PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684567

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684567

Meat Grinder Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

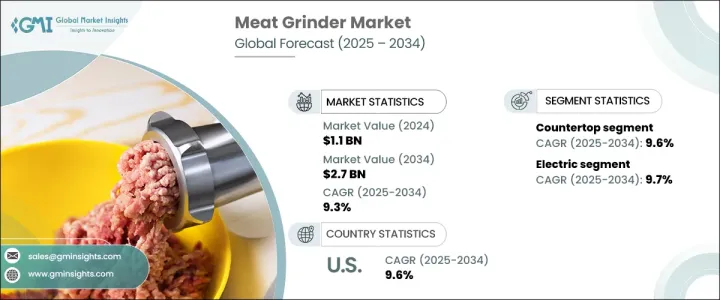

The Global Meat Grinder Market reached USD 1.1 billion in 2024 and is projected to grow at a CAGR of 9.3% between 2025 and 2034. This market forms a vital component of the food processing equipment sector, which plays a significant role in the global supply chain. Increasing consumer awareness about food safety and meat quality, and the rising trend of homemade food preparation have driven the demand for meat grinders for both residential and industrial purposes. Large-scale commercial meat processors are also investing in high-capacity grinders to meet the growing demand. Additionally, the focus on sustainable production practices and the development of strong food retail networks have further fueled the sector's growth.

The market is categorized into manual and electric meat grinders. In 2024, the electric meat grinder segment dominated the market with a valuation of USD 900 million and is expected to grow at a CAGR of 9.7% between 2025 and 2034. Electric grinders are preferred for their efficiency and ease of use, making them indispensable in both commercial and residential settings. These grinders require minimal effort to operate, making them ideal for butcher shops, restaurants, meal prep centers, and busy households. The manual segment, while smaller, continues to cater to niche markets where affordability and simplicity are key factors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.1 Billion |

| Forecast Value | $2.7 Billion |

| CAGR | 9.3% |

Further segmentation of the market includes countertops and mounted meat grinders. In 2024, countertop meat grinders held a 74% market share and are anticipated to grow at a CAGR of 9.6% between 2025 and 2034. Countertop grinders are popular due to their portability, affordability, and versatility. They are particularly favored by small businesses, homeowners, and restaurants that require moderate meat grinding capabilities. Mounted grinders, on the other hand, are preferred in industrial and high-volume settings where stability and durability are critical.

Regionally, the U.S. meat grinder market reached USD 260 million in 2024 and is projected to grow at a CAGR of 9.6% during the forecast period between 2025 and 2034. The country holds a dominant position in the North American market for meat grinders due to its leadership in the food processing and home appliance industries. The U.S. is the world's largest consumer of meat per capita, particularly beef, pork, and chicken, which has driven the demand for meat grinders. These devices are widely used for preparing sausages, burgers, and other ground meat products, catering to both commercial and residential needs.

The global meat grinder market is also witnessing advancements in technology, such as the integration of smart features and energy-efficient designs. Manufacturers are focusing on innovation to enhance product functionality and cater to evolving consumer preferences. The increasing penetration of e-commerce platforms has further boosted market accessibility, enabling consumers to explore a wide range of products and make informed purchasing decisions. These factors collectively indicate a promising growth trajectory for the meat grinder market over the forecast period.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Technological landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing meat consumption worldwide

- 3.7.1.2 Rising popularity of home meat processing

- 3.7.1.3 Technological advancements in meat processing equipment

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High initial costs for industrial grinders

- 3.7.2.2 Stringent food safety regulations

- 3.7.1 Growth drivers

- 3.8 Consumer buying behavior analysis

- 3.8.1 Demographic trends

- 3.8.2 Factors affecting buying decision

- 3.8.3 Consumer product adoption

- 3.8.4 Preferred distribution channel

- 3.8.5 Preferred price range

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Manual meat grinder

- 5.3 Electric meat grinder

Chapter 6 Market Estimates and Forecast, By Material Type, 2021 – 2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Aluminum

- 6.3 Cast iron

- 6.4 Stainless steel

- 6.5 Others (carbon steel, etc.)

Chapter 7 Market Estimates and Forecast, By Structure, 2021 – 2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Countertop meat grinder

- 7.3 Mounted meat grinder

- 7.3.1 Floor mounted

- 7.3.2 Table mounted

Chapter 8 Market Estimates and Forecast, By Capacity, 2021 – 2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Small (Up to 150 lbs/hour)

- 8.3 Medium (150-500 lbs/hour)

- 8.4 Large (Above 500 lbs/hour)

Chapter 9 Market Estimates and Forecast, By Operation, 2021 – 2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Light-duty

- 9.3 Medium-duty

- 9.4 Heavy-duty

Chapter 10 Market Estimates and Forecast, By Price Range, 2021 – 2034 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Low (under USD 500)

- 10.3 Medium (USD 500 - USD 1000)

- 10.4 High (above USD 1000)

Chapter 11 Market Estimates and Forecast, By Feed Type, 2021 – 2034 (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 Tray feed grinder

- 11.3 Vertical feed

- 11.4 Auger feed

- 11.5 Manual push feed

- 11.6 Others (vacuum feed, etc.)

Chapter 12 Market Estimates and Forecast, By End User, 2021 – 2034 (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 Residential

- 12.3 Commercial

- 12.3.1 Hotels and restaurants

- 12.3.2 Catering services

- 12.3.3 Butcher shops

- 12.3.4 Others

- 12.4 Industrial

- 12.4.1 Meat processing plants

- 12.4.2 Food manufacturing facilities

Chapter 13 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034 (USD Billion) (Million Units)

- 13.1 Key trends

- 13.2 Online

- 13.2.1 E-commerce website

- 13.2.2 Company website

- 13.3 Offline

- 13.3.1 Hypermarkets and supermarkets

- 13.3.2 Specialty stores

- 13.3.3 Others (department stores, individual stores, etc.)

Chapter 14 Market Estimates & Forecast, By Region, 2021 – 2034 (USD Billion) (Million Units)

- 14.1 Key trends

- 14.2 North America

- 14.2.1 U.S.

- 14.2.2 Canada

- 14.3 Europe

- 14.3.1 UK

- 14.3.2 Germany

- 14.3.3 France

- 14.3.4 Italy

- 14.3.5 Spain

- 14.3.6 Russia

- 14.4 Asia Pacific

- 14.4.1 China

- 14.4.2 Japan

- 14.4.3 India

- 14.4.4 South Korea

- 14.4.5 Australia

- 14.5 Latin America

- 14.5.1 Brazil

- 14.5.2 Mexico

- 14.6 MEA

- 14.6.1 South Africa

- 14.6.2 Saudi Arabia

- 14.6.3 UAE

Chapter 15 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 15.1 ABM Company

- 15.2 ADE Germany

- 15.3 AlexanderSolia GmbH

- 15.4 Amisy

- 15.5 Ari Makina

- 15.6 ASGO

- 15.7 Bizerba

- 15.8 C.R.M. s.r.l.

- 15.9 Clearline

- 15.10 Dadaux SAS

- 15.11 Dito Sama

- 15.12 Fatosa, S.A.

- 15.13 Fimar S.p.a.

- 15.14 Hobart

- 15.15 Nikai Group

- 15.16 Roser Group

- 15.17 Weston Brands