' ability to work seamlessly with existing semiconductor manufacturing technologies makes it a go-to choice for companies looking to develop commercial quantum optical circuits.

The market is also segmented by integration level, which includes monolithic integration, hybrid integration, and module-based integration. The hybrid integration segment is poised to reach USD 2.4 billion by 2034. Hybrid integration offers flexibility by combining various materials to optimize quantum circuit performance, allowing for customized designs that cater to specific application needs. This approach is helping drive the development of more advanced and capable IQOCs.

The U.S. IQOCs market is poised for substantial growth, with a projected CAGR of 11.2% through 2024. This growth is supported by significant technological advancements, extensive research funding, and collaborative efforts between academic institutions and tech companies. With strong backing from federal funding, research networks, and entrepreneurial initiatives, the U.S. is emerging as a central player in the global IQOC market. The demand for IQOCs in defense, telecommunications, and computing is driving innovation and helping the U.S. lead the charge in scalable quantum technology development.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.7 Growth drivers

- 3.7.1 Surge in demand for secure quantum communication systems

- 3.7.2 Shift in photonic technology

- 3.7.3 Increase in demand for high-speed internet connectivity

- 3.7.4 Growth of quantum computing applications

- 3.7.5 Rising government investments

- 3.8 Industry pitfalls & challenges

- 3.8.1 Complexity of achieving quantum coherence and stability at scale

- 3.8.2 High initial cost of R&D and deployment

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021-2034 (USD billion)

- 5.1 Key trends

- 5.2 Indium phosphide

- 5.3 Silica glass

- 5.4 Silicon photonics

- 5.5 Lithium niobate

- 5.6 Gallium arsenide

Chapter 6 Market Estimates & Forecast, By Component, 2021-2034 (USD billion)

- 6.1 Key trends

- 6.2 Waveguides

- 6.3 Directional coupler

- 6.4 Active components

- 6.5 Light sources

- 6.6 Detectors

Chapter 7 Market Estimates & Forecast, By Integration Level, 2021-2034 (USD billion)

- 7.1 Key trends

- 7.2 Monolithic integration

- 7.3 Hybrid integration

- 7.4 Module-Based integration

Chapter 8 Market Estimates & Forecast, By Fabrication Technology, 2021-2034 (USD billion)

- 8.1 Key trends

- 8.2 Lithography-Based processes

- 8.3 Nanofabrication techniques

- 8.4 Direct laser writing

- 8.5 Molecular Beam Epitaxy (MBE)

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD billion)

- 9.1 Key trends

- 9.2 Optical fiber communication

- 9.3 Optical sensors

- 9.4 Bio medical

- 9.5 Quantum computing

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD billion)

- 10.1 Key trends

- 10.2 Telecommunications

- 10.3 Aerospace and defense

- 10.4 Healthcare

- 10.5 Energy and utilities

- 10.6 Automotive

- 10.7 Academia and research

- 10.8 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD billion)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Rest of Latin America

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

- 11.6.4 Rest of MEA

Chapter 12 Company Profiles

- 12.1 Aifotec

- 12.2 Bluefors

- 12.3 Broadcom

- 12.4 Enablence Technologies

- 12.5 IBM

- 12.6 Infinera Corporation

- 12.7 Intel

- 12.8 Lioni X International

- 12.9 Microsoft

- 12.10 Nanoscribe

- 12.11 QuiX Quantum Holding BV

- 12.12 QuTech

- 12.13 Sicoya GmbH

- 12.14 Tera Xion

- 12.15 Toptica Photonics

- 12.16 Toshiba

- 12.17 Xanadu